Commodities: Global

OPEC Oil Production Fell in April by about 0.2 million barrels per day (mbpd) to 28.6 mbpd due to a halt in Iraqi and Nigerian exports with more declines expected in May due to the lower quotas announced in April. Iran’s oil minister said that their production increased in April from 2.7 mbpd to 3.0 mbpd. Market reaction was surprisingly muted to the seizure of two oil tankers by Iran in retaliation for the US taking one due to sanctions violations. Last year a similar tit-for-tat situation ended with seized tankers eventually returned.

US Oil Production Increased slightly to 12.3 mbpd as companies minimally decreased operating oil rigs from 592 as of March 31st to 591 as of April 28th. Per AAA, US average regular gasoline prices continued higher to $3.61 per gallon as of April 30th, 11¢ higher than last month. The wholesale price of diesel has been sliding, reaching $2.60 a gallon in NY Harbor, down from $4.10 a year ago – the lack of demand for trucking and construction supporting worries of an impending recession. US crude oil exports rose more-than-expected in April, building on a record 4.5 mbpd in March, as Chinese refiners snapped up cargoes to meet rising fuel demand. Such energy exports rose by 22% last year from 2021 after Russia’s invasion of Ukraine led to import bans of Russian oil and changed global flows. Interestingly, the Western hemisphere may be the supply driver in 2023, not OPEC+ as producers in the US, Canada, Brazil and other South America were forecasted to add 1.6 mbpd of net new supply and another 1.0 mbpd in 2024. Finally, coal usage in the US is expected to decline to 17% of the electricity market – smaller than natural gas, renewables or nuclear.

Chinese Crude Imports in March rose to the second highest level on record – 12.4 mbpd, coupled with a high level of refined fuel exports which implied that domestic demand rose only tepidly. Sinopec said they see oil product demand growth in China this year of more than +10% (Bloomberg). Chinese oil refinery throughput surged to a record 14.9 mbpd (+8.8% from a year ago), as refiners stepped up runs to capture strong export demand and build up inventories ahead of planned maintenance. China’s coal production also hit a record high in March, as miners churned out 13.5 million tonnes per day, per Reuters.

Germany Headed in the Opposite Direction as the federal government shut down the remaining three nuclear reactors on April 15th which provided about 5% of the country’s electricity as well as banned new oil and gas heating systems from 2024 with a full transition of all systems by 2045. Heating buildings accounts for a third of Germany’s total energy consumption and 80% of the heat is derived from fossil fuels. Recall that from 2027, European carbon taxes will drive up the costs of such systems. Hopefully there will be no cold winters from now on – perhaps Germany will now promote global warming to stave off another icy winter?

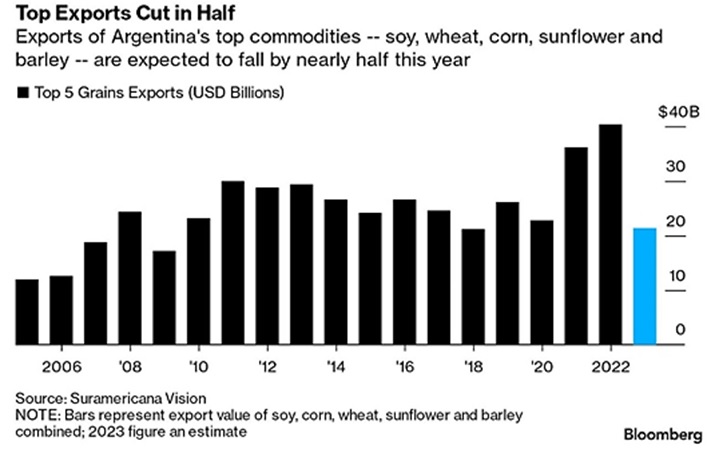

US Crop Planting Accelerated with corn a week ahead of last year (26% planted versus 13%) and same with soy (19% versus 7%) while wheat was behind (12% versus 18%) and cotton in-line (15% versus 15%). Argentina continued down its death-spiral as export revenue looked to collapse versus last year to one of the lowest levels of the last ten years (see graph right). In addition, Argentina owes $17 billion (4% of GDP) in settlements on lost court cases. Finally, note that their central bank raised their benchmark rate to 91% to try to stop inflation (running now at 104% for March) and hold the peso’s value. Meanwhile again Brazil enjoyed an increase in grain production with soy out seen at 153.9 million tons, +2.5m than the previous estimate and corn crop also higher by +2.8m tons at 127.5m tons. Brazil was set to harvest its second-biggest sugar crop on record, boosting sugar output by +4.7% this season. A large Brazilian crop could help ease pressure in global markets after lackluster harvests in other big producers like India and Thailand, which has sent sugar prices to record levels.

owes $17 billion (4% of GDP) in settlements on lost court cases. Finally, note that their central bank raised their benchmark rate to 91% to try to stop inflation (running now at 104% for March) and hold the peso’s value. Meanwhile again Brazil enjoyed an increase in grain production with soy out seen at 153.9 million tons, +2.5m than the previous estimate and corn crop also higher by +2.8m tons at 127.5m tons. Brazil was set to harvest its second-biggest sugar crop on record, boosting sugar output by +4.7% this season. A large Brazilian crop could help ease pressure in global markets after lackluster harvests in other big producers like India and Thailand, which has sent sugar prices to record levels.

And just when you thought that things could not get any worse, the bourbon supply chain could be under threat because of a shortage of the specific type of wood used in the barrels made for aging the liquor, according to Bloomberg: https://www.bloomberg.com/news/articles/2023-05-01/transcript-the-supply-chain-crisis-that-could-wreck-the-bourbon-industry.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource