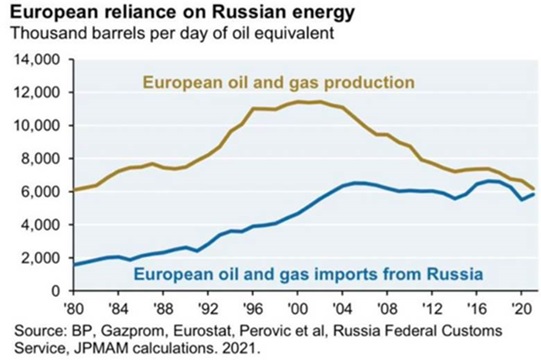

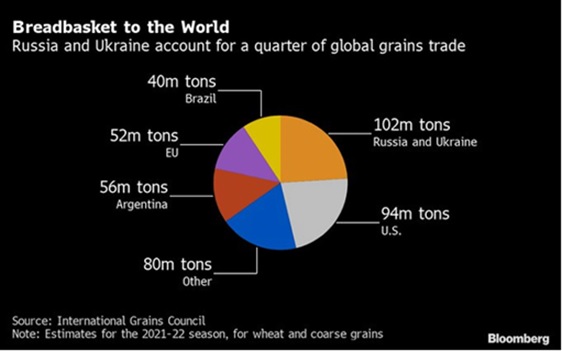

- Ukraine At The Center: The Russian invasion of Ukraine dominated the commodities markets as can be deduced from these two graphics. The first demonstrates Europe’s acquired dependency on Russia for energy – almost equal to what Europe produces directly. While the EU laid out grand plans in early March to replace about 2/3rds of the natural gas

imported from Russia, it will be a race to get that done before winter, if even at all achievable. Unlike Japan which had built redundant energy systems pre-Tohoku earthquake which allowed them to adjust after the Fukushima nuclear plant disaster, the EU has been too busy shutting down energy sources (e.g., Germany closing half its nuclear plants last year and the other half planned for this year) without keeping flexibility or surplus in mind. Russia in early March announced that it would consider cutting off the EU from energy exports in retaliation to sanctions, though that seems a challenge to logistically execute as well as disrupting needed cash flow. Meanwhile, the graphic to the left underscores the amount of grain that both Russia and Ukraine export annually that will not likely be repeated this year as summer sowing se

imported from Russia, it will be a race to get that done before winter, if even at all achievable. Unlike Japan which had built redundant energy systems pre-Tohoku earthquake which allowed them to adjust after the Fukushima nuclear plant disaster, the EU has been too busy shutting down energy sources (e.g., Germany closing half its nuclear plants last year and the other half planned for this year) without keeping flexibility or surplus in mind. Russia in early March announced that it would consider cutting off the EU from energy exports in retaliation to sanctions, though that seems a challenge to logistically execute as well as disrupting needed cash flow. Meanwhile, the graphic to the left underscores the amount of grain that both Russia and Ukraine export annually that will not likely be repeated this year as summer sowing se ason is coming up and Ukraine cannot plant while fighting is raging or would not bother to as it would benefit the incoming Russian regime. There is much more in terms of the ramifications to the Russian invasion that can be covered here – suffice to say that the shortages are not transitory, supply-chain issues will again have to be re-drawn and sadly politics and short-sightedness will extend the misery.

ason is coming up and Ukraine cannot plant while fighting is raging or would not bother to as it would benefit the incoming Russian regime. There is much more in terms of the ramifications to the Russian invasion that can be covered here – suffice to say that the shortages are not transitory, supply-chain issues will again have to be re-drawn and sadly politics and short-sightedness will extend the misery.

- OPEC+ Voted to Increase Production by 400,000 barrels per day (bpd) in early March. OPEC pumped 28.4 million barrels per day (mbpd) during February, up +0.4 mbpd and but still well below allowed quotas. Iran inched closer to a nuclear deal that would bring its oil back legally but again mixed messages and the Ukraine conflict interfered as Iran’s sponsor Russia lost credibility during the talks. The consultancy Platts said Iran could bring 0.75 mbpd to market by August, plus a further 0.3 mbpd of oil from storage, as Iran has 80 mbpd in storage. Remember Iran already exports up to 1 mbpd from their active smuggling operations to China and other countries. Global oil refining capacity fell for the first time in 30 years last year, as new capacity was outweighed by closures, the International Energy Agency said in its monthly oil market report. Refining capacity was down by 0.7 mbpd in 2021, the IEA said, but net additions were expected to equal 1.2 mbpd in 2022.

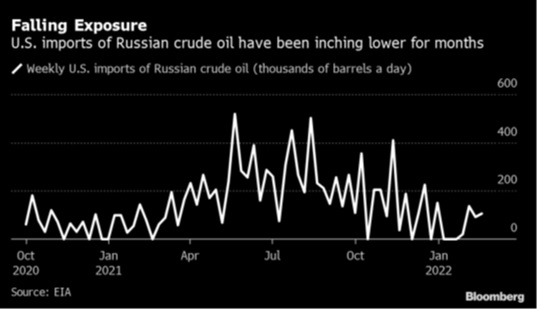

- Russia’s Number Two Spot in Jeopardy with countries cutting their oil purchases wherever possible – Sweden used to get 7% of their imports from Russia and Finland also replaced their Russian purchases. Both the US and Canada banned imports of Russian energy products, though countries import relatively modest amounts and intermittently (see graph right for recent US imports). Current and longer-term production came under pressure as Shell wrote off their involvement in Russia, including the flagship Sakhalin 2 LNG plant and Exxon Mobile dropped the management of oil and gas operations on the same island which it had valued at $4 billion. Due to ships being attacked, freight rates in the Black

Sea region quintupled, discouraging even those willing to deal in the area. Even Baltic ports saw a trebling of freight rates for Russian oil ships. Chinese power plants and steelmakers were reportedly seeking alternatives to Russian coal after some domestic banks suggested they avoid purchases due to the mounting sanctions being imposed on Moscow. Russia is China’s second-biggest source of overseas coal after Indonesia. Finally, the US receives about half of the uranium powering its nuclear plants from Russia and its allies Kazakhstan and Uzbekistan. Recall that Russia helped reverse a coup attempt in Kazakhstan just a few months ago!

Sea region quintupled, discouraging even those willing to deal in the area. Even Baltic ports saw a trebling of freight rates for Russian oil ships. Chinese power plants and steelmakers were reportedly seeking alternatives to Russian coal after some domestic banks suggested they avoid purchases due to the mounting sanctions being imposed on Moscow. Russia is China’s second-biggest source of overseas coal after Indonesia. Finally, the US receives about half of the uranium powering its nuclear plants from Russia and its allies Kazakhstan and Uzbekistan. Recall that Russia helped reverse a coup attempt in Kazakhstan just a few months ago!

- US Oil Production moved up fractionally to 11.6 mbpd during February while operating rigs jumped higher from 495 as of January 28th to 522 as of February 25th. Production was projected to increase by another 1 mbpd by the end of 2022. As part of this, Exxon said it expected to grow its Permian production by another +25% this year after growing by the same amount from 2020 to 2021. Per AAA, US average regular gasoline prices increased to $3.62 on February 28th, up from $3.38 per gallon last month – San Francisco’s average was over $5 and California was $4.92. In an ironic move, Alberta’s leader Kenney said the Keystone XL pipeline could be built by the first quarter of 2023 if the Biden administration gives the go-ahead; his administration declined. The US Supreme Court rejected an appeal by Energy Transfer LP’s Dakota Access Pipeline, letting stand a ruling that required a new federal environmental analysis and left the pipeline vulnerable to being shut down. The Biden administration also overhauled the certification process for new natural gas pipelines, adding additional climate affect evaluations of not only the pipeline itself but also from the upstream production and downstream use of the fuel. A senior analyst at Bloomberg concluded that basically no more natural gas pipelines will be permitted. Changes to oil pipeline permitting is next. With a successful offshore wind farm rights auction last month off the coasts of New York and New Jersey, one wonders what kind of lawsuits and hurdles those windmills will run into. In Canada, a natural gas pipeline worksite was left with millions in damage after a violent attack by 20 masked assailants, some wielding axes and flare guns. As police worked their way through spikes and downed trees to clear the situation, several people threw smoke bombs, injuring one officer. No arrests were made however and the Emergencies Act was not invoked.

- US Farmers Will Boost the amount of soybeans they seed this spring while cutting back on their corn acreage, the US government said in February. The USDA forecasted that soybean acreage will rise to 88.0 million from 87.2 million last year. Corn plantings were seen at 92.0 million acres compared to 93.4 million in 2021. Demand last year was hot as China and Mexico lifted US farm exports +18% to a record-breaking $177 billion. Mexico surpassed Canada as the second biggest export destination, with exports jumping +39% to a record $25.5 billion from the prior year. Brazilian agricultural exports may lose their competitive edge due to a scarcity of fertilizer and soaring prices for the key material. The country relied on imports for about 85% of its fertilizer needs and Russia was its biggest supplier. Russia looked to end fertilizer exports in early March but it was too soon to see the impact. Finally, corn-based ethanol, which for years has been mixed in huge quantities into gasoline sold at US gas pumps, looked likely to a much bigger contributor to global warming than straight gasoline, according to a study published by the National Academy of Sciences. This contradicted the USDA showing ethanol and other biofuels to be relatively green.

Finally, in the kind of news one does not see every day, Bloomberg discussed Ukrainian swear words and their use against Russian troops and Putin. The words actually mentioned in the article are not family-friendly but parents, you be the judge: https://www.bloomberg.com/opinion/articles/2022-03-02/ukrainians-russian-curses-are-like-verbal-molotov-cocktails.

All the best in your investing! Stay healthy!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource