United States

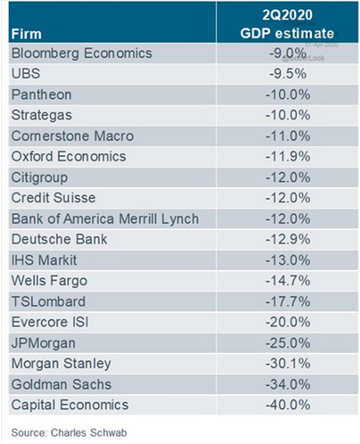

- Q2 GDP is anyone’s guess as demonstrated by the extended range found on the list to the right compiled by

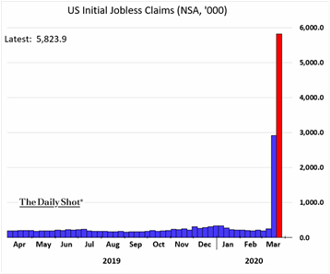

Charles Schwab. Former Fed Chair Janet Yellen said in a recent interview on CNBC that the annualized Q2 GDP hit will be -30%. Largely this is driven by the lockdowns across the US (official or otherwise) that have increased the unemployment claims by over 10 million people during the last two weeks ending in early April (see below). This amount surpasses the numbers seen in the mortgage meltdown eleven years ago (2008-09). Effectively this will set the unemployment rate at about 13% with room to go higher depending on how long the shut-down lasts. For example, the St. Louis Fed offered an extreme 47 million lost jobs with a related 32% unemployment rate! Another way to describe the economic cost in GDP is about $16 billion per day. The US government has been the focal point of generating fiscal stimulus, passing a $2 trillion package (9.3% of GDP) that provides medical aid, sends money directly to citizens, increases and extends current unemployment insurance and grants various subsidized loans for businesses large and small. Unlike what was passed during the 2009

Charles Schwab. Former Fed Chair Janet Yellen said in a recent interview on CNBC that the annualized Q2 GDP hit will be -30%. Largely this is driven by the lockdowns across the US (official or otherwise) that have increased the unemployment claims by over 10 million people during the last two weeks ending in early April (see below). This amount surpasses the numbers seen in the mortgage meltdown eleven years ago (2008-09). Effectively this will set the unemployment rate at about 13% with room to go higher depending on how long the shut-down lasts. For example, the St. Louis Fed offered an extreme 47 million lost jobs with a related 32% unemployment rate! Another way to describe the economic cost in GDP is about $16 billion per day. The US government has been the focal point of generating fiscal stimulus, passing a $2 trillion package (9.3% of GDP) that provides medical aid, sends money directly to citizens, increases and extends current unemployment insurance and grants various subsidized loans for businesses large and small. Unlike what was passed during the 2009  mortgage crisis (which was about 5.5% of GDP), this program did not focus as much on banks and financial institutions but instead looked to try to bridge individuals and businesses through the slowdown so they can maintain high levels of employment and functionality after the crisis has passed. Per the FT on April 6th, every major automobile factory is closed in the US and Europe, not only to protect workers but also demand has collapsed as no one is shopping for a new car at this time (e.g., US car sales in March were the lowest in ten years).

mortgage crisis (which was about 5.5% of GDP), this program did not focus as much on banks and financial institutions but instead looked to try to bridge individuals and businesses through the slowdown so they can maintain high levels of employment and functionality after the crisis has passed. Per the FT on April 6th, every major automobile factory is closed in the US and Europe, not only to protect workers but also demand has collapsed as no one is shopping for a new car at this time (e.g., US car sales in March were the lowest in ten years).

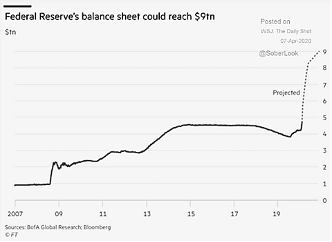

- The Federal Reserve jumped in as well as with every “market assistance” plan AKA “QEVID-19” that one could consider. Besides lowering the short term interest rate target to

0-0.25%, Chair Powell launched a series of debt-buying programs with support from the US Treasury to maintain the prices of corporate bonds, muni bonds, money-market funds, foreign-owned US Treasuries, the current US Treasury and mortgage agency repo markets, bank capital, small business loans, credit card loans, etc. The Fed said the purchases of Treasury and mortgage securities that it approved one week ago are essentially unlimited and the results were plain to see. On the whole, the Fed’s balance sheet went from $4 trillion to $5.6 trillion in March, with expectations to hit $9 to 10 trillion later in 2020. That is equivalent to over 40% of US GDP, double than that last autumn and about the size of the ECB before it accelerated its bond-buying program. At least in early March the Fed began quarantining physical dollars that it repatriated from Asia before recirculating them in the US.

0-0.25%, Chair Powell launched a series of debt-buying programs with support from the US Treasury to maintain the prices of corporate bonds, muni bonds, money-market funds, foreign-owned US Treasuries, the current US Treasury and mortgage agency repo markets, bank capital, small business loans, credit card loans, etc. The Fed said the purchases of Treasury and mortgage securities that it approved one week ago are essentially unlimited and the results were plain to see. On the whole, the Fed’s balance sheet went from $4 trillion to $5.6 trillion in March, with expectations to hit $9 to 10 trillion later in 2020. That is equivalent to over 40% of US GDP, double than that last autumn and about the size of the ECB before it accelerated its bond-buying program. At least in early March the Fed began quarantining physical dollars that it repatriated from Asia before recirculating them in the US.

China

- China’s Economic Recovery was a big question as their largest foreign customers (Europe and US) shut down. While Chairman Xi had been reorienting the economy to generate domestic demand, pre-COVID crisis exports were about 17% of GDP ($2.4 trillion on $14.5 trillion – by comparison the US exported about 12% of GDP). For February (the most recent number we have), the US imported $23 billion of goods from China, the lowest in a

decade – and that’s before the major shutdowns in March. China’s industrial output was down -13.5% year-on-year over the first two months of 2020 and retail sales fell -20.5% (the first drop on record!). The implied GDP impact per Capital Economics would be a fall of -13% in Q1. Looking at the graph to the left, certainly there has been some recovery in activity though still 25% or more lower than “normal.” Traffic congestion indices have also seen a recovery but are still below 2017-19 levels while domestic air travel also has largely but not completely recuperated. With the reopening of the epicenter Wuhan on April 8th, the world will see whether there will be a “second wave” or if the infection spread has been contained.

decade – and that’s before the major shutdowns in March. China’s industrial output was down -13.5% year-on-year over the first two months of 2020 and retail sales fell -20.5% (the first drop on record!). The implied GDP impact per Capital Economics would be a fall of -13% in Q1. Looking at the graph to the left, certainly there has been some recovery in activity though still 25% or more lower than “normal.” Traffic congestion indices have also seen a recovery but are still below 2017-19 levels while domestic air travel also has largely but not completely recuperated. With the reopening of the epicenter Wuhan on April 8th, the world will see whether there will be a “second wave” or if the infection spread has been contained.

- China Reacted with monetary stimulus such as cutting short term rates by 0.2% to 2.2%, and lowering reserve requirements for banks to induce more lending. Fiscally, the central government reduced or temporarily removed various social security obligations, medical costs and taxes and added outright spending and lending. Roughly speaking, they are pumping in about $1.6 trillion in new loans and debt market support and $1.3 trillion in new spending/reduced taxes. Per Bloomberg, the government will track every person via Alibaba and Tencent apps and assign them a color code based on perceived risk and restrict their behavior accordingly. However, there is little data now coming from China apart from no official deaths from COVID-19 and a few “asymptomatic” cases. Apparently, the battle against the virus is going well enough that China proposed a new internet standard to the UN which would extend their control over the internet’s structure (at least with their country) and thus more effectively block / promote information per their wishes. Russia has already come out with their support. Effectively, China’s attention has shifted over to control and propaganda to restore its place in the world and its citizens.

Europe

- Eurozone Braces as GDP projections parallel those in the rest of the world, with Bank of America estimating that

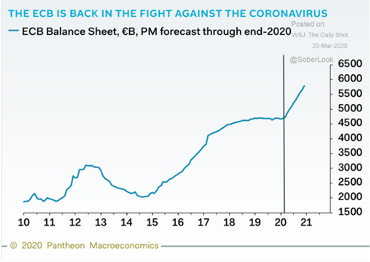

2020 growth will come in at -7.0%. As the graph to the right indicates, the Q2 GDP hit in Europe is expected to be about the same as the US and Canada, if not worse. Other metrics are similar, e.g., auto plant closings, air miles traveled, etc. The response also paralleled other countries mentioned above. The UK pledged loans, guarantees and direct payments equal to 15% of UK GDP. Continental governments pledged around €1 trillion in various programs as well. The ECB made €2.3 trillion available for banks at -0.75% under its existing TLTRO program and a 40% increase in its bond-buying program meaning that it will buy €110 billion in bonds

2020 growth will come in at -7.0%. As the graph to the right indicates, the Q2 GDP hit in Europe is expected to be about the same as the US and Canada, if not worse. Other metrics are similar, e.g., auto plant closings, air miles traveled, etc. The response also paralleled other countries mentioned above. The UK pledged loans, guarantees and direct payments equal to 15% of UK GDP. Continental governments pledged around €1 trillion in various programs as well. The ECB made €2.3 trillion available for banks at -0.75% under its existing TLTRO program and a 40% increase in its bond-buying program meaning that it will buy €110 billion in bonds  per month while lowering credit standards and other restrictions. There is no limit or end date associated with that program (for reference the balance sheet is to the left). The only aspect that saddened the markets is that banks are not allowed to buy back their own stock nor make dividends in 2020. The Bank of England likewise doubled the pace of corporate bond purchases. We shall see if money can cure all these ills.

per month while lowering credit standards and other restrictions. There is no limit or end date associated with that program (for reference the balance sheet is to the left). The only aspect that saddened the markets is that banks are not allowed to buy back their own stock nor make dividends in 2020. The Bank of England likewise doubled the pace of corporate bond purchases. We shall see if money can cure all these ills.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource