- OPEC+ Maintained Production Cuts to 7.7 million barrels per day (mbpd) assuming that one does not count Iranian smuggling. OPEC itself pumped about 24.4 million barrels per day (mbpd) on average in September, a Reuter’s survey found, up 160,000 bpd from August’s revised figure and a further boost from the three-decade low reached in June. Saudi Arabia shipped 6.1 mbpd of crude oil in September, slightly above August levels, and kept output steady at 8.97 million bpd last month. Iran’s oil minister openly admitted in their parliament that they are evading sanctions, “What we export is not under Iran’s name. The documents are changed over and over…” per the website of the government-owned oil company. TankerTrackers believed that 1.5 mbpd in oil and condensate left the country in September to China, Turkey and UAE, twice August’s level. In war news that affected energy production, a truce between the warring factions freed up Libyan production, which reached 250,000 bpd by the end of September and just under 300,000 bpd in early October. Goldman Sachs estimated that production could reach 550,000 bpd by year-end. Given that the country pumped 1.2 mbpd at the beginning of the year, more is to come. On the other hand, fighting flared up between the former Soviet republics of Armenia and Azerbaijan, threatening a BP-operated pipeline that transports as much as 1.2 mbpd from Baku to Turkey. Given that their sponsors (Russia and Turkey, respectively) could be dragged in, one would expect the conflict to be limited, but we shall see if it ends up like western Syria. Outside of OPEC+, the escalation of a strike among offshore oil workers in Norway could affect 330,000 barrels of oil equivalent per day (boepd), but this is expected to be temporary.

- US Crude Oil Production is expected to fall by 800,000 bpd this year to 11.45 mbpd per the US’ Energy Information Administration, a smaller decline than its previous monthly forecast for a drop of 870,000 bpd. The agency estimated that production rose to 11.2 million bpd in September and said it expects output to generally decline to an average of 11 million bpd in the second quarter of 2021 because new drilling activity will not generate enough production to offset declines from existing wells. Oilfield job losses from the COVID-19 pandemic topped 100,000 by August, according to a trade group report, even though some idled drilling projects have resumed. US operating drilling rigs ticked higher to 183 as of September 25th from 180 on August 28th. Coming up, while Tropical Storm Delta is expected to be at hurricane strength when it makes US landfall, the categorization looked in the middle part of the scale – not at the

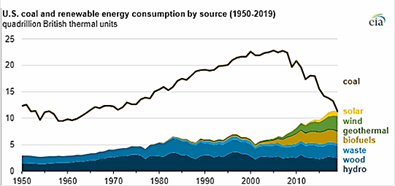

most dangerous levels – and thus likely only to have a temporary impact on energy production, refining and transportation. In looking for one silver COVID lining, the virus accelerated the change away from the dirtiest energy source for US electrical generation with coal falling below the combined renewable forms of energy in terms of BTUs (see graph right). In terms of short tons of coal burned, power plants consumed just 27.4 million short tons of the fuel in April, about 25% of the amount burned in 2000 and the lowest monthly level in the EIA data going back to 1973.

most dangerous levels – and thus likely only to have a temporary impact on energy production, refining and transportation. In looking for one silver COVID lining, the virus accelerated the change away from the dirtiest energy source for US electrical generation with coal falling below the combined renewable forms of energy in terms of BTUs (see graph right). In terms of short tons of coal burned, power plants consumed just 27.4 million short tons of the fuel in April, about 25% of the amount burned in 2000 and the lowest monthly level in the EIA data going back to 1973.

- China is Still Hungary for Oil as throughput in August rose from a year ago, reaching the second-highest on record, as refineries worked to digest record imports brought in earlier this year. The country processed 14 mbpd, up 9.2% from a year earlier. Vessel-tracking and port data compiled by Refinitiv indicated China imported 867,000 bpd of US crude in September, exceeding 654,000 bpd in August and 694,000 bpd in July. China is also hungry for US pork, as German supplies were banned after a finding of wild boars dead from the virulent African Swine Flu – the disease that decimated Chinese herds in 2019. While the German farms were untouched by the disease (they have some of the highest hygiene standards in the world) in the three weeks since the discovery, US prices remained elevated. To rebuild, the Chinese government approved more than 20,000 new hog farms in the first half of 2020, with the capacity to raise over 150 million pigs. This meat is expected to alleviate high prices in 2021 as it takes time for the breeding herd to rebuild. In meat technology, US and UK scientists created gene-edited pigs, goats and cattle to produce sperm with traits such as disease resistance and higher meat quality in what they say is a step towards genetically enhancing livestock to improve food production. Finally, China is hungry for US soy as exports of agricultural products to China reached $10.7 billion in the first eight months of the year, according to USDA data – the highest for that period since 2017. Note that the trade deal target is $36.5 billion, so well short. Lower stocks and dryness during harvest sparked near-term US grain prices despite the harvest in full swing. While the stocks-to-use ratios are expected to be much lower than the last three years, they are multiples higher than the truly tight years in 2012-14. Dry weather slowed the planting in South America but higher prices sparked the idea of more acreage. The latest USDA statement forecasted another record soybean output from Brazil – potentially hitting 131 million tons from 125.6 million tons for this year. Simply put, no one will go hungry.

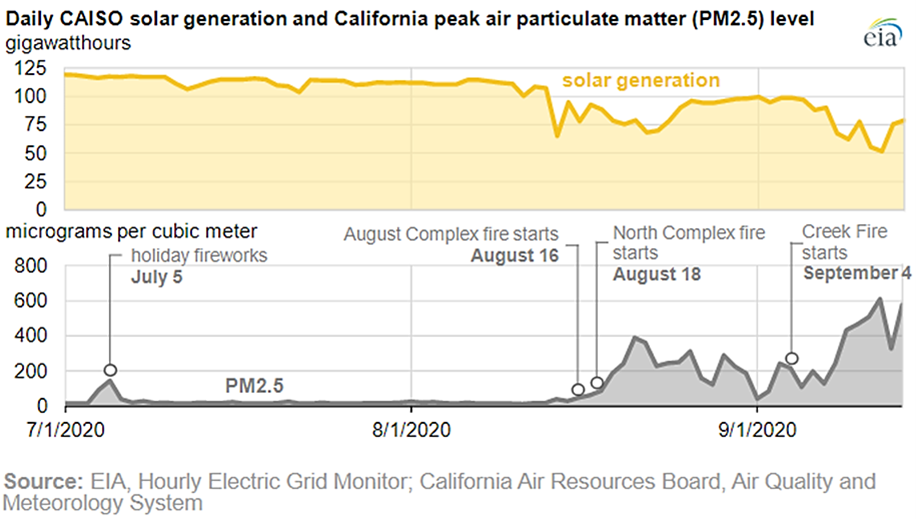

Finally, my state of California also made energy history twice, first by banning the sale of gasoline-powered automobiles after 2035, and second by exposing the electrical grid’s vulnerability to wildfire smoke – while normal solar generation is around 110 gigawatt-hours in summer months, that level fell as low as 50 gwh as particulate matter rose (aka smoke filled the air). See the interesting graph from the US’ EIA below.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource