COVID-19

- Europe Made Headlines with an acceleration in their case count during September to levels that matched or exceeded the case level in the US (45,000 or more per day on average) and at roughly the same amount of deaths (800 or so per day on average). Total 2020 COVID deaths in the US and Europe were close to the same level (almost 210,000 versus just over 192,000) through October 6th as both regions suffered heavily among the elderly early in the year but now gained greater control over the spread and improved medical care. Trendwise, the US was on the decline with the most recent infection rate between 4.5% and 5.0% of tests (versus 8% during the July bump) but Europe was on the upswing, particularly in Spain, France, the UK, Iceland and the Czech Republic. For those wondering, these numbers came from the websites of US’ Center for Disease Control and The COVID Tracking Project[1] and the corresponding European Centre for Disease Prevention and Control. Other sources gave similar but different numbers for these regions (e.g. Statista.com had Europe at more than 235,000 deaths since February 15th). Approved vaccines and therapeutics remained pending with a number of candidates in final trials. Lockdowns in Europe were on the rise again while in the US the situation seemed to reach a status quo with the individual states having already decided whether to open up or not (or partially so). Q3 GDP gains were correspondingly estimated as higher for the US versus Europe (almost +35% versus +30% annualized) and further out GDP growth was more optimistically stated by the US’ Federal Reserve than the European Central Bank.

- US President Trump may be the best known of the recent cases though it was too early as of this writing to know how much of his quick recovery was due to the therapeutics administered by his doctors or his intrinsic health (noting that age and weight were his primary risks but no complicating health conditions). Regardless of location, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- The Friendly Q3 GDP Data started good and got better as time progressed. US unemployment for September fell to 7.9%, a 0.5% improvement versus August’s 8.4%. Nonfarm payrolls improved by 661,000 (lower than expected) but August’s gain was revised upward to 1.49 million, which offset the miss from expectations. Improvements were seen in most racial groups though women’s falling participation in the labor force was a disappointment. Gains in the private sector were broad, which even included 142,000 in retail, but government positions fell 216,000, primarily on local government cuts and the release of temporary federal census workers. Looking ahead, a number of large businesses announced or threatened mass layoffs, including Walt Disney (28,000 jobs), Allstate (3.800), Cineworld movie theaters (45,000 globally), American Airlines (19,000), United Airlines (13,000), Continental Airlines (30,000) and Royal Dutch Shell (9,000 globally). As many as half of New York City’s restaurants could close permanently in 2021 due to the pandemic, eliminating up to 159,000 jobs, according to an audit issued by the New York state government. While the US political parties passed a spending package to maintain government functions through the election, they could not agree on additional stimulus spending of $1.6 to 2.4 trillion – half to two-thirds of the 2020 revenue of $3.7 trillion. Given that many of the largest states were strictly constraining economic activity (and facing budget black holes – California tax revenue was down -45% in Q2 2020 versus the same quarter last year), citizens will have to wait until after the November 3rd election on to see what if any spending will pass. On the other hand, these budget talks never really die. The only truism is that deficits going forward will be massive.

- Consumer Activity was generally good. Retail sales in August rose +0.6% m/m, the first time this year indicating an expansion while industrial production was up +0.4% m/m, less than expected. Existing home sales, a key indicator of consumer willingness to spend, rose +2.4% m/m with closing transactions the fastest since 2006. Looking at office building appraisal values, Wells Fargo Bank indicated alarm as values on properties financed by delinquent CMBS have fallen -27% from the time the debt originated. Perhaps more worrisome was that only 24% of loans more than 60 days delinquent had been examined, so

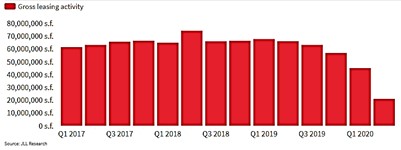

there could be more to come. To quote the report, “in addition to the immediate impact of Covid on hotels and retail properties, concerns are mounting regarding the prospects for multifamily and office properties…” Commericial office space is the key concern with Q2 office leasing activity at about one-third recent levels (see graph right).

there could be more to come. To quote the report, “in addition to the immediate impact of Covid on hotels and retail properties, concerns are mounting regarding the prospects for multifamily and office properties…” Commericial office space is the key concern with Q2 office leasing activity at about one-third recent levels (see graph right).

- Fed Chair Jay Powell Confirmed the new policy that would take a more relaxed stance on inflation. He said the Fed would no longer look to limit inflation to 2%, but instead will seek to average 2% inflation over time (how much time?), which implies periods of higher (much higher?) price increases at the store. Although US consumer prices rose by more than expected in August (+1.3% y/y), annual core inflation is still below the target average at +1.7%. With unemployment below the pre-crisis levels, easy money policies will dominate the next several months.

Macro: Asia

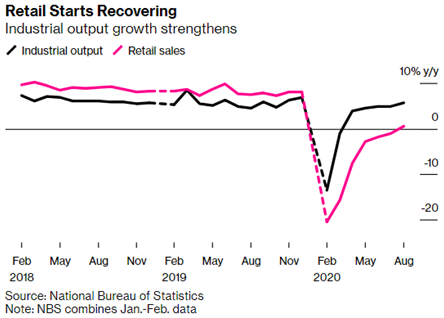

- China’ Slow Recovery Continued as retail sales rose for the first time this year in August, by +0.5% from a year earlier, while industrial production expanded +5.6%, against a forecast of +5.1%. In the first eight months, retail sales slid 8.6%, industrial production advanced 0.4%, and fixed-asset investment was 0.3%

lower than the same period in 2019. The graph left shows this recovery. China’s car sales increased for a second straight month in August, raising optimism that a two-year slump in the world’s biggest market is nearing an end. Retail sales of sedans, SUVs, minivans and multipurpose vehicles increased +8.8% last month from a year earlier to 1.73 million units, following a +7.9% gain in July. Government spending underpinned this growth with local governments to sell $550 billion in “special bonds” by the end of October and to spend half of it on construction, transport and energy projects. Tourism still suffered as Macau expected only half the usual gamblers than usual during the Golden Week holiday in early October. China’s exports grew by +9.5% in August y/y while imports shrank by -2.1%, as the country’s China’s trade surplus with the United States widened by 27% to $34.2 billion compared to a year earlier, despite vowing to buy more US products. While China’s imports of American agricultural imports have picked up, they remain about 1/3rd the promised levels. The prognosis for an uptick is likely as an outbreak of African Swine Flu affecting German hogs and dryness in South America affecting grain planting will likely cause China to look to North America for these commodities. Finally, individual companies flirted with disaster as trading in Evergrande’s bonds had to be halted over concerns that their rapid expansion into new businesses overstretched their cash flow, putting about $120 billion in debt at risk. While large investors stepped up to bail out the company (with consultation with the central government), this sounded all too much like HNA Group last year which had to be taken over by the central government after running up $85 billion in unpayable debts.

lower than the same period in 2019. The graph left shows this recovery. China’s car sales increased for a second straight month in August, raising optimism that a two-year slump in the world’s biggest market is nearing an end. Retail sales of sedans, SUVs, minivans and multipurpose vehicles increased +8.8% last month from a year earlier to 1.73 million units, following a +7.9% gain in July. Government spending underpinned this growth with local governments to sell $550 billion in “special bonds” by the end of October and to spend half of it on construction, transport and energy projects. Tourism still suffered as Macau expected only half the usual gamblers than usual during the Golden Week holiday in early October. China’s exports grew by +9.5% in August y/y while imports shrank by -2.1%, as the country’s China’s trade surplus with the United States widened by 27% to $34.2 billion compared to a year earlier, despite vowing to buy more US products. While China’s imports of American agricultural imports have picked up, they remain about 1/3rd the promised levels. The prognosis for an uptick is likely as an outbreak of African Swine Flu affecting German hogs and dryness in South America affecting grain planting will likely cause China to look to North America for these commodities. Finally, individual companies flirted with disaster as trading in Evergrande’s bonds had to be halted over concerns that their rapid expansion into new businesses overstretched their cash flow, putting about $120 billion in debt at risk. While large investors stepped up to bail out the company (with consultation with the central government), this sounded all too much like HNA Group last year which had to be taken over by the central government after running up $85 billion in unpayable debts.

- Rest of Asia Was Mixed as Japanese exports posted a modest recovery, pushing the lowest year-on-year decline in five months, down -14.8 y/y in August versus -19.2% in July. Industrial production and machine orders also had increases in August, again printing the reduced declines y/y. It looked like that the new Prime Minister, Yoshihide Suga, took over right when the bleeding stopped; whether he can get the economy righted is the question. Singapore and Taiwan also had industrial activity improvements, which generated positive growth over the last twelve months. South Korea too also saw improvement in its exports, growing +7.7% y/y and +8.2% to China. However, without gains in Europe (already up +15.4% y/y) and the US (+23.2% y/y), further growth may be limited.

Macro: Europe

- Europe Stumbled coming into October. Even with good industrial growth in August (+4.1% m/m versus +4.2% estimated), the month saw a climb in unemployment to 8.1% with youth unemployment at 18.1%. Looking ahead however, the prognosis looked iffy with German industrial output falling -0.2%, badly missing forecasts of +1.5%. ECB Chair Lagarde announced no change in its pandemic bond-buying program at 1.35 trillion euros ($1.6 trillion) and kept the deposit rate at -0.5%. However, it did offer 174.5 billion euros ($203 billion) in another dose of ultra-cheap “TLTRO” bank loans at a rate of -1.0%, preserving bank profits. The central bank also lowered reserve requirements and gave more time to write off bad debts in order to spur lending. Will any if this work to get the economy growing again? Demographics say no, with every country apart from Denmark expected to have a decline in births over the next twenty-five years (some double-digit) with a corresponding increase in the aged versus youth populations (aka the age dependency ratio). Fiscally, the EU has a target of not more than 60% government debt to GDP and less than a 3% fiscal deficit. This year, however, the region has an 80% government debt to GDP (and is increasing borrowing) while the fiscal deficit is 5%. Obviously rules are made to be broken. At least the U.K. economy expanded by +6.6% in July, for its third consecutive monthly increase, recovering just over half of the lost output caused by the coronavirus. Unfortunately for the UK, the EU set an ultimatum over Brexit to force PM Johnson to take a deal with no concessions if he wants one before the deadline. Even the UK’s new free trade deal signed with Japan probably will not be enough to cause Johnson to walk away.

[1] This association claims to be the source for the well-known Johns Hopkins coronavirus resource center often cited in the media as well as the White House as the source for some of its studies and testing strategies and many media outlets.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource