COVID-19

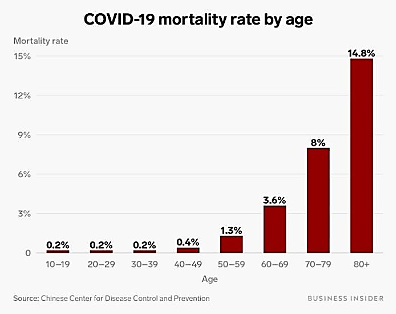

- As Of March 11, 2020 the confirmed global infected surpassed 118,000 with the mortality rates disproportionately

affecting the elderly and those with pre-existing conditions. There is still much that is unknown but given that it is in the family of other respiratory-communicated diseases like the flu, transmission seems similar (via coughing, sneezing, touching surfaces that have been exposed to coughing/sneezing). Washing hands, not touching the face, staying home if ill and cleaning your surroundings are good habits anyway. Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care, which seems to improve the odds dramatically.

affecting the elderly and those with pre-existing conditions. There is still much that is unknown but given that it is in the family of other respiratory-communicated diseases like the flu, transmission seems similar (via coughing, sneezing, touching surfaces that have been exposed to coughing/sneezing). Washing hands, not touching the face, staying home if ill and cleaning your surroundings are good habits anyway. Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care, which seems to improve the odds dramatically.

- China was still the disease epicenter though the official decline in new cases offers promise that their internal travel bans and other measures have put the country in the right direction, even if the actual magnitude of cases and deaths were still “managed.” Zhang Bo-li of the government’s national health panel claimed in early March that Wuhan, the city at the center of the virus, was expected to have zero new cases by the end of the month. The hit to the Chinese economy was still expected to allow Q1 GDP growth, perhaps at 2-3% annualized versus the roughly 6% originally expected. On a global basis, this would lower growth by -0.5%, damaging but not critical. Recall that the SARS epidemic in 2003 knocked Chinese GDP for one quarter by 2% and we have already surpassed that disease impact now in terms of deaths and economic disruption. China’s importance to global GDP is about 4x than what it was back then (from about 4% of global GDP to 16% in 2019). The negative shock may be limited to Q1, but we are only halfway through the quarter.

- Broader COVID-19 Effects captured the markets’ attention at the end of February and into March. Fear over the virus spreading uncontrollably knocked the S&P GSCI Total Return and the Bloomberg Commodity Index down in February, losing -8.4% and -5.0% respectively. Every sector was negative with only a few positive individual commodities. Saudi and Russian oil production increases would also contribute to losses in March as OPEC+ cuts expire (see two paragraphs below).

Commodities: Global

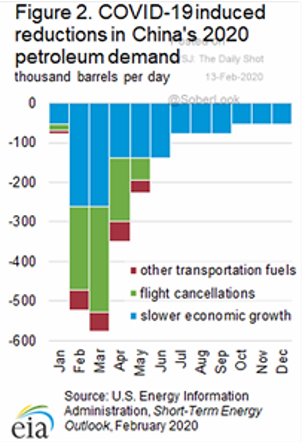

- 2020 Oil Supplies look to be plentiful as the International Energy Agency lowered demand for the first time year-on-year since the GFC in 2009. Increases in India and other emerging markets were offset by declines by China of about 1.8 million barrels per day (mbpd) and globally by 2.5 mbpd in Q1 and into Q2. Before the onslaught of the virus, China’s crude oil imports over the first two months of 2020 rose +5.2% from a year earlier per customs data, as refiners built up inventories of feedstock ahead of the Lunar New Year holiday. However, refineries processed reportedly 4 mbpd less in February versus January (about 70% of normal) due to the lack of demand. Jet fuel demand in China was seen down 2/3 with 10,000 fights cancelled every day per Platts. When travel is strictly limited, people do not consume fuel (see right)! Oil traders were rumored to have rented millions of barrels of crude storage in South Korea this month to hold excess supplies, betting on a demand spike after China recovers from the effects of the coronavirus outbreak.

- The OPEC+ Meeting descended into disarray on Friday March 6th as Russia refused to lower its production further by 500,000 bpd in line with a talked-about 1.6 mbpd cut by Saudi Arabia and other OPEC members. This move effectively killed the current agreement which expires at the end of March. In reaction, Saudi Arabia over the following weekend unilaterally announced increased production from 9.7 mbpd (but exporting only 7.0 mbpd) to over 10 mbpd to approaching 12.3 mbpd, a new record and a level closer to Russia (at 11.3 mbpd in February) and the US. Correspondingly, Saudi Official Selling Prices to the Atlantic area were priced lower by $7-8 per barrel. This made Saudi crude highly attractive everywhere in the world. Is this an issue of revenge? Undercutting US shale production? Kicking a faltering Iran while it is suffering economically, societally and from disease? Of reminding everyone of Saudi importance in a time where focus is elsewhere? A set-up of new negotiations to re-establish goals of $50 or higher? Or simply all of the above?

- In Other Oil News, Libya’s oil output essentially fell to zero as rebel commander Khalifa Haftar continued to block oil exports at ports under his control (Libya does not have an OPEC+ production quota). Mexican crude supply

showed the third consecutive growth in January; it has been gradual on a monthly scale, but accumulated to over +100,000 bpd year-on-year from a low baseline. The national oil company Panamex still struggled as losses doubled year-on-year on heavy debts. COVID-19 mushroomed in Iran as Members of Parliament and other senior government officials fell victim to a sudden outbreak of the disease, forcing the closure of schools and universities. Saudi Arabia banned travel to the holiest sites in Islam (including Mecca and Medina) in an unprecedented move to stop the spread of coronavirus. Brazil’s oil production increased to 3.2 mbpd in January, +2% month-on-month and +20.4% year-on-year.

showed the third consecutive growth in January; it has been gradual on a monthly scale, but accumulated to over +100,000 bpd year-on-year from a low baseline. The national oil company Panamex still struggled as losses doubled year-on-year on heavy debts. COVID-19 mushroomed in Iran as Members of Parliament and other senior government officials fell victim to a sudden outbreak of the disease, forcing the closure of schools and universities. Saudi Arabia banned travel to the holiest sites in Islam (including Mecca and Medina) in an unprecedented move to stop the spread of coronavirus. Brazil’s oil production increased to 3.2 mbpd in January, +2% month-on-month and +20.4% year-on-year.

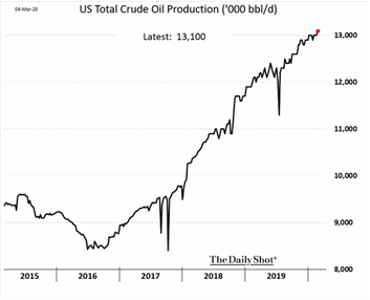

US Crude Oil estimated February production shifted to 13.1 mbpd of crude oil (see graph left) as operating drilling rigs held steady, shifting from 675 on January 31st to 678 on February 28th. The Energy Information Agency originally saw US 2020 production marginally higher but with the increase in Saudi and Russian production, now marginally lower at 12.8 mbpd and at 13.1 mbpd in 2021. US crude oil exports averaged 3 mbpd in 2019, an increase of 930,000 bpd (45%) from 2018, with 44 worldwide destinations, and Canada and South Korea receiving the largest share (each about 15% of the total).

US Crude Oil estimated February production shifted to 13.1 mbpd of crude oil (see graph left) as operating drilling rigs held steady, shifting from 675 on January 31st to 678 on February 28th. The Energy Information Agency originally saw US 2020 production marginally higher but with the increase in Saudi and Russian production, now marginally lower at 12.8 mbpd and at 13.1 mbpd in 2021. US crude oil exports averaged 3 mbpd in 2019, an increase of 930,000 bpd (45%) from 2018, with 44 worldwide destinations, and Canada and South Korea receiving the largest share (each about 15% of the total).  December 2019’s exports reached a new record of 3.7 mbpd. A Chinese independent refinery has bought US crude for delivery in May, a sign that American crude exports to the world’s largest oil importer could pick up. US LNG exports also continue to increase (see graph right). Looking ahead, if US shale production decreases or stagnates, natural gas production should also falter. China at least has started to offer tariff exemptions.

December 2019’s exports reached a new record of 3.7 mbpd. A Chinese independent refinery has bought US crude for delivery in May, a sign that American crude exports to the world’s largest oil importer could pick up. US LNG exports also continue to increase (see graph right). Looking ahead, if US shale production decreases or stagnates, natural gas production should also falter. China at least has started to offer tariff exemptions.

- African Swine Flu moved to the back page, but Indonesia reported a new outbreak. US pork exports to China have remained above historical averages, though COVID-19 restrictions blocking drivers have caused thousands of containers containing frozen meat to pile up at the key ports of Tianjin, Shanghai and Ningbo. As March progressed, these logistics began to be cleared up. Piglet prices hit a new record in China as herd size is still low and ASF-infected wild boar were still being found in Hubei, the center of the COVID-19 outbreak.

- US Grains benefited from China granting tariff exemptions for some crushers to import U.S. soybeans. US farmers were expected to plant 94.0 million acres of corn this spring, up from 89.7 million last year, and 85.0 million acres of soybeans, up from 76.1 million in 2019. The USDA projected U.S. wheat plantings for 2020 at 45.0 million acres, down from 45.2 million a year earlier. Ukraine’s grain exports are up 24% at 41.7 million tonnes so far in the current season with Wheat exports up to 16.7 million tonnes, about 4 million tonnes of barley and 20.4 million tonnes of corn. Looking ahead, Ukraine’s 2020 harvest could fall to 65 million tonnes or higher from a record 75 million in 2019 due to a smaller wheat output caused by a decrease in the sowing area. Argentina’s main farm groups will hold a four-day sales strike in mid-March to protest increased export taxes on beans from 30 to 33% (it was 24.7% in December 2019) and on corn from 12% to 15% (6% last year) and regulations by the new leftist government. India was expected to produce a record 106.21 million tonnes of wheat this year, as favorable weather conditions helped to improve crop yields. In short, the world still has a lot of grain.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource