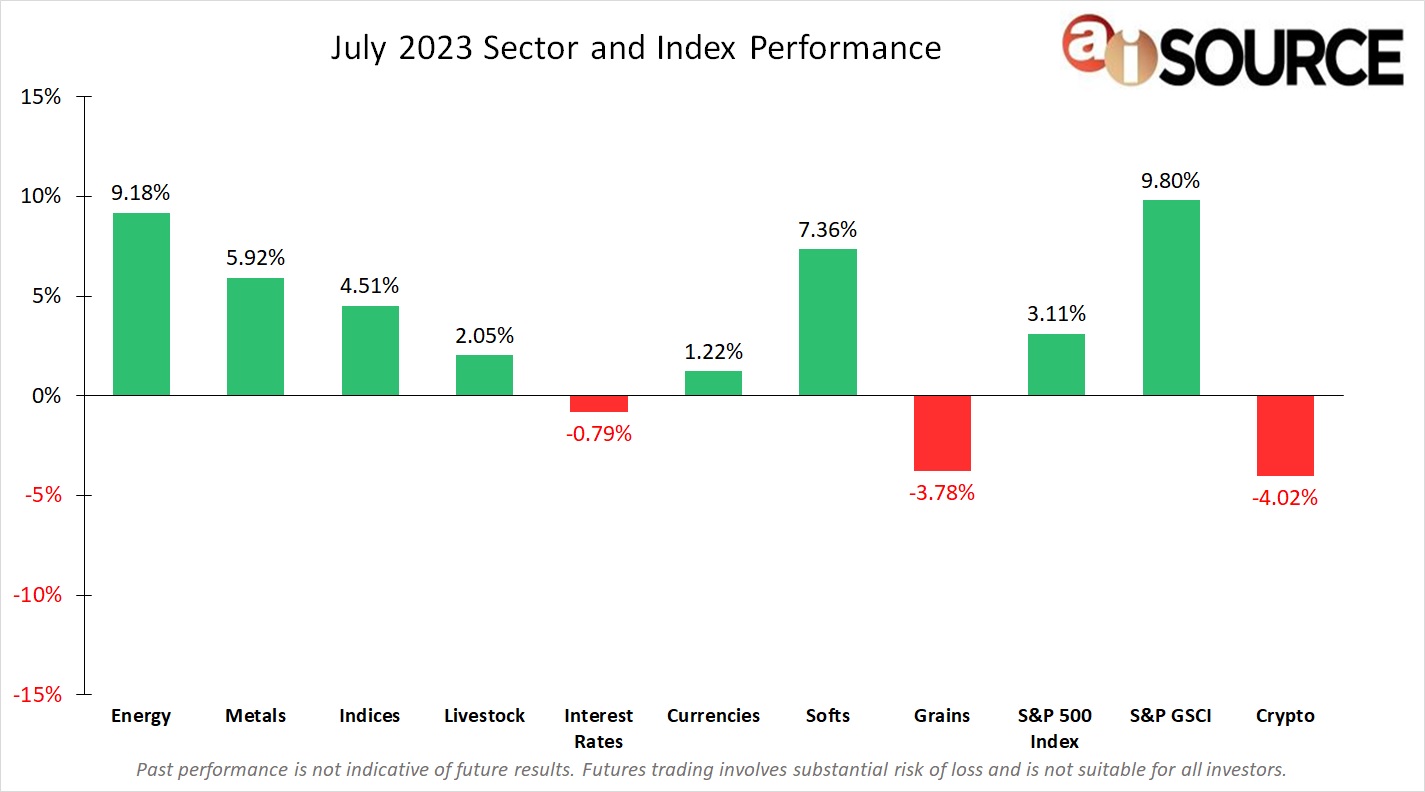

During the month of July, the S&P GSCI (+9.80%) and Energies (+9.18.%) were the top performers. The bottom performers were Crypto (-4.02%) and Grains (-3.78%). Despite the fed raising interest rates in July, the S&P GSCI (+9.80%) produced one of its best months since January of 2022. The S&P 500 (+3.11%) notched its fifth consecutive month of gains, its longest winning streak since 2021. Crypto (-4.02%) had only its second losing month this year, with Interest rates (-0.79%) staying just about flat. As summer strings on and we shift into August, there will not be another FOMC meeting until September 19th, but we do have football season to look forward to!

For month-to-date and year-to-date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. Crypto: Bitcoin and Ethereum. S&P 500 Index – All data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.