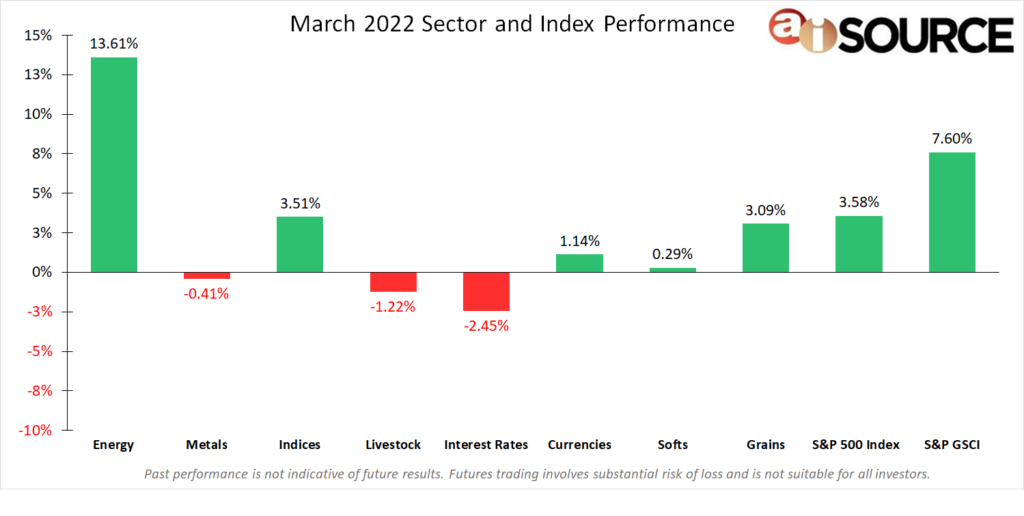

During the month of March, the top 3 performing sectors were: energies (+13.61%), indices (+3.51%), and grains (+3.09%). The bottom 3 sectors were: interest rates (-2.45%), livestock (-1.22%) and metals (-0.41%). March 2022 started with a strong jobs report with the FOMC set to meet later in the month. Most, if not all the focus for the month, was centered around the FOMC meeting that took place March 15-16. With inflation on the rise, most all expected the fed to raise rates, but by how much? After the two day FOMC meeting, the fed raised rates by 0.25% with an expectation to raise rates an additional six times in the next few years. Most all commodities were flat to higher as the S&P GSCI index closed out the quarter nearly +30%.

For month-to-date and year-to-date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. All data collected from investing.com. S&P 500 Index – data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.