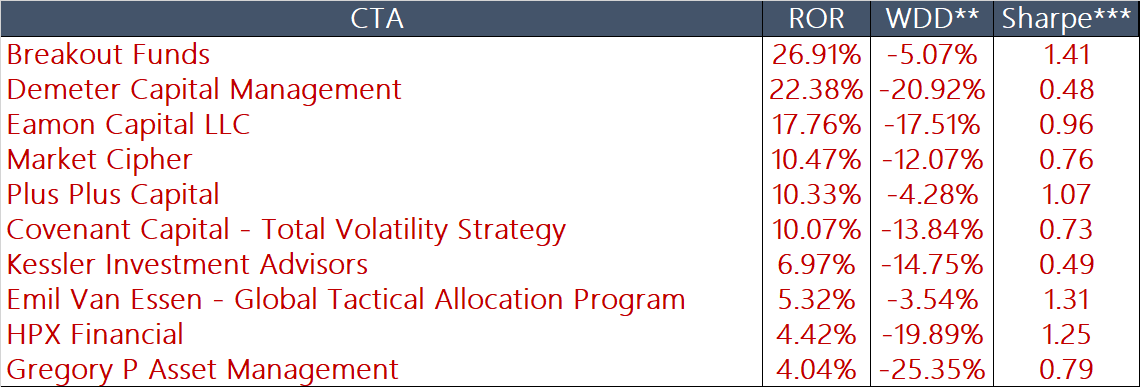

2020 has been a mixed bag for CTAs thus far. CTA indices are also mixed, with Barclay’s CTA index posting a positive YTD return, while the SG CTA index is posting a negative return. Agricultural strategies, which had been out of favor over the past few years are making a comeback. Grain strategies have seen a resurgence in 2020 with a strong grain market over the summer, which continues to be volatile as fall begins. Livestock strategies have also seen a comeback with a number of global demand concerns causing increased volatility. Here are ten of the top performing CTAs in 2020 that are part of aiSource’s approved manager pool:

Past performance is not indicative of future results. All RORs are through August 2020

**WDD: worst drawdown since the inception of the track record

***Sharpe: Sharpe Ratio since the inception of the track record

Three of the above managers are part of the agriculture group: Demeter Capital Management (grains and livestock), HPX Financial (livestock), and Gregory P Asset Management (various commodities).

There are some new entrants to our approved CTA pool this year, which have broken into the top ten list: Emil Van Essen, PlusPlus Capital, and Covenant Capital. Emil Van Essen’s systematic global tactical allocation strategy has maintained its volatility profile while weathering the covid-19 markets. PlusPlus Capital is another systematic strategy that uses a combination of futures and options to trade various global markets. Lastly, Covenant Capital’s total volatility strategy trades the VIX futures curve in a multi-strategy format.