Ukraine-Russia War: Strategic Shift

The Ukraine-Russia Conflict saw little ground movement with minor territorial losses by Ukraine in the east. Russia pressed with its weight in numbers with casualties estimated at three times those suffered by Ukraine. Recall that the Soviet Union had about 90,000 total casualties in Afghanistan and has already reached more than 350,000 military personnel killed and wounded in Ukraine per NATO. In short, Ukraine is being pushed back but grimly giving better than what it takes. However, a NATO weaponry and ammunition influx can turn the initiative back around to Ukraine.

The War Shifted to a Strategic Level with Ukraine lashing out at Russian refineries to undermine not just attack capabilities but the overall Russian economy. Approximately 15% of oil refining capacity had been damaged by early April, with Russia’s third-largest refinery losing half its volume on April 2nd. Since many of these plants were built with now-sanctioned western technology, Russia may have to look to Chinese or their own equipment for replacements. By the end of the month, about 1 million barrels per day (mbpd) of Russian crude processing capacity was offline from the drone attacks, impacting its high-sulfur oil exports which are processed at Chinese and Indian refineries. In addition, Bloomberg estimated that Russia would see diesel exports from its ports on the Baltic and Black Seas decline by -21% in April, denting needed currency. Already over 3.7 million barrels of Russian diesel were sitting on ships idling in waters near Brazil, as payment sanctions limited customers. The Biden administration expressed its worries about higher oil prices to Ukraine because of these successful strikes, but with its survival on the line, Ukraine undoubtedly ignored them. Also strategically, Ukraine struck a number of Russian naval ships in Crimea that were used for electronic warfare and surveillance, forcing two capital ships to leave their ports to the Red Sea for safety. Finally in early April, Ukraine went after Russia’s drone manufacturing facilities, hitting a target over 1000 kilometers (620 miles) away, much further than the range of known Ukrainian drones. While Ukraine’s efforts may be insufficient in the end, one must note the tenacity and variety of their targets, which would keep Russia off-balance as it now must shift to a spread-out and expensive air defense to avoid further economic damage.

Ukraine’s Grain Exports Fell to around 5.2 million metric tons in March from 5.8 million tons in February, per their agriculture ministry. The UCAB Ukrainian farm business association linked the decline to Russian forces shelling southern Ukraine, which interrupted operations at seaports, and to Polish protesters blocking of land exports (see graph right on the shift in EU wheat imports) on fears of a supply glut.

in February, per their agriculture ministry. The UCAB Ukrainian farm business association linked the decline to Russian forces shelling southern Ukraine, which interrupted operations at seaports, and to Polish protesters blocking of land exports (see graph right on the shift in EU wheat imports) on fears of a supply glut.

Macro: Asia

China Economic Headlines Were Good Overall – apart from property data. YTD fixed asset investment grew +4.2% y/y rising from the +3.0% growth in 2023 and better than the +3.4% consensus, retail sales gained +5.5% y/y from December’s +7.4% gain, though outperforming the expected +5.0%, and industrial production was up +7.0% y/y over the period, while the unemployment rate increased to 5.3% as of February. Floor space completions (important for base metals) dropped on the year, falling by -21% y/y, while floor space new starts were down by -31% y/y. Property woes still plagued the government’s management of the economy as regulators revealed that China Evergrande Group, the defaulted developer at the heart of China’s real estate crisis, inflated business revenue by more than $78 billion over two years. Its rival Country Garden Holdings, warned it will miss its March 31st deadline for reporting annual results, further complicating plans to restructure its debt following a default last year. The impact on China’s banks escalated as combined profits at China’s commercial banks rose 3.2% to 2.4 trillion yuan last year, but bad loans climbed to a record 3.2 trillion yuan. Looking at the bigger picture, those who criticized the lack of Chinese government stimulus so far this year seem to miss that the CCP may be holding back in case they need to bail someone(s) out.

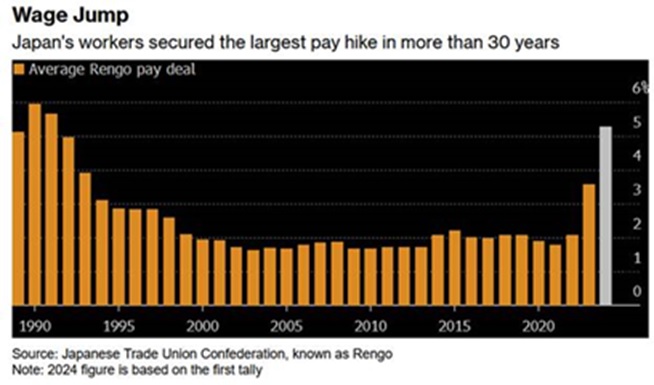

The Bank of Japan (BOJ) Ended eight years of negative interest rates and other remnants of its extreme policy on March 19th, with its first interest rate hike in 17 years. Massive monetary stimulus stayed in place as the BOJ stated that rates will remain stuck at around zero as a fragile economic recovery forces the central bank to go slow with any further rise in borrowing costs. The BOJ set the overnight call rate at a range of 0.0 – 0.1%. The central bank also abandoned yield curve control (YCC), a policy that had been in place since 2016 that capped long-term interest rates at around zero. The BOJ additionally decided to discontinue purchases of market assets like exchange-traded funds and Japanese real estate investment trusts, though when those will be sold or run off was unknown. No QT for sure. Meanwhile, Japan’s biggest union federation known as Rengo demanded its biggest pay hike since 1993 of +5.85%, more than +4.5% from a year ago. With inflation picking up, will Japan enter a classic price-wage upward spiral?

the BOJ stated that rates will remain stuck at around zero as a fragile economic recovery forces the central bank to go slow with any further rise in borrowing costs. The BOJ set the overnight call rate at a range of 0.0 – 0.1%. The central bank also abandoned yield curve control (YCC), a policy that had been in place since 2016 that capped long-term interest rates at around zero. The BOJ additionally decided to discontinue purchases of market assets like exchange-traded funds and Japanese real estate investment trusts, though when those will be sold or run off was unknown. No QT for sure. Meanwhile, Japan’s biggest union federation known as Rengo demanded its biggest pay hike since 1993 of +5.85%, more than +4.5% from a year ago. With inflation picking up, will Japan enter a classic price-wage upward spiral?

Macro: US

The Federal Reserve Fed meeting in March indicated that rate cut possibilities were deferred to the June or later meetings though there is possibility of slowing (AKA tapering) their balance sheet reductions starting after the May meeting. Chair Powell spoke dovishly during the press conference saying that while an unexpected weakening in the labor market might spur the decision to begin the cutting cycle, rapid labor market growth from here would by itself not be a reason to hold off on rate cuts – dovish and dovish. As for the warm inflation prints that we have seen so far in 2024, Powell seemed to view them as just bumps in the road, saying to look past one or two data points. The strong March payroll report of +303,000 jobs and the unemployment rate fell slightly t0 3.8% from 3.9%.

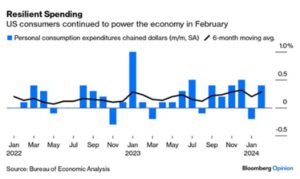

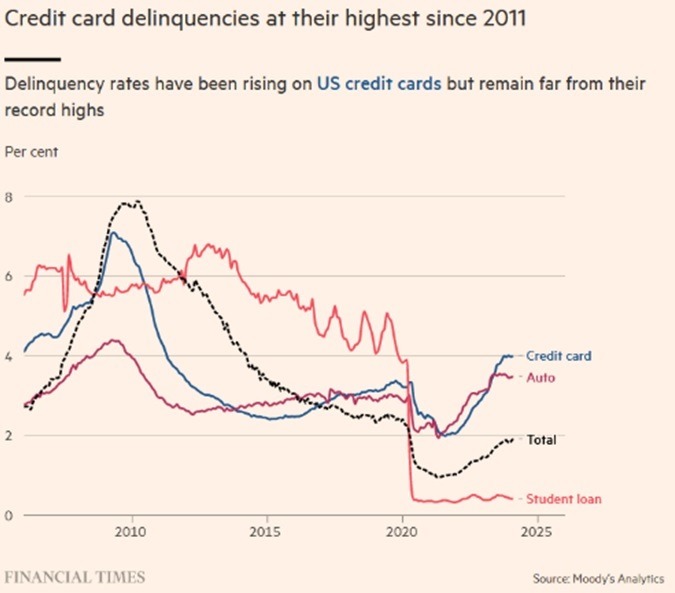

Other US Economic Statistics Held Up so far with Q1 GDP growth estimated at +2.8% annualized by the Atlanta Fed branch. Consumer spending (graph right) also moved forward, though there were more signs of a “two-speed” economy – i.e., one where the top cohorts are pulling further ahead of the bottom ones. Lower-income consumers increasingly have spent their savings and are turning to grocery stores instead of restaurants, McDonald’s CFO Ian Borden said, explaining why same-store sales were expected to not to grow as much as last year. Consumer delinquency rates continued their move up (right) though still remain below the 2008 highs – though with credit card interest

“two-speed” economy – i.e., one where the top cohorts are pulling further ahead of the bottom ones. Lower-income consumers increasingly have spent their savings and are turning to grocery stores instead of restaurants, McDonald’s CFO Ian Borden said, explaining why same-store sales were expected to not to grow as much as last year. Consumer delinquency rates continued their move up (right) though still remain below the 2008 highs – though with credit card interest rates hitting almost 23% and other loan interest rates at twenty-year highs, this situation could escalate quickly. However, the effective rate that households are paying on their mortgages remains very low (estimated at 3.8%) as many locked in low rates during 2020-21 and aren’t moving. Commercial real estate also showed more signs of cracking with commercial real estate collateralized loan obligations (CRE CLO) share of troubled assets surging four-fold – rising by one measure to more than 7.4%. “The loans inside CRE CLOs tend to be for transitional properties, so the borrowers are counting on reselling them before the loan matures. But today many borrowers can’t sell properties for anywhere near where they bought them,” quoted the Financial Times. While a small market overall, the more public nature of CRE CLOs have acted as an early indicator to the sector.

rates hitting almost 23% and other loan interest rates at twenty-year highs, this situation could escalate quickly. However, the effective rate that households are paying on their mortgages remains very low (estimated at 3.8%) as many locked in low rates during 2020-21 and aren’t moving. Commercial real estate also showed more signs of cracking with commercial real estate collateralized loan obligations (CRE CLO) share of troubled assets surging four-fold – rising by one measure to more than 7.4%. “The loans inside CRE CLOs tend to be for transitional properties, so the borrowers are counting on reselling them before the loan matures. But today many borrowers can’t sell properties for anywhere near where they bought them,” quoted the Financial Times. While a small market overall, the more public nature of CRE CLOs have acted as an early indicator to the sector.

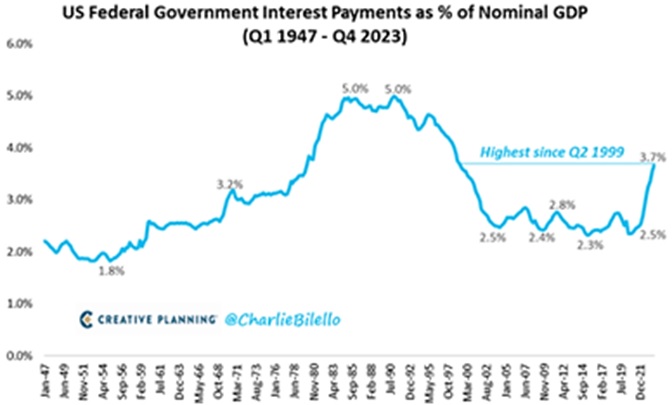

The US Government Interest Payments surpassed the $1 trillion annual rate, increasing 98% over the past 3 years, reaching 3.7% of GDP in Q4 2023, the highest percentage since Q2 1999 (see graph right). Although cutting rates by the Federal Reserve could halt this progression, inflation may not play along – while year-over-year inflation may be still declining, the 3-month and 6-month price changes bottomed in late 2023 and have started rising. With the Congressional Budget Office projected 2024 deficit of $1.6 trillion (barring additional spending on Ukraine,

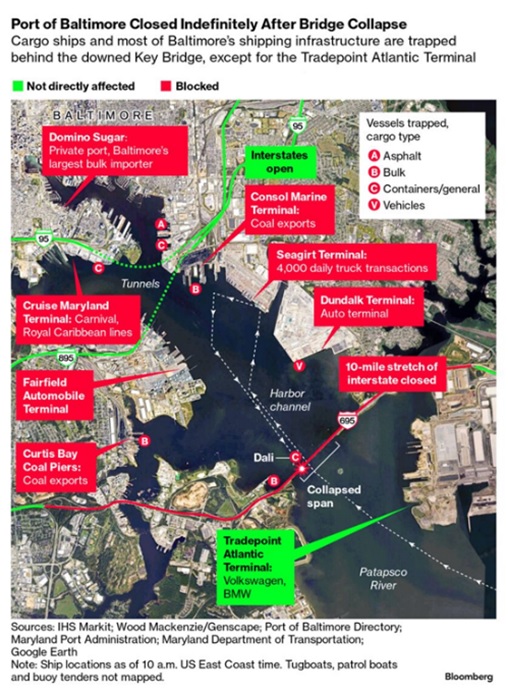

reaching 3.7% of GDP in Q4 2023, the highest percentage since Q2 1999 (see graph right). Although cutting rates by the Federal Reserve could halt this progression, inflation may not play along – while year-over-year inflation may be still declining, the 3-month and 6-month price changes bottomed in late 2023 and have started rising. With the Congressional Budget Office projected 2024 deficit of $1.6 trillion (barring additional spending on Ukraine, Israel/Gaza or other supplemental packages), upward pressure on interest rates will continue to stalk the Federal Reserve’s movement to lower rates. Finally, while economically important to the central East Coast, the collapse of the Francis Scott Key bridge in Baltimore will likely have a small and temporary impact, with container and bulk traffic rerouted until demolition crews clear a channel. “A short-term shock,” was how the CFO of DHL Group described it. Lloyds of London estimated total insurance payouts at about $3 billion, though it was unknown what the replacement cost will be. Spot container rates from Asia to the US East Coast were initially little changed, increasing to $5,301 for a 40-foot container as of March 31 from $5,284 the previous week but the first increase after five weeks of declines.

Israel/Gaza or other supplemental packages), upward pressure on interest rates will continue to stalk the Federal Reserve’s movement to lower rates. Finally, while economically important to the central East Coast, the collapse of the Francis Scott Key bridge in Baltimore will likely have a small and temporary impact, with container and bulk traffic rerouted until demolition crews clear a channel. “A short-term shock,” was how the CFO of DHL Group described it. Lloyds of London estimated total insurance payouts at about $3 billion, though it was unknown what the replacement cost will be. Spot container rates from Asia to the US East Coast were initially little changed, increasing to $5,301 for a 40-foot container as of March 31 from $5,284 the previous week but the first increase after five weeks of declines.

Macro: Europe

European Inflation Ticked Lower from +2.6% to +2.4% over the last twelve months ending March and core inflation followed (from +3.1% to +2.9%) as unemployment held steady at 6.5% in February. Economic indicators were mixed as German factory orders dropped sharply by -11.3% for January at the start of 2024. Germany’s Bundesbank warned that output could contract in Q1 2024 after already falling -0.3% in the final three months of 2023. The full-year growth forecast for 2024 was cut to +0.2% — a much flatter rebound than the +1.3% predicted a few months back. Financial markets expect the lower inflation and GDP growth to push the ECB to cut interest rates before the US Federal Reserve.

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource