Commodities: Global

OPEC Oil Output Fell last month per Reuters, reflecting lower exports from Iraq and Nigeria. OPEC produced 26.4 million barrels per day (mbpd) in March, down fractionally from February. Iraq lowered output as they had promised after overproducing in prior months but have to do more to meet their pledge of reducing output. Nigerian production also declined, with exports falling more sharply as the Dangote refinery, which has a total capacity of 650,000 bpd, took in more cargoes. OPEC+ agreed to maintain their -2.2 mbpd output cuts and the Saudis held to their voluntary cut of -1.0 mbpd. Russia pledged to hold their crude oil and fuel export cuts by a combined -0.5 mbpd, and damage from Ukrainian attacks on refineries made this a certainty. Mexico’s state-controlled oil company Pemex plans to halt some crude exports over the next few months as part of an effort to produce more domestic gasoline and diesel ahead of the June 2 presidential election. Currently, Mexico exports about 600,000 barrels a day of Maya-grade crude oil.

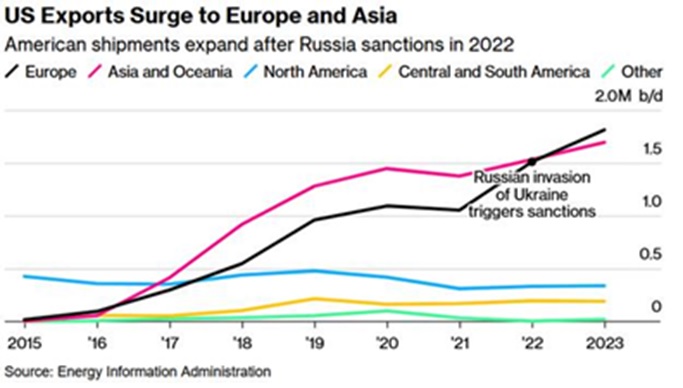

US March Oil Production  set back slightly from the record set in January to 13.1 mbpd as operating oil rigs increased from 500 as of March 1st to 506 as of March 29th. Winter weather in Texas and North Dakota hampered production. US shipments of crude oil to Europe hit a record 2.2 mbpd in March, particularly into the Netherlands, France and Spain (see graph right). India in March imported the most U.S. crude in over a year as they shied away from importing as much from Russia. Per AAA, US average regular unleaded gasoline prices continued higher to $3.54 (+21¢) as of the end of the month. California prices increased +50¢ to $4.90 per gallon for regular unleaded. Higher oil prices caused the Biden administration to halt plans to buy more oil for the strategic reserve, as incremental as that has been so far.

set back slightly from the record set in January to 13.1 mbpd as operating oil rigs increased from 500 as of March 1st to 506 as of March 29th. Winter weather in Texas and North Dakota hampered production. US shipments of crude oil to Europe hit a record 2.2 mbpd in March, particularly into the Netherlands, France and Spain (see graph right). India in March imported the most U.S. crude in over a year as they shied away from importing as much from Russia. Per AAA, US average regular unleaded gasoline prices continued higher to $3.54 (+21¢) as of the end of the month. California prices increased +50¢ to $4.90 per gallon for regular unleaded. Higher oil prices caused the Biden administration to halt plans to buy more oil for the strategic reserve, as incremental as that has been so far.

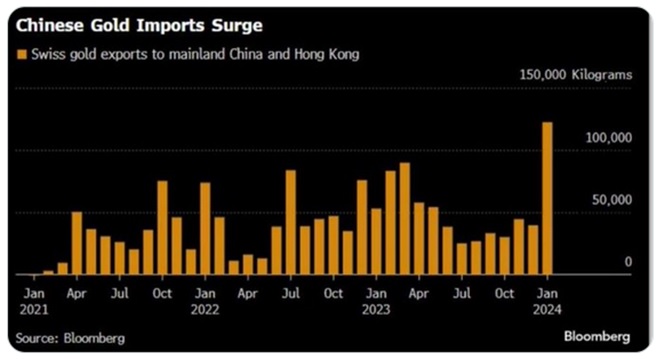

China’s Crude Oil Imports rose +3% compared to the same two months a year earlier as refineries raised production to meet strong demand for transport fuels over the busy Lunar New Year travel period. Total refinery throughput in the world’s second-largest oil consumer was 14.5 mbpd. Russia remained China’s top oil supplier in the first two months of this year, rising +13% on the year to 2.16 mbpd over the January and February period. China unveiled regulations that aim to more tightly control the world’s largest pig population, after a recent growth in herd numbers weighed heavily on pork prices. China’s pig population was 434 million by the end of 2023, up significantly from a low of 310 million in 2019. Pork prices dropped -13.6% in 2023, according to a Nomura analysis. To reiterate from last month, Chinese gold imports surged, reflecting the population’s search for places to maintain their wealth as real estate disappoints.

fuels over the busy Lunar New Year travel period. Total refinery throughput in the world’s second-largest oil consumer was 14.5 mbpd. Russia remained China’s top oil supplier in the first two months of this year, rising +13% on the year to 2.16 mbpd over the January and February period. China unveiled regulations that aim to more tightly control the world’s largest pig population, after a recent growth in herd numbers weighed heavily on pork prices. China’s pig population was 434 million by the end of 2023, up significantly from a low of 310 million in 2019. Pork prices dropped -13.6% in 2023, according to a Nomura analysis. To reiterate from last month, Chinese gold imports surged, reflecting the population’s search for places to maintain their wealth as real estate disappoints.

Brazil’s Soybean Harvest reached 69% of the planted area, slightly below the 70% seen at the same time a year earlier. Brazilian soybean production will total 156.5 million metric tons this year per an agribusiness consultancy, an increase from an initial projection of 152.2 million tons. Dry weather in Argentina’s main agricultural regions will benefit the start of soy and corn harvests after recent heavy rains. US farmers were planning to cut corn plantings by more than expected in 2024 while expanding soybean seeding, the US Department of Agriculture (USDA) said as low crop prices and high input costs have many growers looking to cut expenses. Private sources advised Coloma that mud and standing water in fields further slowed corn planting this year. US winter wheat crop conditions came in at 56% good/excellent, in line with market expectations and much better than last year’s 28% rating in early April. The overall condition of the winter wheat crop was the highest in four years for early April while soft red wheat conditions tied for the highest in the last twelve years.

In interesting non-commodity news, Barron’s reported that the only known handwritten copy of Arthur Conan Doyle’s second book in the four-novel Sherlock Holmes series, The Sign of Four, could sell for $1.2 million at Sotheby’s June auction. The edition of more than 170 pages includes notations and markings from the British author.

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource