Commodities: Global

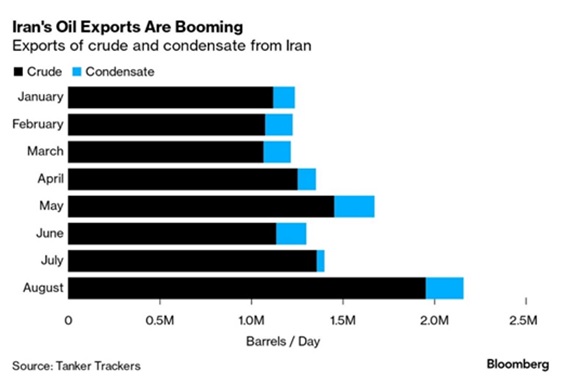

OPEC Oil Output Rose over 200,000 barrels per day (bpd), reaching 27.6 million bpd in August, as Iranian supply increased to its highest since 2018 (see graphic right). Per Bloomberg, American officials privately acknowledged a “lighter touch” in enforcing sanctions on Tehran’s oil sales. Iran has restored production to the highest level since the ban five years ago to about 3.1 mbpd and is shipping the most crude to China in a decade (about 75% of the total). Iranian officials are confident they’ll pump even more “soon.” In a surprise move in the beginning of September, the Kingdom of Saudi Arabia extended their 1 million barrels per day (mbpd) reduction and Russia likewise their 0.3 mbpd cuts for three months – instead of for just one month – to the end of the year. Meanwhile, the military in Gabon seized power. The small country exported a monthly average of 160,000 barrels per day to Asia from May to July, Kpler ship-tracking data showed. Coups are back in style with the last one in Niger in July. Military officers have also seized power in Mali, Guinea, Burkina Faso and Chad.

“lighter touch” in enforcing sanctions on Tehran’s oil sales. Iran has restored production to the highest level since the ban five years ago to about 3.1 mbpd and is shipping the most crude to China in a decade (about 75% of the total). Iranian officials are confident they’ll pump even more “soon.” In a surprise move in the beginning of September, the Kingdom of Saudi Arabia extended their 1 million barrels per day (mbpd) reduction and Russia likewise their 0.3 mbpd cuts for three months – instead of for just one month – to the end of the year. Meanwhile, the military in Gabon seized power. The small country exported a monthly average of 160,000 barrels per day to Asia from May to July, Kpler ship-tracking data showed. Coups are back in style with the last one in Niger in July. Military officers have also seized power in Mali, Guinea, Burkina Faso and Chad.

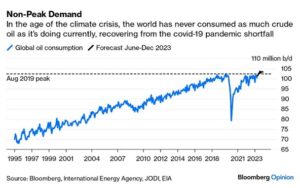

Crude Demand Not Going Away: The graphic below says it all:

US Oil Production Popped to 12.8 mbpd in August despite a dramatic decrease in operating oil rigs from 529 as of July 28th to 512 as of September 1st. Oil companies cited productivity enhancements in their shale regions. Per AAA, US average regular gasoline prices moved up again to $3.82 per gallon as of August 31st, 4¢ higher than last month. While the US summer driving season failed to translate into the usual gasoline demand, ultra-low inventories in storage across the energy complex pushed up prices. US’ EIA expected oil production again was revised upward to increase this year and next, reaching 12.8 mbpd and 13.1 mbpd, respectively. Shale regions were forecasted to stay steady at about 9.4 mbpd. Meanwhile, Biden continued to restrict future production, terminating oil and gas leases in Alaska (which he had suspended in 2021) and proposing a ban on 40% of the 23-million acreage in the National Petroleum Reserve space. Finally, New York City is at risk of power outages by 2025 as rising demand amid intense heat and the push toward electrification outpace the grid’s capacity. At peak times this summer, the city needs about 8,800 megawatts but by summer 2025 it would be about 446 megawatts short for nine hours at a time. 1,027 megawatts from natural gas plants, which provide energy at times of high demand, were taken off the grid this year to comply with a 2019 antipollution law with more scheduled to be taken offline by mid-2025. Will this be similar to California which had to backtrack on shutting nuclear and natural gas plants this year because the government realized that one cannot have Silicon Valley if there is no electricity? The “City That Never Sleeps” may have enforced naps if power shuts off…

Chinese Crude Imports in July fell 19% from June (which was the 2nd most ever) to reach 10.2 mbpd, but still +17% year-on-year. 2023 imports for the first seven months of the year were up +12.4% year on year at just under 11.0 mbpd. Russia remained China’s largest crude supplier, even as Russian shipments fell to 1.9 mbpd.

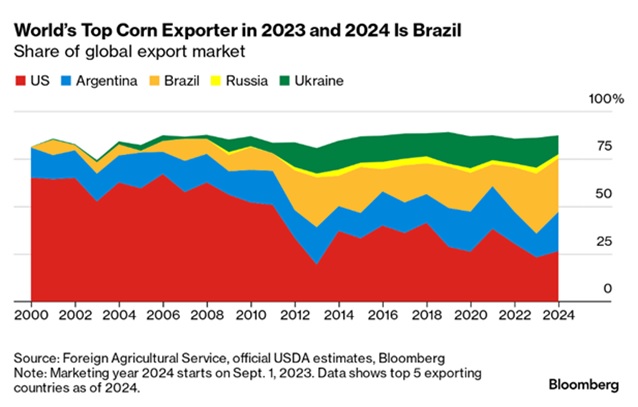

US Crop Conditions for corn, wheat and soybeans remained not particularly good but prognosticators stated that the US could have the second-largest corn harvest regardless as August rains made up for earlier dryness. Demand for US corn exports wilted because of a massive harvest in Brazil, which is projected to overtake the United States as the world’s top corn supplier (see graph right). Also negative for prices was fresh rainfall over Argentina’s agricultural heartland which brought significant relief to the wheat crop, raising hopes for a good upcoming season after the harsh droughts of recent years. An interesting study found that 12% of Americans are responsible for eating half of all beef consumed on a given day per journal Nutrients, which analyzed data from the CDC. I am not really sure that is possible!

US could have the second-largest corn harvest regardless as August rains made up for earlier dryness. Demand for US corn exports wilted because of a massive harvest in Brazil, which is projected to overtake the United States as the world’s top corn supplier (see graph right). Also negative for prices was fresh rainfall over Argentina’s agricultural heartland which brought significant relief to the wheat crop, raising hopes for a good upcoming season after the harsh droughts of recent years. An interesting study found that 12% of Americans are responsible for eating half of all beef consumed on a given day per journal Nutrients, which analyzed data from the CDC. I am not really sure that is possible!

Finally, France will pay farmers €200 million for destroying their wine surplus and to keep prices high – a crime if I have ever heard of one.

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource