Commodities: Global

Hamas’ Attack on Israel Popped Energy and precious metals as Middle East conflict came again to the fore. Narrowing the lens to the commodities markets, the brutal incursion directly highlighted the security concerns surrounding the Mediterranean natural gas rigs jointly serviced by Israel and Egypt – threatening energy supplies not just to those two countries but in Europe. Scaling up one level, the attack puts the Iranian oil sanction negotiations with the US and Europe in question. Does the US/Europe look the other way from Hamas’ sponsor and demonstrate Chamberlain-style appeasement or will sanctions be enforced with oil tankers boarded? Iran’s crude exports of about 1.5 mbpd stand at their highest in more than four years, with more than 80% shipped to China. A tough response would take up to 3% of global oil production off the market, or further drive the discount lower with Chinese buyers. A heated conflict in the key oil tanker transit point of the Straits of Hormuz would affect about 20% of global oil supply. However, for now, one should assume the impact to be modest and Saudi Arabia can increase production to address global shortfalls, should they wish.

OPEC Oil Output Rose about 120,000 bpd, reaching 27.7 mbpd in August, as Iran, Iraq and Nigeria more than offset further reductions by Saudi Arabia and Russia. At the beginning of September, the Kingdom of Saudi Arabia extended their 1 mbpd reduction and Russia likewise their 0.3 mbpd cuts for three months to the end of the year. The OPEC+ alliance collectively continues to produce significantly below its quotas, with the total shortfall 1.1 mbpd in August, according to a Platts survey. Goldman Sachs expected Saudi Arabia to restore supplies to prevent prices climbing far beyond $105 a barrel, in case that erodes consumption. The full 23-nation OPEC+ coalition will hold a ministerial meeting on November 26 to review policy for 2024. WSJ and Bloomberg forecasted that 2024’s demand increase will be at a slower pace than that seen this year, moving from +2.2 mbpd in 2023 to +1.0 mbpd in 2024.

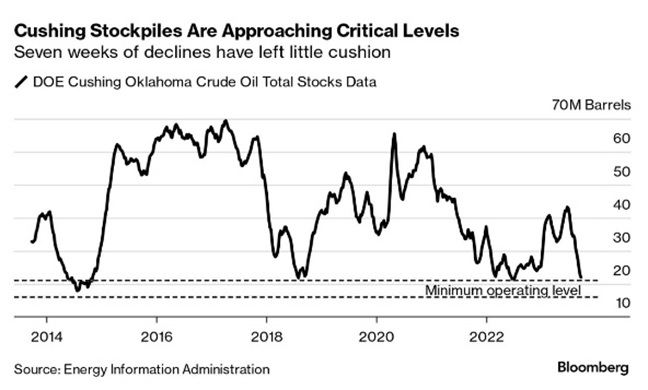

US Oil Production Inched Higher to 12.9 mbpd despite a dramatic decrease in operating oil rigs from 512 as of September 1st to 502 as of September 29th. Oil companies cited productivity enhancements in their shale regions. Per AAA, US average regular gasoline prices held at $3.82 per gallon as of September 30th, with an intra-month high of $3.88. However, California prices, for example, were up much higher to $6.08 per gallon per Bloomberg. Such prices had an impact on gasoline demand, cutting consumption over 10% versus the end of June (last quarter). US gasoline use averaged 600,000 barrels a day — or -6% — below 2019 levels during the driving season, which runs from late May’s Memorial Day to Labor Day at the start of September. As reference, AAA US average regular gasoline at the end of September, 2019 was $2.66, over $1.20 lower. US jet fuel demand also lagged behind pre-COVID levels, down -9% from 2019’s summer average. Driving a large part of these higher prices was very low inventories – the reference delivery location of Cushing, OK is basically dry (a minimum amount of oil is required to flow through pipes and operate pumps). Meanwhile, the Biden administration sketched out plans to drastically reduce the number offshore lease permits, with only three blocks available from 2025-2029. On the other hand, US exports of superchilled natural gas, particularly to Europe, jumped in the last year as buyers looked for alternatives to Russian gas imports and to fill Europe’s storage inventories. For the first six months of the year, the US was the largest exporter of NLG.

shale regions. Per AAA, US average regular gasoline prices held at $3.82 per gallon as of September 30th, with an intra-month high of $3.88. However, California prices, for example, were up much higher to $6.08 per gallon per Bloomberg. Such prices had an impact on gasoline demand, cutting consumption over 10% versus the end of June (last quarter). US gasoline use averaged 600,000 barrels a day — or -6% — below 2019 levels during the driving season, which runs from late May’s Memorial Day to Labor Day at the start of September. As reference, AAA US average regular gasoline at the end of September, 2019 was $2.66, over $1.20 lower. US jet fuel demand also lagged behind pre-COVID levels, down -9% from 2019’s summer average. Driving a large part of these higher prices was very low inventories – the reference delivery location of Cushing, OK is basically dry (a minimum amount of oil is required to flow through pipes and operate pumps). Meanwhile, the Biden administration sketched out plans to drastically reduce the number offshore lease permits, with only three blocks available from 2025-2029. On the other hand, US exports of superchilled natural gas, particularly to Europe, jumped in the last year as buyers looked for alternatives to Russian gas imports and to fill Europe’s storage inventories. For the first six months of the year, the US was the largest exporter of NLG.

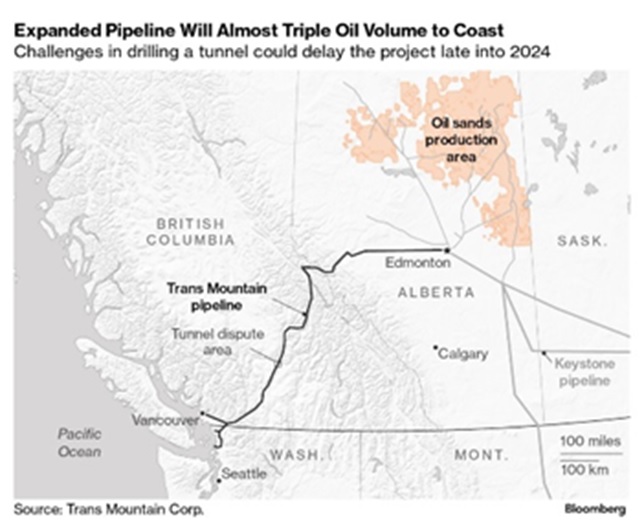

Canada, home to the world’s third-largest crude deposits, is poised to reshuffle global oil flows next year. The nearly completed expansion of the Trans Mountain pipeline promises to vault Canada into a new role in global markets by transporting an additional 600,000 barrels a day—on par with the daily output of Azerbaijan—from the country’s vast oil sands to a port on the Pacific Coast. Instead of moving that volume (and associated revenue) through the US Keystone pipeline (killed by Biden soon after his election), Canada will control those flows. Wonder if Trudeau will be there for the opening commemoration?

pipeline promises to vault Canada into a new role in global markets by transporting an additional 600,000 barrels a day—on par with the daily output of Azerbaijan—from the country’s vast oil sands to a port on the Pacific Coast. Instead of moving that volume (and associated revenue) through the US Keystone pipeline (killed by Biden soon after his election), Canada will control those flows. Wonder if Trudeau will be there for the opening commemoration?

US Crop Harvests Began Early with almost 25% already completed. Demand for US corn exports reached new levels, with the US the highest export market share of any country, while Brazil and Argentina took a commanding lead in soybeans. Brazil, however, still will have a record corn crop and Ukraine saw unexpected demand from China for feed corn – Russia will not interfere with those shipments to its semi-ally, for certain! Brazil’s soybean exports should reach 99 million metric tons in 2023, up by 500,000 from a month ago per a leading exporter. Despite the noise around adverse weather both in the Americas and Europe, the world will still be fed.

And in other news:

In case you are still hungry, an eye-watering-sized onion set new world record (subject to Guinness verification) at the Harrogate Autumn Flower Show – tipping the scales at 8.97 kilograms (19.7 pounds): https://www.bbc.com/news/uk-england-york-north-yorkshire-66836934

Costco started selling 1 ounce gold bars online with prices including shipping and insurance. Customers with an executive membership are still eligible for 2% cash back. “It’s heavier than I thought,” one TikToker said in a video unboxing two bars of gold she bought from Costco. How much did that person expect two ounces to weigh? https://www.usatoday.com/story/money/business/2023/10/03/costco-gold-bars-online-member-price/71043206007/

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource