What are circuit breakers?

Circuit breaker limits act as safety nets in unstable financial conditions. They are a set of levels, if breached, the market halts trading for a period of time. For instance, the market will pause after a 7% intraday drop in the S&P 500. Levels are calculated by the SEC and are changed accordingly as new market environments arise.

Why circuit breakers?

Originally introduced in 1987, Black Monday’s 22% drop in the Dow Jones Industrial Average gave reason for the SEC to implement such a system. On May 2010, the DIJA experienced a flash crash, dropping over 1000pts in less than 10 minutes. And circuit breakers triggered again after the 2016 election. Proven to have worked correctly, you can see how these so-called safety nets aid a weakened market and prevent a crash.

March 9-13, 2020

Circuit breakers were reached twice this past week, once on Sunday night and Monday morning and once again on Wednesday night and Thursday morning. Equity futures markets were limit down (-5%) Sunday night. No trading was allowed all night that would allow the market to surpass the -5% loss. Once the day session opened on Monday, the next circuit breaker level of -7% was reached almost immediately at 8:30 AM CST. After a 15-minute halt on Monday, the market was allowed to re-start trading with a new circuit breaker of -13%, although that was never reached.

The overnight circuit breaker of -5% was reached again Wednesday night, causing the markets to halt all night. Upon the day session open on Thursday morning, the -7% circuit breaker was again reached, with the market dropping to ~-11% during the day Thursday. As of the time of this article, the upside circuit breaker was reached overnight Thursday of +5%, however, the market is now up only ~+3% on Friday morning.

What are the levels?

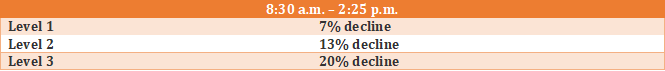

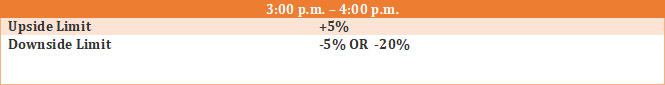

During regular trading hours, there are 3 different levels to the circuit breaker system. As mentioned before, the first intraday circuit breaker triggers at 7%, and trading stops for 15 minutes. Circuit breaker 2 triggers at 13%, and trading stops for 15 minutes. And circuit breaker 3 triggers at 20%, and trading stops for the rest of the day. Overnight circuit breakers are plus or minus 5% in either direction, and then trading his halted until 8:30AM the following morning. Refer to the different levels below.

Data from CME Group

Side effects of a circuit breaker market?

These market environments are extremely volatile, and with volatility, comes abnormal market conditions. Spreads and premiums increase, sharp market movements happen more often, and panic and uncertainty are at all-time highs.

Joe Faerber

aiSource