Macro: North America

- Q1 2020 US Growth Estimate from the Atlanta Fed is holding strong at +3.1% as business investment, consumer

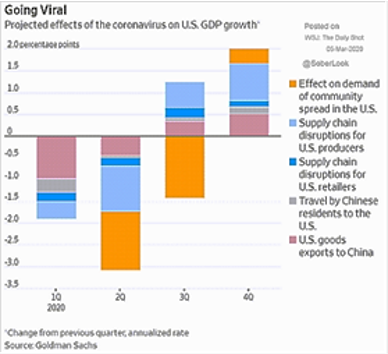

spending and government outlays are all forecasted to increase. There may be some frontloading of consumer spending in particular so how long this lasts is an open question. Payrolls put in another very strong month with the February report at +273,000, about +100,000 jobs more than economist forecasts. Unemployment moved down marginally to 3.5% and hourly earnings for workers were up a robust +0.3% on a monthly basis. Goldman Sachs estimated (see right) the impact by the COVID-19 virus on the US economy, which if overlaid with GDP growth expectations, would cause a GDP decline in Q2 but otherwise would be absorbed and recovered by the end of 2020.

spending and government outlays are all forecasted to increase. There may be some frontloading of consumer spending in particular so how long this lasts is an open question. Payrolls put in another very strong month with the February report at +273,000, about +100,000 jobs more than economist forecasts. Unemployment moved down marginally to 3.5% and hourly earnings for workers were up a robust +0.3% on a monthly basis. Goldman Sachs estimated (see right) the impact by the COVID-19 virus on the US economy, which if overlaid with GDP growth expectations, would cause a GDP decline in Q2 but otherwise would be absorbed and recovered by the end of 2020.

- Pending Home Sales increased year-on-year +6.7% year-on-year, handily beating expectations of +2.1% on low interest rates and decent weather. January retail sales rose +0.3% with demand reported as steady. January manufacturing output fell -0.1% matching the survey as Boeing continued to have 737 Max production issues – the COVID-19 negative impacts will begin to hit in February. Durable goods orders fell -0.2% but that was much better than expected. In corporate restructuring news, Expedia (the online travel company) announced 3,000 jobs cuts (about 12% of their total) after its CEO and CFO were forced out last year – hopefully the firm can turn around.

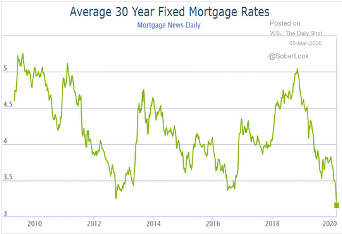

- The Federal Reserve made a large surprise rate cut on March 3rd of ½ percent, citing COVID-19 concerns. While there was a brief rally at first, markets took the move as a sign of desperation and a sell-off ensued in early March. Another ½ to ¾ point cut was projected at the upcoming March 17th-18th meeting, underscoring to some fear in the Fed’s actions. Furthermore, Fed repo auctions increased, sending their balance sheet higher on the extra liquidity to banks. Consumers have benefited from lower mortgage rates at least (see right).

Macro: Asia

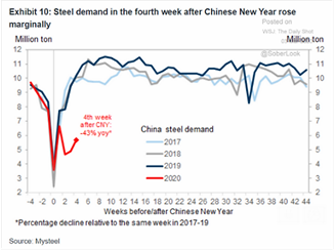

- China Halfway Back At Best as many metrics showed well below-normal numbers. To pick a few examples, first

the graph on the right showed the lack of steel demand. China car sales were down -80% year-on-year at the end of February. China’s exports fell -17.2% year-on-year versus -16.1% expected. Imports declined 4% from a year earlier, though commodity imports were up (soybean up +14.2%, coal +33.1% and iron ore +1.5%). Property transactions remained at very low levels, which put the squeeze on real estate development companies. China’s central bank cut interest rates marginally, made targeted loans to keep businesses going and firms in Hubei province, the epicenter of the outbreak, will not have to pay pension, jobless and work-injury insurance until June. S&P estimated that China’s banking sector may face a surge of up to 7.7 trillion yuan ($1.1 trillion) of

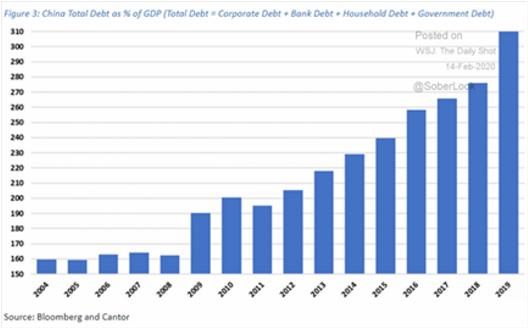

the graph on the right showed the lack of steel demand. China car sales were down -80% year-on-year at the end of February. China’s exports fell -17.2% year-on-year versus -16.1% expected. Imports declined 4% from a year earlier, though commodity imports were up (soybean up +14.2%, coal +33.1% and iron ore +1.5%). Property transactions remained at very low levels, which put the squeeze on real estate development companies. China’s central bank cut interest rates marginally, made targeted loans to keep businesses going and firms in Hubei province, the epicenter of the outbreak, will not have to pay pension, jobless and work-injury insurance until June. S&P estimated that China’s banking sector may face a surge of up to 7.7 trillion yuan ($1.1 trillion) of  non-performing loans in 2020 if the coronavirus outbreak doesn’t peak until April, though the central government decided to allow small and medium businesses to apply for a delay of their loan accounting to avoid recognition of bad debts. As the graph to the left shows, total country debt is a real problem – almost on par with the United States. Looking at corporate news, HNA, the conglomerate which often paid top dollar for trophy assets ranging from the historic Waldorf Astoria hotel in Manhattan and the AC Milan soccer team, was taken over by the government with around $75 billion in debt still outstanding. Meanwhile, Apple partner Foxconn, which builds iPhones, said that it expects to be back to full seasonal capacity by the end of the month after coronavirus fears stalled some production in China. We shall see how it goes.

non-performing loans in 2020 if the coronavirus outbreak doesn’t peak until April, though the central government decided to allow small and medium businesses to apply for a delay of their loan accounting to avoid recognition of bad debts. As the graph to the left shows, total country debt is a real problem – almost on par with the United States. Looking at corporate news, HNA, the conglomerate which often paid top dollar for trophy assets ranging from the historic Waldorf Astoria hotel in Manhattan and the AC Milan soccer team, was taken over by the government with around $75 billion in debt still outstanding. Meanwhile, Apple partner Foxconn, which builds iPhones, said that it expects to be back to full seasonal capacity by the end of the month after coronavirus fears stalled some production in China. We shall see how it goes.

- Japan’s Economy Contracted by an annualized -7.1% in the last quarter of 2019, worse than the -6.6% expected as an increase in the consumption tax hit consumer spending. Q1 2020 was expected to also be damaged from virus effects as Chinese / Korean tourism evaporated, travel restrictions imposed and supply chains disrupted. The government passed a large-scale 13.2 trillion yen ($129 billion) stimulus package in December which may be used to offset these impacts. India’s fourth-largest bank, Yes Bank, collapsed under bad debts and that country’s central bank seized control of the remaining assets to be auctioned off. Asia faces recession but it was already in trouble from last year.

Macro: Europe

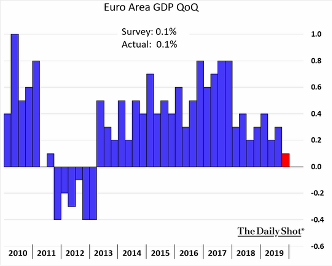

- The Eurozone Barely Grew in Q4 2019 as GDP growth came in at +0.1% for the quarter (see right) with Germany showing zero growth as industrial figures had the largest monthly fall in four years (-1.5% year-on-year instead of a

decline of -1.0%). South Bay Research’s EU Shipping Index continued to show a trade contraction with an accelerated decline in January. The EU has to set a new budget without the UK’s revenues but with higher spending – who will pay more? With China putting in an uncertain performance and the COVID-19 breaking out in Europe (particularly in Italy), the challenges just increased. Travel and gathering restrictions came into effect all over Europe to try to limit the spread of the disease. Italy unveiled a €3.6 billion stimulus package and applied for relief from EU budget constraints. A key auto electronics plant that closed due to COVID-19 could ripple into more closures in Fiat Chrysler, Renault, BMW and Peugeot factories at a time then auto revenues and profits from China were compromised. HSBC announced plans to cut 35,000 employees over the next three years to try to boost profitability and reduce risk. Finally Russia announced a constitutional rewrite to allow Putin to stay in control until 2036, twelve years after term limits normally would have forced his retirement. It is good to be the tsar!

decline of -1.0%). South Bay Research’s EU Shipping Index continued to show a trade contraction with an accelerated decline in January. The EU has to set a new budget without the UK’s revenues but with higher spending – who will pay more? With China putting in an uncertain performance and the COVID-19 breaking out in Europe (particularly in Italy), the challenges just increased. Travel and gathering restrictions came into effect all over Europe to try to limit the spread of the disease. Italy unveiled a €3.6 billion stimulus package and applied for relief from EU budget constraints. A key auto electronics plant that closed due to COVID-19 could ripple into more closures in Fiat Chrysler, Renault, BMW and Peugeot factories at a time then auto revenues and profits from China were compromised. HSBC announced plans to cut 35,000 employees over the next three years to try to boost profitability and reduce risk. Finally Russia announced a constitutional rewrite to allow Putin to stay in control until 2036, twelve years after term limits normally would have forced his retirement. It is good to be the tsar!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource