Ukraine: Slog Continues

The Ukraine-Russia Conflict slogged forward with the Ukrainian military making little progress despite the infusion of US/EU equipment. By necessity to avoid higher casualty rates, the attack tempo stayed slow – recall that Ukraine has one-third the population of Russia and its soldiers (and citizens) have to continually punch above their weight. Russia announced plans to increase its government spending by 25% in 2024 to support military operations. While the numbers favor Russia, UK’s head of the armed forces said “Russia has lost nearly half the combat effectiveness of its army. Last year it fired 10mn artillery shells but at best can produce 1mn shells a year. It has lost 2,500 tanks and at best can produce 200 [new] tanks a year.” We shall see if these limitations keep Russia from going on the offensive.

Grain Exports Still the Focus by both Russian and Ukraine as Russian attacks on Ukrainian ports and grain silos on the Black Sea and Danube River maintained their high tempo. However, Ukraine had effectively opened a shipping corridor saying five ships were heading to its Black Sea ports for loading, while three others recently left with cargoes by the end of the month. Chinese importers were believed to have made large purchases of animal feed corn from Ukraine in the last two weeks of September. Russia would be quite foolish to interfere with those purchases if it wants to stay on the good side of its key military supplier. Preserving these trade flows will be critical as the Ukrainian Grain Association estimated an overall harvest of about 80 million tons — up +8% from last year and well above earlier forecasts.

Energy Exports Too were in the spotlight as Russia temporarily banned exports of gasoline and diesel to keep supplies available for the war effort. Year-to-date, Russia exported about 1 million barrels per day (mbpd) diesel/gasoil and 0.13 mbpd of gasoline – important but absorbable. On the other hand, the oil that would otherwise be refined must be exported or stored if not consumed. By the end of the month there were already signs that this ban would be reversed in October (perhaps after harvest). Russian oil revenues were estimated up about $2.8 billion over the last three months due to the move higher in oil prices as well as strong demand from India and China. In fact, India’s crude oil imports from Russia were seen at a rate of 1.8 mbpd, making them the highest from any supplier, rising to 2.0 mbpd by the end of October as refiner maintenance ends. The Urals grade of crude is good for making diesel, which makes up 40% of India’s fuel consumption. India was said to be paying at least $80 for Russian crude, $20 over the G7 cap.

Macro: Asia

China’s Exports improved year-on-year in August falling a better-than-expected -8.8% year-on-year with imports also better, down -7.3% versus -9.0% forecasted for the last twelve months. China’s crude oil imports surged in August, as refiners built inventories and increased processing to benefit from higher profits from exporting fuel. Shipments last month to the world’s biggest oil importer were 12.43 mbpd, the third-highest daily rate ever according to Reuters calculations. Crude imports were up +30.9% versus a year ago. Meanwhile the Chinese currency fell to the lowest level versus the US dollar since 2007, to 7.3 RMB/USD, weaker than during early COVID. China’s headline economic activity data for August was mixed, but on balance slightly more positive than expectations. Fixed asset investment growth decelerated further to +3.2% over the last twelve months but retail sales were better at +4.6% and industrial production rose +4.5%. However, property data for the month of August remained weak with declines in floor space new starts (-23%) and other related measures. The central government continued to tinker around the edges to reverse the trend – for example, changing the rules slightly on who qualifies for better rates on new mortgages. Another marginal change was People’s Bank of China lowered the reserve requirement ratio for most banks by 25 basis points, but major banks still have over a 10% reserve ratio requirement. Meanwhile problem developer Evergrande failed to repay a $547 million local bond and its ex-CEO was placed under house arrest.

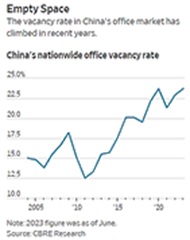

China Worse Than US? Chinese office-tower space reached a vacancy rate of up to 24%, higher than the US’ 18.2% (see WSJ graphic right – apologies if a bit bleary). Meanwhile, China’s total debt to GDP ratio (the sum of government, corporate and individual debt) has now overtaken the same ratio for the US (360% versus 340%) – unlike during the 2009 Great Financial Crisis (GFC), China is not in a position to spend their way through this.

bleary). Meanwhile, China’s total debt to GDP ratio (the sum of government, corporate and individual debt) has now overtaken the same ratio for the US (360% versus 340%) – unlike during the 2009 Great Financial Crisis (GFC), China is not in a position to spend their way through this.

Macro: US

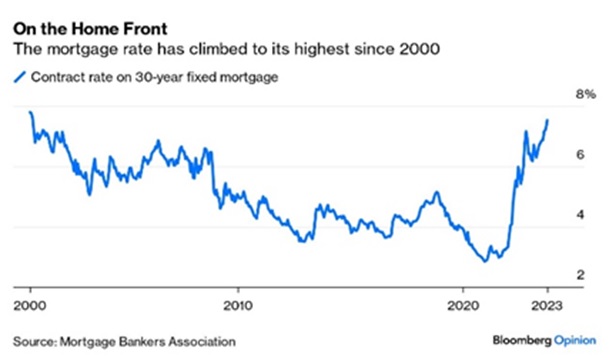

Federal Reserve left its benchmark interest rate unchanged at its September meeting while signaling borrowing costs will likely stay higher for longer after one more hike this year. Yields increased most of the second half of the month and into October with the 30-year bond touching 5%. Other interest rates moved higher, with benchmark 30-year mortgage rates reaching almost 7.5% (see left). The average monthly payment for new mortgages increased 46% in 2022, and the total costs and fees associated with home loans also increased by roughly 22% over the 12-month period, reaching a median of $5,954. US employment unexpectedly surged in September, illustrating a durable labor market and maintaining higher US interest rates. Nonfarm payrolls increased 336,000 last month — the most since the start of the year — after sizable upward revisions over the last several months. The unemployment rate held at 3.8%, and wages rose at a modest pace (+0.2% month-on-month). The number of workers with multiple jobs resumed climbing, indicating that there are more people under financial stress (and without health insurance). Strike action also has picked up (for example 75,000 hospital workers at Kaiser) as inflation continued to outpace wage growth (+0.6% in CPI for the month of August, fueled by a 10%+ increase in fuel prices). Core inflation moved higher in August as well, offsetting better overall figures.

payment for new mortgages increased 46% in 2022, and the total costs and fees associated with home loans also increased by roughly 22% over the 12-month period, reaching a median of $5,954. US employment unexpectedly surged in September, illustrating a durable labor market and maintaining higher US interest rates. Nonfarm payrolls increased 336,000 last month — the most since the start of the year — after sizable upward revisions over the last several months. The unemployment rate held at 3.8%, and wages rose at a modest pace (+0.2% month-on-month). The number of workers with multiple jobs resumed climbing, indicating that there are more people under financial stress (and without health insurance). Strike action also has picked up (for example 75,000 hospital workers at Kaiser) as inflation continued to outpace wage growth (+0.6% in CPI for the month of August, fueled by a 10%+ increase in fuel prices). Core inflation moved higher in August as well, offsetting better overall figures.

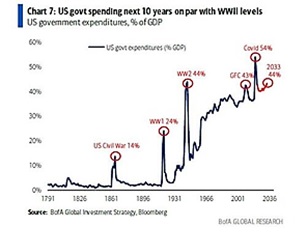

The US Federal Government spent at a rate of 44% of GDP per year, the same levels as during World War 2 and the GFC (see graph right). In 2020, the US spent a record breaking 54% of GDP in one year! Interest payments have surged to $1 trillion annualized, basically double than a few years ago. However, the US Treasury logged a rare surplus for the month of August as the department accounted for revenue from student-loan payments, reflecting the Supreme Court’s invalidation of the Biden administration’s move to forgive the debt. The federal government had an $89.2 billion surplus for August as officials added $319 billion to revenues. September and October should also see one-time boosts as California residents have to pay their income taxes, which were delayed from the usual April deadline to October due to 2022-3 winter storms. Meanwhile, budget negotiations became heated as expanding deficits pressed some lawmakers to seek to cut spending while others fought to preserve their projects. Look for more in this war of words over the next 45 days (the extension time to the September 30th deadline). Looking ahead to 2024, JPMorgan forecasted higher Federal debt issuance next year, further straining the debt markets, and by implication, the economy. Just in time for the election!

the US Treasury logged a rare surplus for the month of August as the department accounted for revenue from student-loan payments, reflecting the Supreme Court’s invalidation of the Biden administration’s move to forgive the debt. The federal government had an $89.2 billion surplus for August as officials added $319 billion to revenues. September and October should also see one-time boosts as California residents have to pay their income taxes, which were delayed from the usual April deadline to October due to 2022-3 winter storms. Meanwhile, budget negotiations became heated as expanding deficits pressed some lawmakers to seek to cut spending while others fought to preserve their projects. Look for more in this war of words over the next 45 days (the extension time to the September 30th deadline). Looking ahead to 2024, JPMorgan forecasted higher Federal debt issuance next year, further straining the debt markets, and by implication, the economy. Just in time for the election!

Macro: Europe

European Central Bank Increased their main interest rate by 25 basis points to a record 4%, though inflation rates fell in September to 4.3% from August’s 5.2% rate. While that was positive, business activity as measured by the purchasing managers’ index indicated a further contraction of new orders. Budgets for 2024 had a wide range with Germany at only a 2.5% deficit but Italy was over the EU limit of 3% at 4.3% expected. Their 2023 deficit estimate also exceeded expectations, moving from 4.5% to 5.3%. Italian 10-year government bond yields bounced to 5% (exceeded those of the US) and the highest in ten years (during the previous financial crisis). German 10-year bonds by comparison are close to 3%. After revisions, German industrial output ending July fell for the third month in a row (-0.8% month-on-month versus -0.4% expected) as well as for the quarter ending June, tipping EU GDP to the barely positive (+0.1% for Q2 2023). With little chance of interest, energy or labor costs declining into the end of the year, Europe will continue to struggle.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource