COVID-19

US Case Count Fell to 4% of the High as the seven-day average fell in half during March to 30k per Reuters with US deaths per day falling to 900 on March 31st. Germany, by comparison was at 77% of their peak, though declining. Their daily death rate was holding steady, not falling. For comparison, on a per 100,000 person basis, 64 Americans were diagnosed while 1,530 Germans were considered positive. An Omicron sub-variant was classified with the possibility of infecting those that have all the shots and/or had the original Omicron infection. China’s case count is officially climbing with mass lockdowns in the critical commercial city of Shanghai. Finally, British scientists identified some genes associated with more severe symptoms such as blood clotting and lung inflammation (per FT). As always, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Ukraine

Enter Attrition as Russia retreated from exposed positions around Kiev and built up troop concentrations in the eastern portion of Ukraine. Russia still has the edges of offensive initiative, secure bases to rest troops and fire missiles, larger military size and destruction of only Ukraine’s ports, infrastructure, housing and factories (not Russia’s). On the other hand, Ukraine benefits from the home advantages of fighting spirit and area knowledge, a large population (this is not tiny 2008 Georgia or 1994-2000 Chechnya), advanced weapons from NATO and focus – they have one enemy: Russia.

Consider Mariupol – before the war the contested city had a population in the 400,000s, bigger than Florence, and comparable to Stalingrad’s population of 490,000 in 1940. The fighting in Stalingrad in 1942-1943 cost the lives of over half a million in total from both sides (plus another 1.5 million captured, wounded or diseased). Kiev at 2.9 million inhabitants in peacetime was the 7th most populous city in Europe, larger than Rome or central Paris. Russia’s entire invasion force on all fronts (~190,000 soldiers) would seem inadequate to take the city from well-supplied, determined defenders. Russian casualty estimates have been very much a guess but 5,000-7,000 killed looked reasonable or about 3.5% of the invading force. Historically, when the dead get to about 10% of the force, offensive operations become untenable, without wholesale replacements or unit reconstitution. Furthermore, the Russian military’s 126,000 conscripts were due to leave service (unknown how many were in Ukraine) – and the replacement draftees have not started training. The door to Russian success is closing – but can they kick it open?

Consider China: Internationally, Russia must consider their frenemy China as well as possibly antagonistic and definitely fearful next-door countries like Japan, Finland and the Baltics. China should be reconsidering its own military adventures abroad (literally overseas) given the reality of the hyped Russian military. While Russia may be gearing up for a push from the east and south, NATO-fed Ukrainian military intelligence can pre-position assets to counter. This is going to be a long, hot summer.

Macro: US

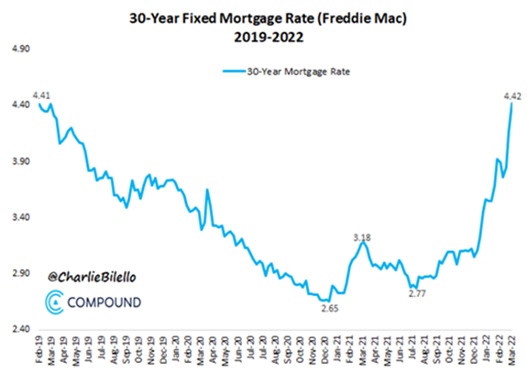

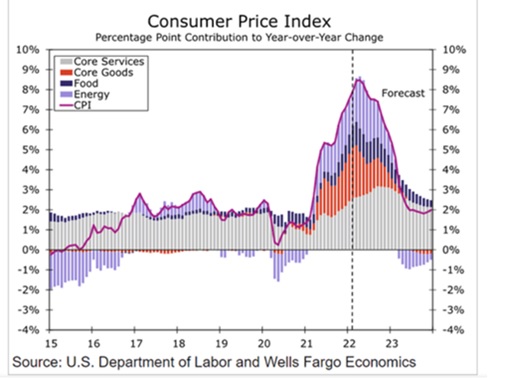

US Consumer Prices continued higher to +7.9% year-on-year in February (pre-invasion), with more price increases expected in shipping, housing and consumer products in 2022. Core inflation likewise accelerated to +6.4% year-on-year. These were the highest broad price increases since 1982. Gasoline, groceries and shelter were largest contributors with the rent equivalent portion the largest increase since 1987. Inflation-adjusted average hourly earnings continued to lose ground, dropping -2.6% in February from a year earlier, the largest  decline since May and the 11th straight decrease. Most people (62%) said inflation had affected their spending. See the next page for the projection of the peak in summer 2022, assuming interest rate increases and slowing economic activity. Meanwhile, unemployment continued to be strong, falling to 3.6% in March as nonfarm payrolls increased 431,000 last month after an upwardly revised 750,000 gain in February. Average hourly earnings rose +0.4% from February and +5.6% from a year ago, but as outlined above, inflation handily outpaced these gains. Other economic news was also negative overall, with a record US trade deficit hit in January, lower pending housing sales on higher interest rates (see graph below for the rapid increase in mortgage rates), February durable goods fell overall but rose on a core basis and core capital goods orders fell unexpectedly (-0.3% versus +0.5% forecasted).

decline since May and the 11th straight decrease. Most people (62%) said inflation had affected their spending. See the next page for the projection of the peak in summer 2022, assuming interest rate increases and slowing economic activity. Meanwhile, unemployment continued to be strong, falling to 3.6% in March as nonfarm payrolls increased 431,000 last month after an upwardly revised 750,000 gain in February. Average hourly earnings rose +0.4% from February and +5.6% from a year ago, but as outlined above, inflation handily outpaced these gains. Other economic news was also negative overall, with a record US trade deficit hit in January, lower pending housing sales on higher interest rates (see graph below for the rapid increase in mortgage rates), February durable goods fell overall but rose on a core basis and core capital goods orders fell unexpectedly (-0.3% versus +0.5% forecasted).

Fed Chair Powell Formally Announced the halt to quantitative easing (the last bond purchase was March 9th of $4 billion of 3-year notes) and increased interest rates by +0.25% at the March 15-16th meeting (the first of many and some expected at +0.50% in 2022). The minutes showed that the planned run-off of bond maturation would be phased in and likely reach $95 billion per month but that will be decided at the May meeting. This was almost double the $50 billion per month back in 2017-19, but the balance sheet is twice as large this time at $8.9 trillion. Mortgage rates have reverted to levels back in 2019 and have kept going – higher than the levels on that chart – to 4.9% at the end of March on 30-year fixed home loans. Zillow estimated that mortgage payments would be 36% higher than a similar loan a year ago. Office building owners continued to face rent revenue pressure – even in Houston which reportedly had one of the highest back-to-office ratios of 85% where floors were only 52% full. The implications for commercial values, related municipal tax revenue and local businesses is not good. An analysis of the sector estimated that $1.1 trillion worth of office buildings nationwide face foreclosure over the next four years due to high leverage and declining revenues.

Macro: Europe

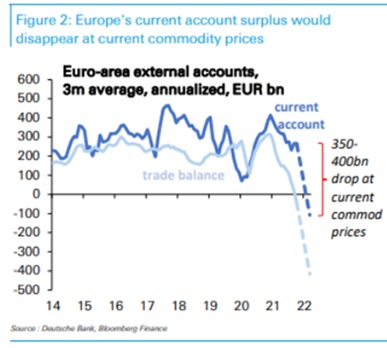

ECB Signaled a Possible Ending of their large-scale QE in April. Higher energy prices (+44% from a year ago) sent Eurozone prices to a record +7.5% year-on-year, well over

the forecasted +6.6%. German inflation hit a 40-year high. Even still, the ECB is just slowing purchases in April with not halting bond-buying until Q3. Definitely dovish versus the United States. Factory Orders in Germany shrunk -2.2% month-on-month in February, significantly missing consensus expectations of just a -0.2% drop, representing renewed supply chain issues and surging energy costs. Higher energy, metals and food costs are sending the EU trade balance into a tailspin as they cannot replace Russian natural gas easily, cheaply or soon (for up to ten years or so). As the above graph shows, The Eurozone’s trade balance swung to a record deficit in January as imports increased 44% over the last twelve months (mostly commodities related). The goods deficit with Russia increased to €11.9 billion in January from €4.4 billion a year earlier. Similarly, the deficit with Norway rose to €5.8 billion from €0.1 billion, Eurostat said (all largely due to energy imports).

Macro: Asia

Evergrande Lost $2.1 Billion in Cash… well, not lose it per se but was seized by lenders as partial payment towards $20 billion in debt. Only $300 billion in other liabilities to figure out. Deloitte and PwC resigned from auditing the books of five property developers and PwC is undergoing an investigation for their role in Evergrande. High yield bonds continued their crash as the graph to the right demonstrates. China industrial production, however, did look more positive, trending higher in the first two months of the year (+7.5% vs 4.3% over the last twelve months in December), with accelerating production seen from the manufacturing, mining and utilities sectors. Likewise, China’s retail sales of consumer goods rose +6.7% in January and February from a year ago. Will this continue? Covid-19 controls increased in southern China. In particular, congestion in the key Chinese ports of Shenzhen and Hong Kong due to Covid-19 lockdowns increased to the highest level in five months, with ~174 vessels anchored or loading off the South China hubs. A queue of ships was also growing at Shanghai and Ningbo.

Japan’s New Generally Positive as machine tool orders recorded double-digit growth for the thirteenth consecutive month in February and overall industrial output edged up month-on-month. Exports grew 19.1% from a year earlier but declined slightly on a seasonal basis. Imports continued rapid growth at +34% year-on-year on energy costs. GDP grew an annualized +4.6% for Q4, compared with the government’s initial +5.4% estimate.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource