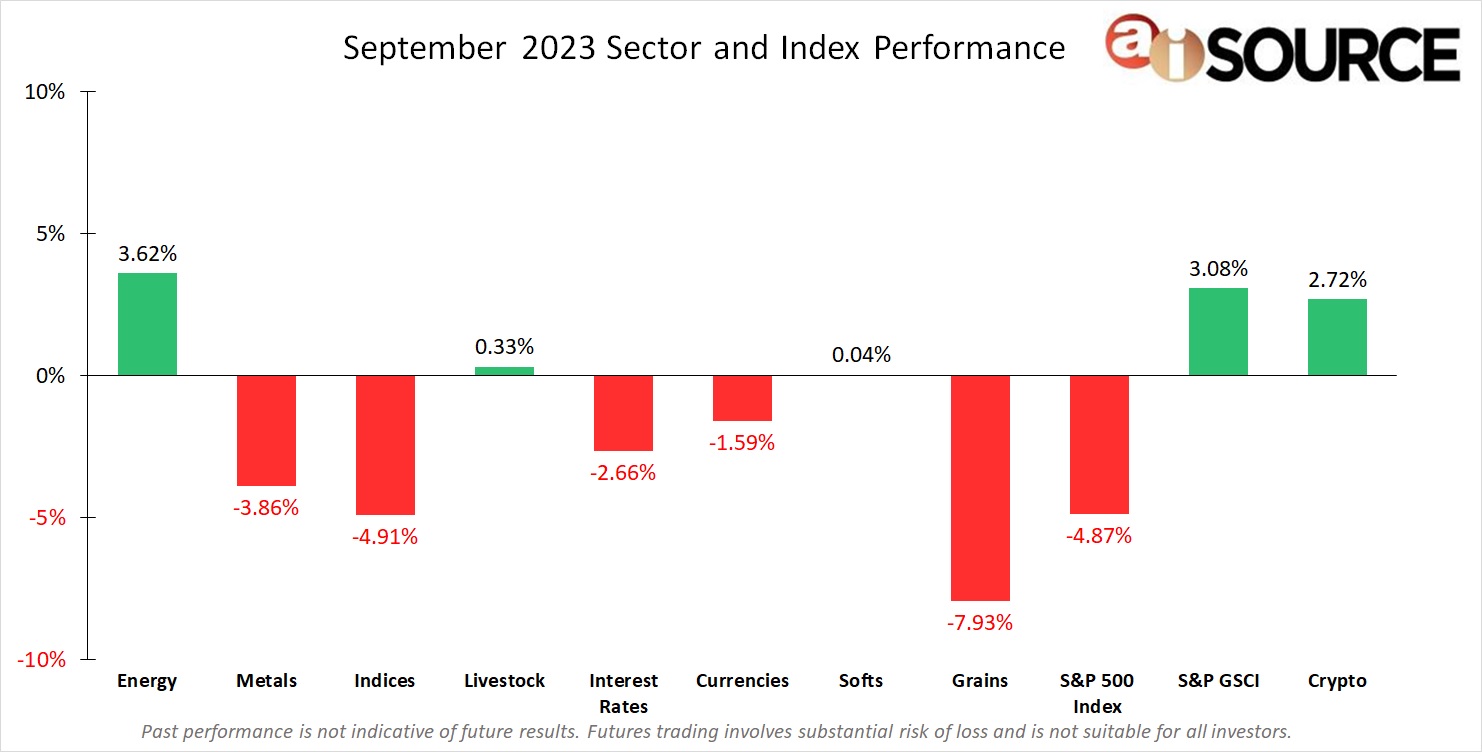

During the month of September, Energy (+3.62%) and the S&P GSCI (+3.08%) were the top performers. The bottom performers were Grains (-7.93%) and Indices (-4.91%). We are in the midst of harvest season, which is the main contributor to the selloff in Grains (-7.93%) with Corn (+3.42%) being the sole positive performer in the sector. The S&P GSCI (+3.08%) has now outperformed the S&P 500 Index (-4.87%) for the third consecutive month. As currencies (-1.59%) performed below par, The U.S. Dollar (+2.15%) remains king providing the only positive performance in the sector.

For month-to-date and year-to-date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. Crypto: Bitcoin and Ethereum. S&P 500 Index – All data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.