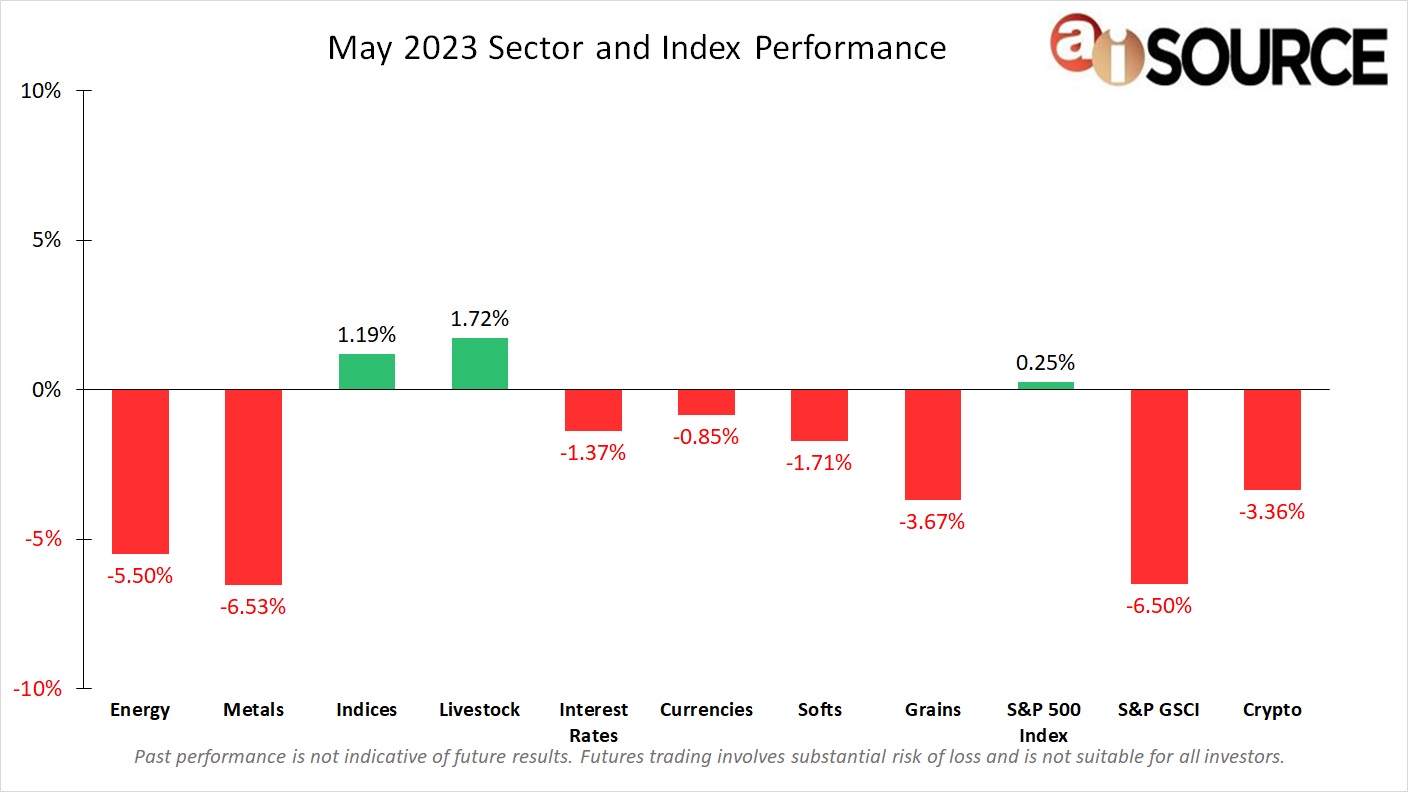

During the month of May, Livestock (+1.72%) and Indices (+1.19%) were the top performers. The bottom performers were Metals (-6.53%) and Energy (-5.50%). After a strong finish in April carried over to the beginning of May, the markets came to a slow as investors held back while talks on the debt ceiling dragged on. Last night, the house voted 314-117 to suspend the federal governments borrowing limit until 2025. The legislation is now sent to the Senate, which must enact the measure and get it to the Presidents desk before Monday’s deadline, when the federal government is expected to run out of money. As we wait for more news on the debt ceiling, we turn our attention to the Fed, who will have a two day meeting spanning from June 13th to June 14th.

For month-to-date and year-to-date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. Crypto: Bitcoin and Ethereum. S&P 500 Index – All data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.