War Impact: Everyone knows that the fighting hit supplies and spiked commodities prices. Pre-COVID Russia produced 11.4 million barrels per day (mbpd), which fell to 9.3 mbpd in mid-2020 and had been recovering ever since. Russia’s production of oil and gas condensate in early April fell to 10.5 mbpd during April 1-6 from a March average of 11.0 mbpd per Reuters. Russian crude recently found homes in Asia – India, China, Japan and Korea. India so far booked at least 14 million barrels of Russian oil since the beginning of the Ukraine invasion – almost as much as all of 2021 (16 million barrels). Bloomberg Economics expected Russia will earn about $320 billion from energy exports this year, up by more than a third from 2021 due to higher prices. War turning a profit already. Brazil faced its last shipments of fertilizer from Russia before supplies plunge, potentially hurting harvests in the biggest grower of crops from coffee to sugar to soybeans. Dozens of Russian vessels laden with fertilizer were en route, with a final ship unloading May 5th, according to StoneX analysts. After that, no one knows where Brazil, which imports 85% its fertilizer, will get those supplies. Ukraine’s grain silos were stuck with 15 million tons of corn from the autumn harvest—most of which should have been hitting world markets by now. For the upcoming season, UkrAgroConsult estimated that the wheat harvest will be down -38% year-on-year (19.8m tons, versus 32.1m tons last year) with corn -55% (19m tons, versus 41.9m tons last year). Fuel deficits are the most critical factor constraining spring sowing and the Agriculture Ministry estimated sowing areas may shrink by -30% to -50% from last year. Even after the war ends, it will take time to clean everything up, including removing mines and ordinance from fields.

OPEC+ Voted to Increase Production by 400,000 barrels per day (bpd) in early April. OPEC pumped 28.5 mbpd during March, up +0.1 mbpd but less than current quotas. The US’ new sanctions against parties involved in Iran’s ballistic missile program signaled that the Iran nuclear deal may not be imminent. However, as it is a key policy goal of the Biden administration, it should come together at some point. The consultancy Platts said Iran could bring 0.75 mbpd to market by August, plus a further 0.3 mbpd of oil from storage, as Iran has 80 mbpd in storage. Remember Iran already exports up to 1 mbpd from their active smuggling operations to China and other countries. Saudi Arabia and the UAE suffered from drone attacks by Yemen’s Iran-backed Houthi militia, though damage was minimal.

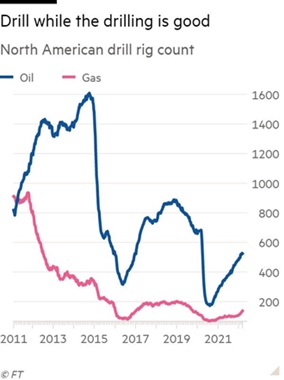

US Oil Production moved up fractionally to 11.8 mbpd during March while operating rigs jumped higher from 522 as of February 25th to 533 as of April 1st. Per AAA, US average regular gasoline prices increased to $4.22 on March 31st, up from $3.62 per gallon last month – San Francisco’s average hit $5.90 and California’s $5.85. The Biden administration dropped its new rules for new natural gas pipelines, which would have halted new construction. Biden also ordered the release of an “unprecedented” 180mn barrels of crude over the next six months  from the US Strategic Petroleum Reserve in an attempt to offset supply disruptions. Once completed, there will be ~385mn barrels remaining in the SPR, resulting in a buffer of just 70m barrels versus statutory levels. This came after Saudi Arabia and the UAE ignored phone calls by Biden – the Gulf states had been the point of verbal and policy abuse by Biden over their Yemen war and the Khashoggi murder, and angered by the US’ overtures to their political and religious enemy, Iran. Separately, other countries pledged to release an additional 60 million barrels from their various reserves. Meanwhile, the new Biden budget proposal requested an end to $43.6 billion over ten years in deducible drilling costs – that will not spur drilling. Finally, Biden delayed selling new oil leases in the Gulf of Mexico, also limiting future energy production. While this may appease environmental constituents, do not expect relief from inflation or higher energy costs in your household budget anytime.

from the US Strategic Petroleum Reserve in an attempt to offset supply disruptions. Once completed, there will be ~385mn barrels remaining in the SPR, resulting in a buffer of just 70m barrels versus statutory levels. This came after Saudi Arabia and the UAE ignored phone calls by Biden – the Gulf states had been the point of verbal and policy abuse by Biden over their Yemen war and the Khashoggi murder, and angered by the US’ overtures to their political and religious enemy, Iran. Separately, other countries pledged to release an additional 60 million barrels from their various reserves. Meanwhile, the new Biden budget proposal requested an end to $43.6 billion over ten years in deducible drilling costs – that will not spur drilling. Finally, Biden delayed selling new oil leases in the Gulf of Mexico, also limiting future energy production. While this may appease environmental constituents, do not expect relief from inflation or higher energy costs in your household budget anytime.

Latest US Government Grain Estimates indicated steady ending supplies of corn but lower soybean stocks as exports were increased, despite an increase in soy acres. Booming wheat exports from India helping ease the global shortage as it has the potential to ship 12 million tons, the most on record, compared with shipments of 8.5 million tons last season. With European fertilizer supplies threatened due to high natural gas costs (~80% of fertilizer production costs).

The London Metal Exchange (LME) was forced to halt nickel trading and cancel trades after prices doubled to more than $100,000 per tonne in a surge sources blamed on short covering by one of the world’s top producers. Chinese entrepreneur Xiang Guangda – known as “Big Shot” – had for months held a large short position on the LME through his company, Tsingshan Holding Group Co., the world’s largest nickel and stainless steel producer. Gold ETFs in March had their strongest inflow since 2016, with assets reaching just below the record set in 2020. Inflation concerns?

Finally, in reaction to Putin’s command that “hostile” countries have to pay for energy in rubles, which sent the Russian currency back to its pre-war highs, a member of a Bloomberg chat group composed this commemorative haiku:

Pay me in rubles

What the hell is a “ruo-bull?”

Just a bunch of rubes

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource