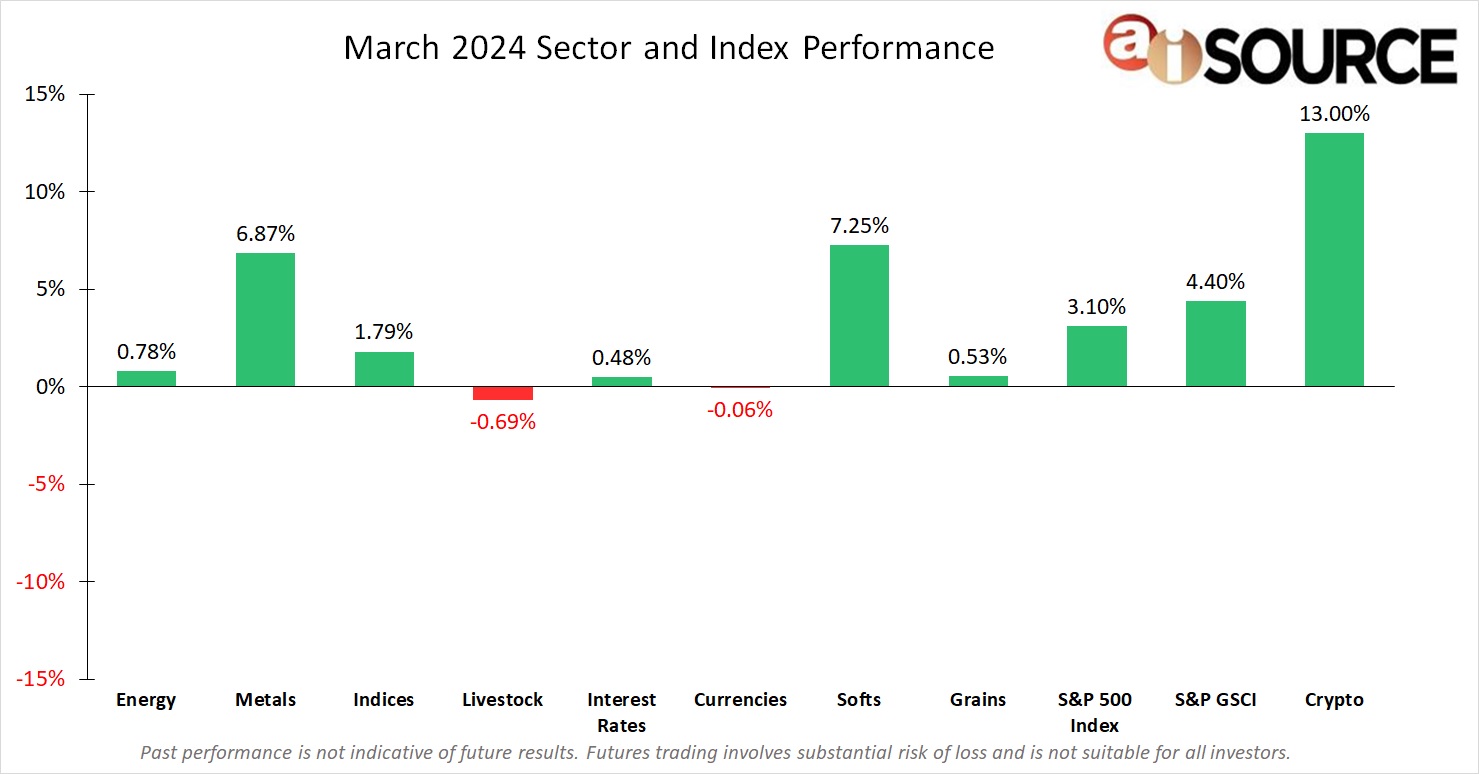

During the month of March, Crypto (+13.00%) and Softs (7.25%) were the top performers. The bottom performers were Livestock (-0.69%) and Currencies (-0.06%). Another colossal rally in Cocoa (+50.02) carried the soft sector (+7.25) into the positive for the third consecutive month. The S&P GSCI (+4.40%) continued its winning streak, also moving to a third straight positive month. Crypto (+13.00%) moves into the seventh month of consecutive positive gains, with the last negative month being all the way back in August. The next Federal Reserve meeting is scheduled for April 30th, where the FOMC is not expected to raise rates.

For month-to-date and year-to-date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. Crypto: Bitcoin and Ethereum. S&P 500 Index – All data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.