Ukraine-Russia War & Red Sea Shipping: Positioning

The Ukraine-Russia Conflict saw little progress on the ground by both sides as Ukraine strove to shore up military funding from Europe and the US. Russia pressed with its weight in numbers though evidence of equipment shortages was seen by the utilization of antiquated tanks (i.e., T-62s which were first introduced in 1961 and even T-55s which first came out in 1946) to press assaults. While China, Vietnam and North Korea may readily sell Russia small arms and ammunition, I doubt that armored vehicles will be on their export lists. On the commodity front, Ukraine’s grain exports so far in the 2023/24 July-June marketing season have fallen to about 19.4 million metric tons from almost 23.6 million tons at the same stage last year, agriculture ministry data showed early in the month, with half corn and the rest wheat and a little barley. What really heated up the commodity war was the repeated attacks by Ukrainian drones on oil refineries in southern Russia, causing limited but effective damage. For example, repairs at Lukoil’s 0.34 million barrels per day (mbpd) Nizhny Novgorod refinery will reportedly take at least a month. Russian gasoline exports slumped by a third in January as these attacks and needed maintenance hit supply. Even the Houthis attacked a tanker carrying Russian fuel, though they played it off as they thought it was a “British oil ship” (the Houthis claim to not target Russian, Chinese and Iranian ships).

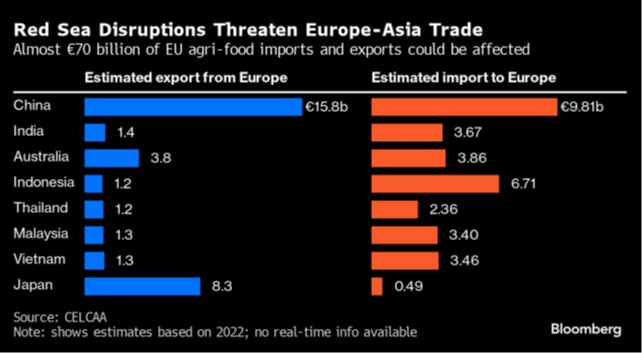

US Finally Involved as shelling by Iranian proxy groups more actively attacked US bases in Syria, Jordan and Iraq, killing Americans and allies. While these actions won’t halt the attacks completely, giving Iran free rein over the Red Sea and the Middle East is a lose-lose proposition. With regards to food commodities, China looks to have the most at risk per the table to the right and yet they do not contribute to protecting Red Sea shipping despite entreaties from US

killing Americans and allies. While these actions won’t halt the attacks completely, giving Iran free rein over the Red Sea and the Middle East is a lose-lose proposition. With regards to food commodities, China looks to have the most at risk per the table to the right and yet they do not contribute to protecting Red Sea shipping despite entreaties from US officials (Financial Times). Russian exports of cereals to China rose fourfold in 2023 to nearly 1.2 million tons — although that was still just 2% of the country’s total purchases — while shipments of some edible oils (sunflower, rapeseed and mustard) have ballooned to over half of China’s imports of those products, per Bloomberg. Looking at the graph to the left, Chinese-Russian trade has expanded over the last few years. As China seeks to diversify away from the US for food supplies, Russian alternatives are a natural consideration.

officials (Financial Times). Russian exports of cereals to China rose fourfold in 2023 to nearly 1.2 million tons — although that was still just 2% of the country’s total purchases — while shipments of some edible oils (sunflower, rapeseed and mustard) have ballooned to over half of China’s imports of those products, per Bloomberg. Looking at the graph to the left, Chinese-Russian trade has expanded over the last few years. As China seeks to diversify away from the US for food supplies, Russian alternatives are a natural consideration.

Macro: Asia

China’s Economic Data was mixed as while December exports grew +2.3% y/y in US dollar terms (vs. +0.5% in November), exports to the U.S. declined -6.9% y/y and to the EU dropped -1.9% y/y. For the full year of 2023, exports shrank by -4.6%, the first decline since 2016, reversing a +7% growth in 2022. Imports inched up +0.2% y/y last month (again better than -0.6% y/y in November), with full-year volume being down -5.5% in 2023.  Retail sales were up less on a trailing twelve month basis compared to November (+7.4% y/y versus +10.1%), showing a slowdown. Industrial production stayed steady. Property continued to show weakness, with declines in all the metrics (floor space new starts (-12% y/y last month and -21% for full year 2023), home sales by value (-26% y/y and -12% for 2023), as well as by floor space (-26% y/y and -8% for 2023). Secondhand home prices in its four wealthiest cities—Beijing, Shanghai, Guangzhou and Shenzhen—declined by between -11% and -14% in December from the year before, according to the broker Centaline Property. Looking longer-term, the graph to the right over the last twenty years shows the rapid decline in housing sales since the COVID lockdowns. With the slowing economy, defaults increased, with the government blacklisting 8.5 million people (admittedly small at 1% of working adults) for missing payments, up from 5.4 million pre-COVID restrictions. With Evergrande now formally in bankruptcy and having to divest itself of its assets, more bad debts will spread through the economy. Zhongzhi, a conglomerate with a private lending “wealth management” business, declared a shortfall of $36 billion in early January and went directly into liquidation (the bad debts believed to be absorbed by government banks). In response, China reduced the reserve requirement ratio for banks to add up to $139 billion in lending capacity and the state banks and insurance companies were seen to be buying equities to halt the stock market slide.

Retail sales were up less on a trailing twelve month basis compared to November (+7.4% y/y versus +10.1%), showing a slowdown. Industrial production stayed steady. Property continued to show weakness, with declines in all the metrics (floor space new starts (-12% y/y last month and -21% for full year 2023), home sales by value (-26% y/y and -12% for 2023), as well as by floor space (-26% y/y and -8% for 2023). Secondhand home prices in its four wealthiest cities—Beijing, Shanghai, Guangzhou and Shenzhen—declined by between -11% and -14% in December from the year before, according to the broker Centaline Property. Looking longer-term, the graph to the right over the last twenty years shows the rapid decline in housing sales since the COVID lockdowns. With the slowing economy, defaults increased, with the government blacklisting 8.5 million people (admittedly small at 1% of working adults) for missing payments, up from 5.4 million pre-COVID restrictions. With Evergrande now formally in bankruptcy and having to divest itself of its assets, more bad debts will spread through the economy. Zhongzhi, a conglomerate with a private lending “wealth management” business, declared a shortfall of $36 billion in early January and went directly into liquidation (the bad debts believed to be absorbed by government banks). In response, China reduced the reserve requirement ratio for banks to add up to $139 billion in lending capacity and the state banks and insurance companies were seen to be buying equities to halt the stock market slide.

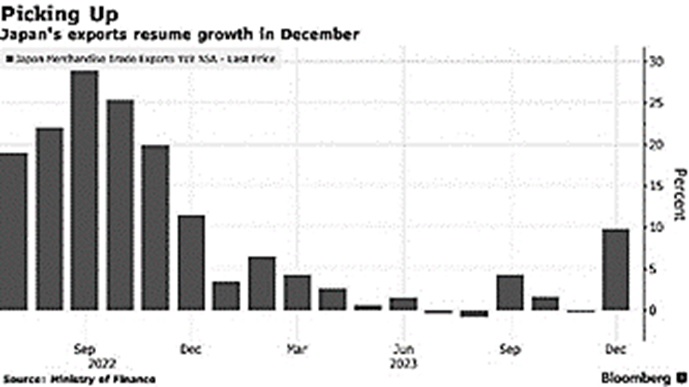

Japan saw a pickup in exports last month as shipments to the US increased at a double-digit clip and those to China rose for the first time in 13 months. Exports rose +9.8% in December from a year earlier, the biggest jump in a year and reversing from a -0.2% dip in the previous month (see left). Economists had forecast a 9.2% increase. The data will boost prospects for Japan’s economy returning to growth in the October-December quarter.

Macro: US

The Federal Reserve left its benchmark interest rate unchanged at its January meeting and made more direct guidance that the number of 2024 interest rate cuts would be closer to three (0.75%) rather than the market’s bets on six, and the first cut would be “unlikely” at the March meeting which is when the market originally was placing its bets. Chair Powell cited stronger economic conditions for the Fed view, bolstered by low unemployment (January nonfarm payrolls expanded by 353,000 for the month, almost double the estimate. The unemployment rate held at 3.7%, against the estimate for 3.8%. Average hourly earnings increased +0.6%, also double the monthly estimate. On a year-over-year basis, wages jumped 4.5%, well above the 4.1% forecast), ISM’s metric for prices paid for materials jumped 7.3 points to 64, the most since 2012 showing inflation is not dead, and GDP is not dead either, growing at an annualized +3.3% in Q4 2023 and the current estimate for Q1 2024 is over 4% per the Atlanta Fed model. Good numbers were seen in industrial production for December and Q4 2023 retail sales, but were mixed in housing (worst existing home sales since 1995 but strong new home sales in December as mortgage rates dropped). Finally, South Bay Research noted that semiconductor chip orders turned positive in Q4 2023, indicating growth in durable goods in Q2 or so.

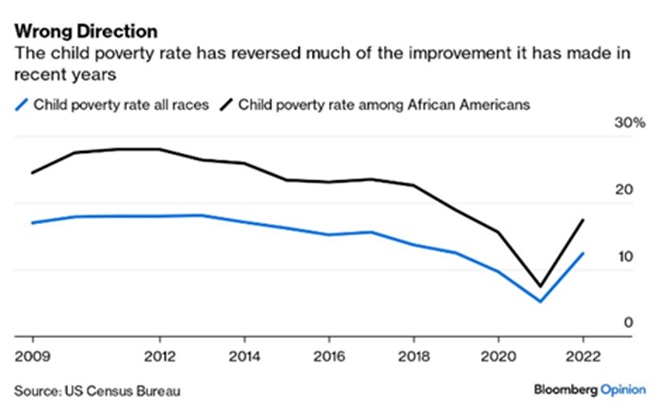

Inflation Not Tamed Yet per the December numbers as it accelerated at the close of 2023. The consumer price index increased +3.4% for 2023, the most in three months according to government figures. On a monthly basis, it also rose by more than forecast. The CPI excluding food and energy rose +0.3% in December from a month earlier. On an annual basis, this core measure increased +3.9%, higher than expectations. This particularly affects people on fixed incomes and the poor as seen in the increase of child poverty rates (see right). The final takeaway from these data points and the Fed meeting was that Chair Powell does not want to repeat the mistakes of the 1970s and cut interest rates too soon only to see inflation re-accelerate, particularly when there have been no problems in the labor market (so far).

increased +3.4% for 2023, the most in three months according to government figures. On a monthly basis, it also rose by more than forecast. The CPI excluding food and energy rose +0.3% in December from a month earlier. On an annual basis, this core measure increased +3.9%, higher than expectations. This particularly affects people on fixed incomes and the poor as seen in the increase of child poverty rates (see right). The final takeaway from these data points and the Fed meeting was that Chair Powell does not want to repeat the mistakes of the 1970s and cut interest rates too soon only to see inflation re-accelerate, particularly when there have been no problems in the labor market (so far).

Macro: Europe

European Inflation Ticked Lower from +2.9% to +2.8% over the last twelve months but core inflation was higher than expected (+3.4% versus +3.2%). ECB Chair Lagarde held to the view that it was “premature to discuss rate cuts” but one should expect so in coordination with the Fed. Unemployment fell to the lowest level recorded at 6.4% but Q4 2023 GDP growth was flat with Spain and Italy registering positive and France and Germany negative. German industrial production fell more than expected in December, marking the seventh monthly decline in a row and highlighting weakness in the backbone of Europe’s largest economy. Industrial production fell -1.6% compared with the previous month. UK inflation picked up unexpectedly for the first time in 10 months, also tempering interest rate cut discussion at the Bank of England. Their Consumer Prices Index rose +4.0% from a year earlier in December, up from a +3.9 increase the previous month. Given that Europe is more exposed to higher shipping costs and losses from Red Sea attacks than the US, higher inflation pressures should continue.

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource