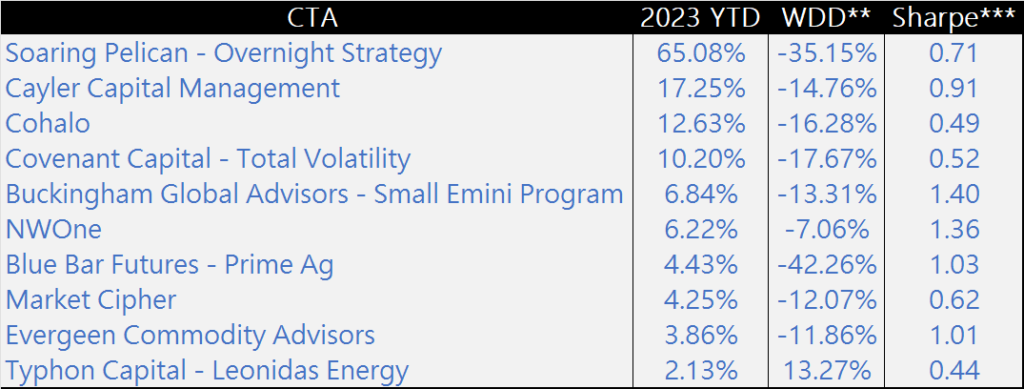

2023 has shown regression from 2022 in terms of CTA performance. CTA indices are reporting modest results, with Barclay’s CTA index posting ~0.50% return through June 2023, and the SG CTA index posting a comparable number. Similar to 2022, trend following strategies are receiving most of the attention and causing investor assets to flow into the space. Due to the volatility in various commodities, commodity specific managers are also doing well. Lastly, short-term systematic space is also performing well as day-to-day volatility has become a mainstay this year. Here are ten of the top performing CTAs in 2023 that are part of aiSource’s approved manager pool+:

Past performance is not indicative of future results. All RORs are through June 2023

**WDD: worst drawdown since the inception of the track record

***Sharpe: Sharpe Ratio since the inception of the track record

Two of the above managers are part of the short-term space: Soaring Pelican and NWone. Commodity specific strategies from the above group are Cayler Capital, Blue Bar, NWOne, Evergreen and Typhon’s Leonidas strategy.

There are some new entrants to our list this year: Cohalo and Covenant both trade volatility through VIX futures. Blue Bar, an agriculture manager trades the lean hog market through the use of both futures and options.

+: Approved managers are CTAs with whom aiSource has active investments with or has had investments with previously.