Commodities: Global

OPEC+ Decided to Cut Production at their June 3rd meeting but it would not be effective until 2024. The headline number was a decline by 1.4 million barrels per day (mbpd) with a production target of 40.46 mbpd for 2024. This is lower than the 41.86 mbpd production target set back in October last year, which runs from November 2022 to December 2023. At the June meeting, Saudi Arabia announced that they will unilaterally cut output by 1 million barrels per day (mbpd) in July. At the beginning of July, the Kingdom extended that cut for the month of August. Russia also announced an additional cut of 0.5 mbpd for August, but observers are still waiting to see evidence of previous cuts. While many forecasters are projecting a supply deficit later this year, a global recession could upend that prognosis and extend the Saudi and Russia reductions. Bloomberg reported that Iranian crude exports in May rose to their highest amount in almost 5 years, exceeding 1.5 mbpd in May, the highest monthly rate since 2018, according to the consultant Kpler. Iran said in May it has boosted its crude output to above 3 million bpd. Russian supplies accounted for 46% of India’s oil imports last month, according to data from analytics firm Kpler — a staggering leap from less than 2% before the invasion of Ukraine.

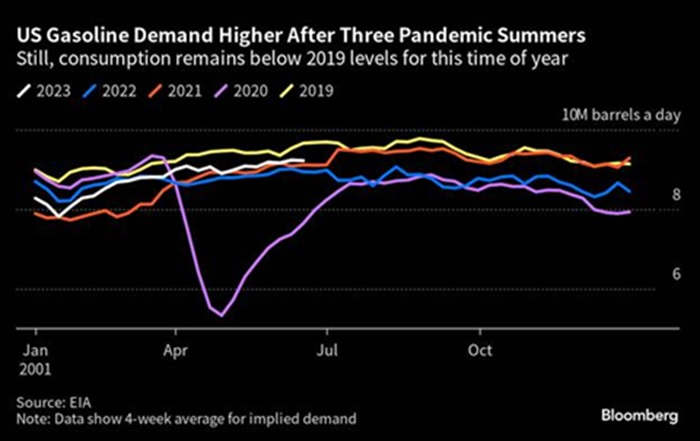

US Oil Production Stayed at 12.2 mbpd in June despite another decrease in operating oil rigs from 555 as of June 2nd to 545 as of June 30th. Per AAA, US average regular gasoline prices slipped slightly to $3.54 per gallon as of June 30th, 3¢ lower than last month. Summer driving season in the US has not translated into the usual amount of gasoline demand. The US Department of Energy indicated that it would likely buy another 6 million barrels in addition to the 6 million it had already tendered for this year, which would increase reserves by just over 3%. Recall that Biden authorized a 50 million barrel release in 2021 and another 180 million barrels in 2022, so these are token purchases at best. US gasoline demand moved higher but still below average going into summer – see graph right. Congestion pricing moved forward to enter New York City’s midtown Manhattan with drivers slated to begin paying $23 to enter south of 60th Street soon as April 2024. In other New York City news, its government drafted new laws to require wood-fired pizza restaurants to slice carbon emissions by up to 75% at a cost of about $20,000 per system. I sense some very thin crusts in the near future. Germany signed another long-term deal to import more US liquefied natural gas, as Berlin moves to replace Russian energy in its economy. The twenty-year deal for 2.25 million tonnes a year will supply 5% of Germany’s needs. Norway also signed a deal, for fifteen years, to import US LNG.

gallon as of June 30th, 3¢ lower than last month. Summer driving season in the US has not translated into the usual amount of gasoline demand. The US Department of Energy indicated that it would likely buy another 6 million barrels in addition to the 6 million it had already tendered for this year, which would increase reserves by just over 3%. Recall that Biden authorized a 50 million barrel release in 2021 and another 180 million barrels in 2022, so these are token purchases at best. US gasoline demand moved higher but still below average going into summer – see graph right. Congestion pricing moved forward to enter New York City’s midtown Manhattan with drivers slated to begin paying $23 to enter south of 60th Street soon as April 2024. In other New York City news, its government drafted new laws to require wood-fired pizza restaurants to slice carbon emissions by up to 75% at a cost of about $20,000 per system. I sense some very thin crusts in the near future. Germany signed another long-term deal to import more US liquefied natural gas, as Berlin moves to replace Russian energy in its economy. The twenty-year deal for 2.25 million tonnes a year will supply 5% of Germany’s needs. Norway also signed a deal, for fifteen years, to import US LNG.

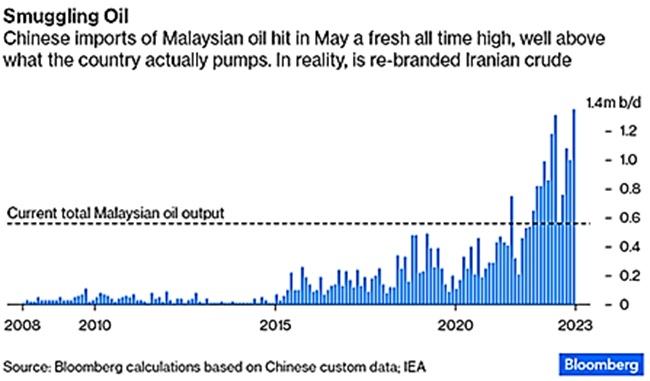

Chinese Crude Imports in May were the 3rd highest on record. May saw average imports of 12.1 mbpd, which was well above Aprils’ level of 10.3 mbpd. More to come as the central government issued a third batch of 2023 crude oil import quotas, raising the total volume in the first half of this year to +20% from the same period last year. China’s oil imports from Russia jumped to a record high in May to 2.3 mbpd. “Malaysian” crude imports hit a new record AKA smuggled Iranian crude as imports were more than Malaysia’s entire production! Already the world’s top importer of corn and soybeans, China was poised to overtake Egypt and Turkey as the biggest buyer of wheat in the year through June, Chinese and US official data showed. Purchases exceeded 12 million tons in the first 11 months of the marketing year, which runs through June, more than half supplied by Australia.

to come as the central government issued a third batch of 2023 crude oil import quotas, raising the total volume in the first half of this year to +20% from the same period last year. China’s oil imports from Russia jumped to a record high in May to 2.3 mbpd. “Malaysian” crude imports hit a new record AKA smuggled Iranian crude as imports were more than Malaysia’s entire production! Already the world’s top importer of corn and soybeans, China was poised to overtake Egypt and Turkey as the biggest buyer of wheat in the year through June, Chinese and US official data showed. Purchases exceeded 12 million tons in the first 11 months of the marketing year, which runs through June, more than half supplied by Australia.

US Planting of Corn, Wheat and Soybeans may be complete but the conditions are not very good, with only about 50% of the crop rated Good/Excellent. Most of the corn and soybean crops are in dry environments (technically “drought”), at 70% and 63%, respectively. However, to be clear, no one will starve, and if the aquafers are good, then the tap roots will still lead to a decent overall crop. USDA acreage survey did produce some surprises, with soybeans more heavily planted than expected at the expense of corn. Wheat and cotton were slightly above estimates. US grain merchant Bunge and Glencore-backed Viterra announced merger plans to create an agricultural trading giant worth about $34 billion including debt. The deal brings the combined company closer in global scale to leading rivals Archer-Daniels-Midland and Cargill, valuing Bunge and Viterra at about $17 billion each. Canadian farmers seeded the most wheat in 22 years, slightly more than expected, and also planted more canola than the industry was forecasting. Argentina’s soy harvest concluded with yields of 45% less than normal, coming in at 21m metric tons. Its exports of grains and their derivatives totaled $1.58 billion in June, down -59% from a year earlier. Brazil’s second corn crop was expected to hit 102.9 million metric tons in 2023, agribusiness consultancy AgRural said, increasing its May forecast of 97.9 million metric tons because of favorable weather. Brazil 2022-23 total soybean crop was seen at 155.7 million metric tons, raised from 154.8 million metric tons.

If you haven’t seen enough videos of Chinese electric cars exploding, here is your chance to catch up:

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource