Commodities: Global

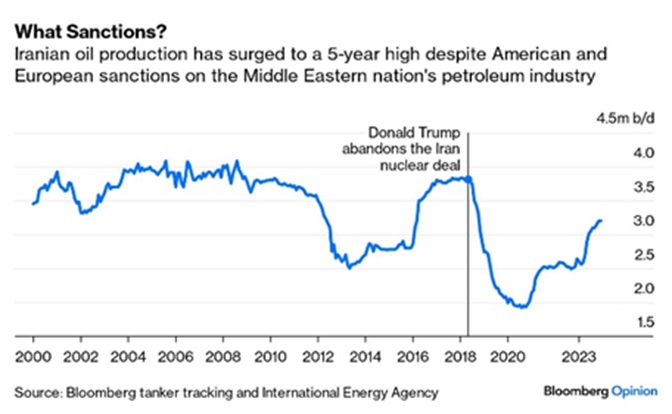

OPEC Oil Output Decreased to 26.6 million barrels per day (mbpd) in January, as the country of Angola left the cartel so that it would not have to abide by production quotas (though its production was not significant anyway). Production also fell in Libya temporarily by 300,000 bpd due to local unrest, Iran was believed to lower exports and Iraq, Kuwait and Algeria all cut production to be in line with their current OPEC limits. From a longer-term perspective, Saudi Arabia’s state-run Aramco said it had been ordered to stop work on expanding its maximum sustainable capacity to 13 mbpd, from its current 12 mbpd. A lack of demand in future years was cited. Amidst the Red Sea unrest, Iran has been increasing production, flouting the nuclear negotiations with Biden and enjoying the uptick in prices (graph left). Per Bloomberg, Iran pocketed more than $10 billion in 2023 thanks to its higher oil output – plenty to supply Houthis, Hezbollah, Hamas and Iraqi Shiites with more missiles and weapons.

production quotas (though its production was not significant anyway). Production also fell in Libya temporarily by 300,000 bpd due to local unrest, Iran was believed to lower exports and Iraq, Kuwait and Algeria all cut production to be in line with their current OPEC limits. From a longer-term perspective, Saudi Arabia’s state-run Aramco said it had been ordered to stop work on expanding its maximum sustainable capacity to 13 mbpd, from its current 12 mbpd. A lack of demand in future years was cited. Amidst the Red Sea unrest, Iran has been increasing production, flouting the nuclear negotiations with Biden and enjoying the uptick in prices (graph left). Per Bloomberg, Iran pocketed more than $10 billion in 2023 thanks to its higher oil output – plenty to supply Houthis, Hezbollah, Hamas and Iraqi Shiites with more missiles and weapons.

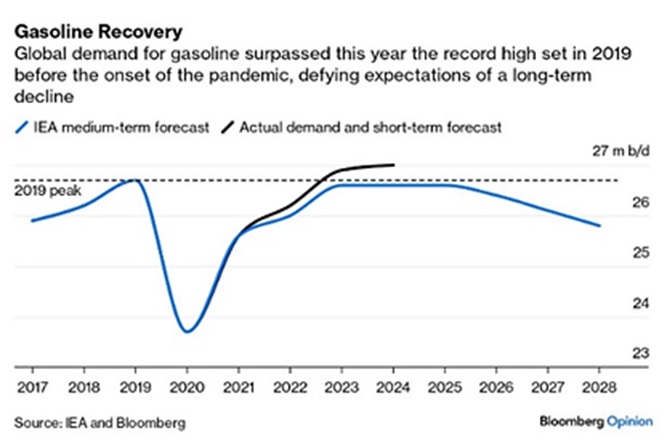

US Oil Production slipped back from the record set last month to 13.0 mbpd as operating oil rigs declined from 500 as of December 29th to 499 as of February 2nd. The US shipped 4.1 mbpd of crude abroad in 2023, up +13% from the previous year. Per AAA, US average regular gasoline prices ticked higher to $3.15 (+4¢) as of the end of the month. California prices fell 18¢ to $4.29 per gallon for regular unleaded – nice to see lower but still a wide differential. In electric vehicle news, the death of the internal combustion engine had been heralded too soon as global gasoline usage set a new record, surpassing the pre-COVID lockdown highs (see right). JPMorgan projects oil demand to grow by +1.6 mbpd in 2024, coming off demand growth of +1.9 mbpd in 2023. Electric vehicle sales in the US grew by just +1.3% in the final months of 2023, the latest sign that many American drivers remain cautious about making the leap to battery-powered cars. A total of 317,168 EVs were sold in the fourth quarter, up from 313,086 in the prior three months, a deceleration from sequential gains of about +5% in the third quarter and +15% in the April-through-June period. Another marker was the news that rental car firm Hertz announced plans to sell at a loss a third of its US electric vehicle fleet and reinvest in gas- powered cars due to weak demand and high repair costs for its battery-powered options. The sales of 20,000 EVs began in December and will continue over the course of 2024.

from 500 as of December 29th to 499 as of February 2nd. The US shipped 4.1 mbpd of crude abroad in 2023, up +13% from the previous year. Per AAA, US average regular gasoline prices ticked higher to $3.15 (+4¢) as of the end of the month. California prices fell 18¢ to $4.29 per gallon for regular unleaded – nice to see lower but still a wide differential. In electric vehicle news, the death of the internal combustion engine had been heralded too soon as global gasoline usage set a new record, surpassing the pre-COVID lockdown highs (see right). JPMorgan projects oil demand to grow by +1.6 mbpd in 2024, coming off demand growth of +1.9 mbpd in 2023. Electric vehicle sales in the US grew by just +1.3% in the final months of 2023, the latest sign that many American drivers remain cautious about making the leap to battery-powered cars. A total of 317,168 EVs were sold in the fourth quarter, up from 313,086 in the prior three months, a deceleration from sequential gains of about +5% in the third quarter and +15% in the April-through-June period. Another marker was the news that rental car firm Hertz announced plans to sell at a loss a third of its US electric vehicle fleet and reinvest in gas- powered cars due to weak demand and high repair costs for its battery-powered options. The sales of 20,000 EVs began in December and will continue over the course of 2024.

China’s Crude Oil Imports hit an all-time high in 2023, customs data showed, as fuel demand recovered from a pandemic-induced slump despite economic headwinds. China imported +11% more crude oil last year versus 2022 at 11.3 mbpd, up from a previous record of 10.8 mbpd in 2020. China’s coal output also reached a record high in 2023, amid an ongoing focus on energy security and a rise in demand after pandemic-related restrictions eased. The world’s biggest coal producer mined 4.66 billion metric tons of the fuel last year, up +2.9% from a year earlier. In Q3 2023, China permitted more new coal plants than in all of 2021 and power capacity could rise by more than 200 gigawatts by the end of the decade – more than all the power capacity in Canada.

Brazilian Farmers were projected to harvest a soybean crop of 150 million metric tons in the 2023/2024 cycle per agribusiness consultancy StoneX, cutting again their estimate for Brazilian soybean production citing weather issues. The new forecast was -1.6% lower than January’s and -4.8% lower from last year’s record output. However, Brazil’s soybean harvest had reached 11% of the planted area, up +5% from the previous week and well above the 5% seen at the same time a year earlier. In comparison, the Buenos Aires Grains Exchange now sees soybeans from the 2023/24 harvesting season at 52.5 million metric tons, or up about +1% compared to the previous forecast. Brazilian farmers have sown 27% of the area expected to be planted with second corn, marking the fastest pace since records began in 2013. On the other hand, rice prices moved higher on India curbing exports due to declining stocks (graph right). Cocoa prices also have soared higher on too much rain spread plant diseases and rots in Ghana and Ivory Coast, which represent about 60% of cocoa production. Enjoy that chocolate while you still can!

again their estimate for Brazilian soybean production citing weather issues. The new forecast was -1.6% lower than January’s and -4.8% lower from last year’s record output. However, Brazil’s soybean harvest had reached 11% of the planted area, up +5% from the previous week and well above the 5% seen at the same time a year earlier. In comparison, the Buenos Aires Grains Exchange now sees soybeans from the 2023/24 harvesting season at 52.5 million metric tons, or up about +1% compared to the previous forecast. Brazilian farmers have sown 27% of the area expected to be planted with second corn, marking the fastest pace since records began in 2013. On the other hand, rice prices moved higher on India curbing exports due to declining stocks (graph right). Cocoa prices also have soared higher on too much rain spread plant diseases and rots in Ghana and Ivory Coast, which represent about 60% of cocoa production. Enjoy that chocolate while you still can!

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource