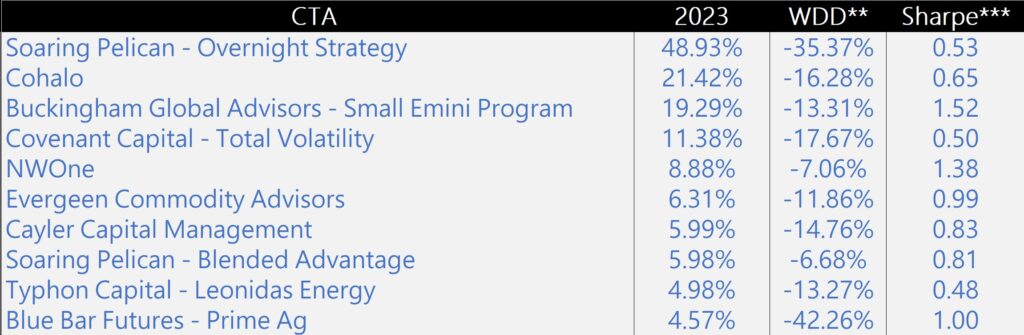

2023 was a lackluster year for CTAs – one that brought few complaints, but few accolades, as well. CTA indices reported slightly negative results, with Barclay’s CTA index posting a ~-0.30% return for the year, and the SG CTA index posting a return of ~3.4%. Similar to 2022, trend following strategies received most of the attention, however investor assets were stagnant in 2023. Volatility in various commodity sectors dried up; for example, outside of a couple months in the summer, grains saw a slow decline throughout the year. Lastly, VIX and S&P managers saw some resurgence in 2023. Here are ten of the top performing CTAs in 2023 that are part of aiSource’s approved manager pool+:

Past performance is not indicative of future results. All RORs are through December 2023

**WDD: worst drawdown since the inception of the track record through Dec 2023

***Sharpe: Sharpe Ratio since the inception of the track record through Dec 2023

Three of the above managers are part of the short-term space: Soaring Pelican, NWone and Buckingham. Commodity specific strategies from the above group are Cayler Capital, Blue Bar, NWOne, Evergreen and Typhon’s Leonidas strategy.

There are some new entrants to our list this year: Cohalo and Covenant both trade volatility through VIX futures. Blue Bar, an agriculture manager trades the lean hog market through the use of both futures and options.

If you have any specific questions on the above managers please reach out to: info@theaisource.com

+: Approved managers are CTAs with whom aiSource has active investments with. Also, the CTA must have an active client track record for the entire calendar year to be considered (proprietary track records were not considered).