Ukraine: Summer Offensive?

The Ukraine-Russia Conflict stalemated with neither side making any real progress on the ground. The main excitement was inside Russia itself with a coup/”protest” by a mercenary group. While not a positive sign for Putin personally, the nationalistic agenda of Prigozhin and his supporters indicated a continuation of the Ukrainian invasion, not a cessation. Ukrainian crop exports continued to falter as the UN-brokered deal was assailed by Russia. Russia’s foreign ministry said directly “that there are no grounds for the further continuation of the Black Sea Initiative which expires on July 17th.” However, Russia did say that it would “ensure the back-log of ships awaiting inspection would be clear before the deal expires.” We shall see if these maneuvers reopen some of slowed Russian grain exports that also have been made more expensive due to insurance cancellations by European firms. Researcher UkrAgroConsult upgraded Ukrainian crop production slightly to 47.3m tons on slightly better plantings with a corresponding small increase to exports at 32.5m tons. This would still be a decline of 10% overall production due to fewer acres planted.

Macro: Asia

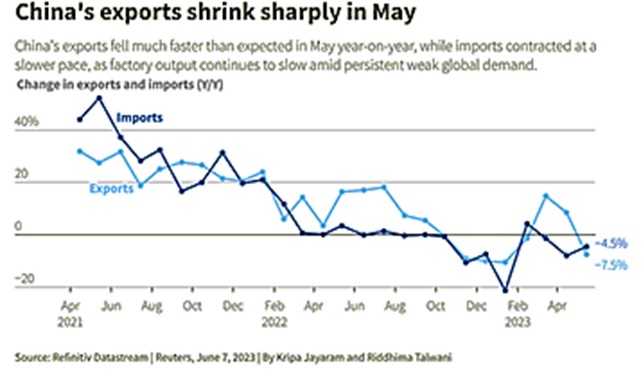

China’s Imports continued their year-on-year decline in May (-4.5% but better than the -8.0% expected), while exports surprisingly fell -7.5% year-on-year versus -1.8% expected and +8.5% from last month, reinforcing signs of feeble demand despite the lifting of COVID curbs and heaping pressure on an economy struggling from cooling global growth. South Korean data last week showed shipments to China slid -20.8% in May, marking a full year of monthly declines, with semiconductor exports dropping -36.2%, suggesting weak demand for components for final manufacture. US trade fell -5.5% during the first five months of the year compared with a year earlier, with China’s trade surplus dropping -14.5%. Trade with Japan declined -3.5% year on year. And now China announced export curbs on critical semiconductor metals gallium and germanium – the EU imports 71% and 45% of those components. While there are workarounds, alternative metals are not as efficient. However, also these metals are at least partially recyclable. Will China succeed in its retaliation in the computer space where Russia failed so far in the energy space?

signs of feeble demand despite the lifting of COVID curbs and heaping pressure on an economy struggling from cooling global growth. South Korean data last week showed shipments to China slid -20.8% in May, marking a full year of monthly declines, with semiconductor exports dropping -36.2%, suggesting weak demand for components for final manufacture. US trade fell -5.5% during the first five months of the year compared with a year earlier, with China’s trade surplus dropping -14.5%. Trade with Japan declined -3.5% year on year. And now China announced export curbs on critical semiconductor metals gallium and germanium – the EU imports 71% and 45% of those components. While there are workarounds, alternative metals are not as efficient. However, also these metals are at least partially recyclable. Will China succeed in its retaliation in the computer space where Russia failed so far in the energy space?

China’s Headline Economic Activity holds some promise with China projecting +5% GDP growth for 2023 and the OECD predicting a higher +5.4% number. Retail sales were still good on a year-on-year basis at +12.7% in May, but industrial production rose less than before at +3.5% year-on-year and fixed asset investment growth decelerated further to +4.0% year-on-year. The labor market remained weak with youth unemployment jumping to a record 20.8%. The overall jobless rate stayed at 5.2% in May. Finally, 140.47 million trips were made in China during the three-day Dragon Boat Festival, up +89.1% from a year earlier but down -22.8% from the pre-COVID levels of 2019. This tourism data during the June 22-24 holiday is closely watched as a barometer of China’s economic health. In mid-June, interest rates were lowered slightly by 10 basis points and while stimulus was said to be on the table, no announcement was made. Time is running out as two more Chinese developers failed to meet dollar-bond payments. Central China Real Estate Ltd. failed to pay interest due and would suspend payments on all offshore debt. Smaller Leading Holdings Group Ltd. disclosed that it hadn’t paid the entire $119.4 million of principal plus interest due. Chinese offshore debt issuance fell by 78% from a year earlier to $8.7 billion in Q1 2023. No surprise there.

Japan’s Economy Expanded at a faster pace than initially estimated as businesses ramped up spending. GDP grew at an annualized +2.7% in the first quarter from the previous three months, beating both an initial reading of +1.6% and the +1.9% expansion forecast. Japanese exports and imports both fell in May for the month, but with exports still up slightly at +0.2% year-on-year and imports off -9.9% year-on-year.

Macro: US

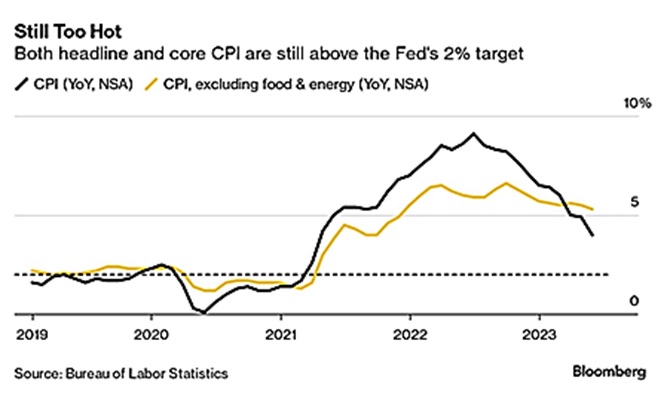

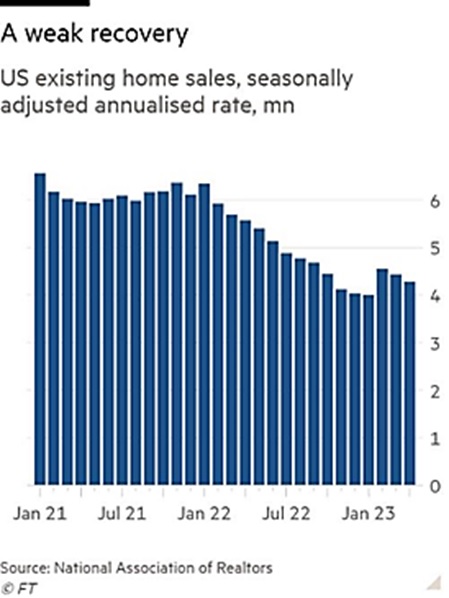

The Fed Held Their Word that there would be no increase at the June 13-14th meeting but Chair Powell noted late in the month that two more hikes were likely. Fed Governors repeatedly mentioned the July 25- 26th meeting as seeing a +0.25% increase. As a side note, number of other central banks raised rates in June including the ECB, Bank of England and the Reserve Bank of Australia. Turkey was the “winner,” however, by raising rates +6.5% to 15% after Erdogan again was re-elected President at the end of May. Coincidence? US inflation for twelve months ending May rose +4.0%, slightly better than the +4.1% forecasted but the Core CPI (ex-food and energy) rose more by +5.3% versus +5.2% expected. Lower prices for housing should keep dragging down the top-line inflation number, but that does not mean a recovery in shelter. Looking at the existing home sales numbers to the left (about 90% of home sales), the US

26th meeting as seeing a +0.25% increase. As a side note, number of other central banks raised rates in June including the ECB, Bank of England and the Reserve Bank of Australia. Turkey was the “winner,” however, by raising rates +6.5% to 15% after Erdogan again was re-elected President at the end of May. Coincidence? US inflation for twelve months ending May rose +4.0%, slightly better than the +4.1% forecasted but the Core CPI (ex-food and energy) rose more by +5.3% versus +5.2% expected. Lower prices for housing should keep dragging down the top-line inflation number, but that does not mean a recovery in shelter. Looking at the existing home sales numbers to the left (about 90% of home sales), the US  was still 30% below the number of two years ago – and mortgage rates are still at 7%, more than double that of eighteen months ago. People were “trapped” in their homes as lagging real wages meant they could not afford the higher monthly payments now required at today’s rates. The consumer also showed signs of tightness as real retail sales fell -3.3% over the last year, the 7th consecutive twelve-month decline. That’s the longest down streak since 2009. Nominal sales increased +0.7% year-on-year versus a historical average of +4.8%. Industrial production fell -0.2% month on month, following the +0.5% surge in April. Finally, credit card delinquencies shifted higher, though still well below the 2008 highs (last at 2.5% from 1.75% to almost 7% at the worst point in the 2008 financial crisis).

was still 30% below the number of two years ago – and mortgage rates are still at 7%, more than double that of eighteen months ago. People were “trapped” in their homes as lagging real wages meant they could not afford the higher monthly payments now required at today’s rates. The consumer also showed signs of tightness as real retail sales fell -3.3% over the last year, the 7th consecutive twelve-month decline. That’s the longest down streak since 2009. Nominal sales increased +0.7% year-on-year versus a historical average of +4.8%. Industrial production fell -0.2% month on month, following the +0.5% surge in April. Finally, credit card delinquencies shifted higher, though still well below the 2008 highs (last at 2.5% from 1.75% to almost 7% at the worst point in the 2008 financial crisis).

In Better News, the Atlanta Fed projected annualized US real (after-inflation) GDP for Q2 as +2.0%, at the upper end of consensus. If so, this matches Q1’s result, though still seems underwhelming. At long last, US wages outpaced inflation on a year-on-year basis in May by +0.2%, ending an ignominious streak of 25 consecutive months of negative real wage growth. New-home sales, in contrast to existing-home sales mentioned above, did outpace normal trends, growing +12.2% per the annualized monthly figure and marking the third month of growth. The number of homes sold in May and awaiting the start of construction also rose for a third month.

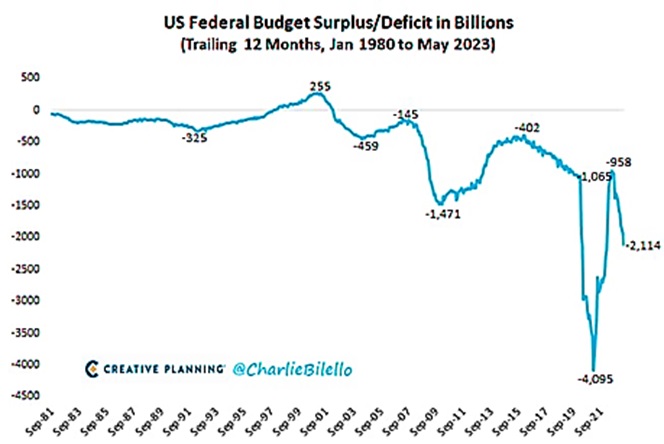

The US Debt Trend remained relentless, with post-COVID twelve-month accumulated deficit breaking the $2 trillion level last month (see right). With today’s Treasury interest rates ranging from 5.25% at the front end (soon to be higher) out to just under 4% at the 30-year maturity, current Federal government interest payments at $900 billion annually should continue to blow out, taking them from the current 3.5% of GDP to the 5% highs last seen in the 1980’s – and perhaps beyond. In 2020, the US was at 2.5%, which was the level since about 2000. A recession, student debt forgiveness ($329 billion in forgone revenue per Bloomberg), and no debt ceiling for two years could accelerate this process.

today’s Treasury interest rates ranging from 5.25% at the front end (soon to be higher) out to just under 4% at the 30-year maturity, current Federal government interest payments at $900 billion annually should continue to blow out, taking them from the current 3.5% of GDP to the 5% highs last seen in the 1980’s – and perhaps beyond. In 2020, the US was at 2.5%, which was the level since about 2000. A recession, student debt forgiveness ($329 billion in forgone revenue per Bloomberg), and no debt ceiling for two years could accelerate this process.

Macro: Europe

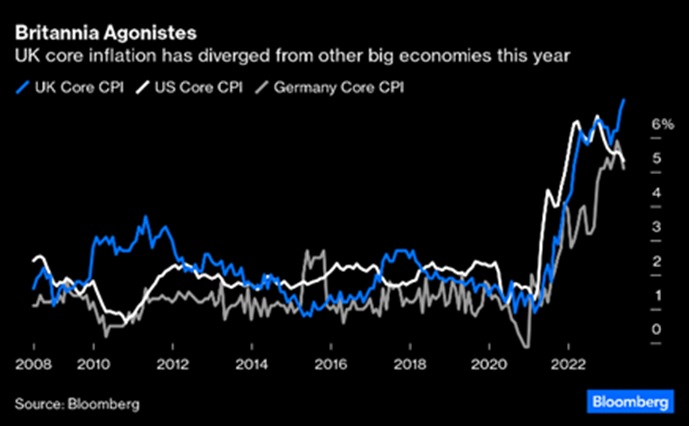

Eurozone GDP Shrank two quarters in a row, entering technical recession as Q1 quarterly data showed a -0.1% reading coming on the heels of the Q4 quarterly number of -0.1%. While not deep certainly, it underscore the regions fragility. The European Central Bank again raised rates, for the 8th straight time, to 3.5% and warned of another +0.25% increase in July. Christine Lagarde urged the ECB to persist with high interest rates to prevent high inflation due to tight labor markets and corresponding big increases in wages. Euro-area inflation confirmed its downward trajectory, falling to +6.1% year-on-year in May from +7.0% in April. The core reading also eased slightly to 5.3% from 5.6%. Energy prices may be normalized (or at least not outrageous), but it is anyone’s guess how this winter will go. The UK inflation rate bucked this lower trend with their core inflation heading higher, not lower – see right. The Bank of England raised rates by +0.5% to 5.0%, more than the +0.25% hike most had anticipated. The rate hike was the 13th in a row, putting rates at their highest level since 2008. Capital Economics noted that 700,000 UK mortgages are coming up for renewal over the remainder of this year, and over 95% of them are on interest rates of 2.5% or less. The hit to disposable incomes will likely be “grievous,” to use their word.

coming on the heels of the Q4 quarterly number of -0.1%. While not deep certainly, it underscore the regions fragility. The European Central Bank again raised rates, for the 8th straight time, to 3.5% and warned of another +0.25% increase in July. Christine Lagarde urged the ECB to persist with high interest rates to prevent high inflation due to tight labor markets and corresponding big increases in wages. Euro-area inflation confirmed its downward trajectory, falling to +6.1% year-on-year in May from +7.0% in April. The core reading also eased slightly to 5.3% from 5.6%. Energy prices may be normalized (or at least not outrageous), but it is anyone’s guess how this winter will go. The UK inflation rate bucked this lower trend with their core inflation heading higher, not lower – see right. The Bank of England raised rates by +0.5% to 5.0%, more than the +0.25% hike most had anticipated. The rate hike was the 13th in a row, putting rates at their highest level since 2008. Capital Economics noted that 700,000 UK mortgages are coming up for renewal over the remainder of this year, and over 95% of them are on interest rates of 2.5% or less. The hit to disposable incomes will likely be “grievous,” to use their word.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource