Commodities: Global

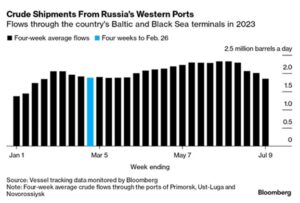

OPEC Oil Output Fell by 840 million barrels per day (mbpd) in July from June per Reuters survey, mostly due to the Saudi cuts and to a lesser degree due to an export terminal problem in Nigeria. Total OPEC production was 27.34 MMBPD, which is the lowest since September 2021. At the beginning of July, the Kingdom of Saudi Arabia extended their 1 mbpd cut for the month of August, and again in early August to extend it into September. Russia also announced an additional export decrease of 0.3 mbpd in early August, and evidence of previous promises to cut 1.4 mbpd started to materialize (see left). Note that one of those ports

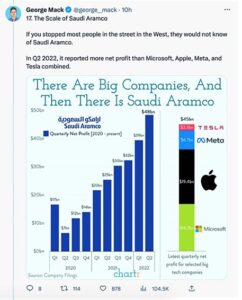

Saudi cuts and to a lesser degree due to an export terminal problem in Nigeria. Total OPEC production was 27.34 MMBPD, which is the lowest since September 2021. At the beginning of July, the Kingdom of Saudi Arabia extended their 1 mbpd cut for the month of August, and again in early August to extend it into September. Russia also announced an additional export decrease of 0.3 mbpd in early August, and evidence of previous promises to cut 1.4 mbpd started to materialize (see left). Note that one of those ports (Novorossiysk) was the one attacked by Ukraine, though the effect won’t be seen yet in that graph. Rystad Energy analysis had all Russian seaborne exports in August falling to 3.1-3.2 mbpd, down from April and May’s rate of 3.7 mbpd. Come September, though, exports may increase as refinery processing was expected to fall by 500-600 bpd. In case anyone had any questions about the profitability of Saudi Arabia’s oil business, the graphic to the left compares Saudi Aramco to the combined profits of the biggest of the big tech darling companies…

(Novorossiysk) was the one attacked by Ukraine, though the effect won’t be seen yet in that graph. Rystad Energy analysis had all Russian seaborne exports in August falling to 3.1-3.2 mbpd, down from April and May’s rate of 3.7 mbpd. Come September, though, exports may increase as refinery processing was expected to fall by 500-600 bpd. In case anyone had any questions about the profitability of Saudi Arabia’s oil business, the graphic to the left compares Saudi Aramco to the combined profits of the biggest of the big tech darling companies…

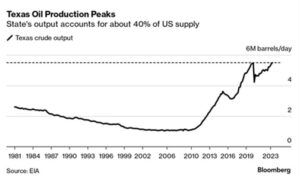

US Oil Production Stayed at 12.2 mbpd in July despite another decrease in operating oil rigs from 545 as of June 30th to 529 as of July 28th. Oil companies cited productivity enhancements in their shale regions. Per AAA, US average regular gasoline prices moved up about +7% to $3.78 per gallon as of July 31st, 24¢ higher than last month. While the US summer driving season had not translated into the usual amount of gasoline demand, ultra-low inventories in storage pushed up prices. The US Department of Energy cancelled its 6 million barrel auction as it considered the price too high (over $80 per barrel). It bought 6 million barrels earlier this year, which increased reserves by only under +2%. Recall that Biden authorized a 50 million barrel release in 2021 and another 180 million barrels in 2022, so these have been token purchases at best. US’ EIA expected oil production to increase this year and next, reaching 12.6 mbpd and 12.85 mbpd, respectively. Texas oil production revisited its high while US crude exports stood at 5.3 mbpd at the end of July, the third-highest weekly export total on record (Reuters). Exports in the first six months of the year have averaged 4.1 mbpd, +28% — or nearly 1 mbpd — higher than the same period in 2022. And with Midland WTI crude now deliverable into the global Brent benchmark, even more exports will be on their way. Meanwhile US natural gas production will rise to record highs in 2023 per US EIA with dry gas production rising to 102.4 billion cubic feet per day (bcfd) in 2023 and 102.4 bcfd in 2024 from the previous record of 98.13 bcfd in 2022.

these have been token purchases at best. US’ EIA expected oil production to increase this year and next, reaching 12.6 mbpd and 12.85 mbpd, respectively. Texas oil production revisited its high while US crude exports stood at 5.3 mbpd at the end of July, the third-highest weekly export total on record (Reuters). Exports in the first six months of the year have averaged 4.1 mbpd, +28% — or nearly 1 mbpd — higher than the same period in 2022. And with Midland WTI crude now deliverable into the global Brent benchmark, even more exports will be on their way. Meanwhile US natural gas production will rise to record highs in 2023 per US EIA with dry gas production rising to 102.4 billion cubic feet per day (bcfd) in 2023 and 102.4 bcfd in 2024 from the previous record of 98.13 bcfd in 2022.

Chinese Crude Imports in June were the 2nd most ever at 12.7 mbpd, +45.3% year-on-year from last year’s Covid restricted level. 2023 imports for the first 6 months of the year were up +11.7% year on year at 11.4 mbpd. China’s imports of crude oil from Russia hit an all-time high in June, beating May’s record, with arrivals from Russia totaling 2.6 mbpd. A little surprising given the country’s economic malaise but this oil would have been purchased a few months ago when prices were a lot lower. China imported 10.3 million metric tons of soybeans in June, up +24.5% from a year earlier, as large purchases of cheap Brazilian beans reached the market. Shipments for the first six months of the year reached 52.6 million metric tons, up +13.6% year-on-year.

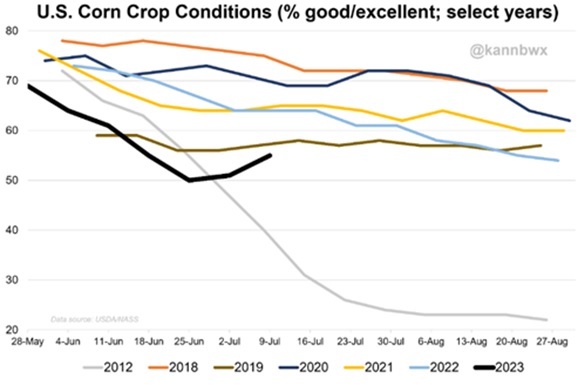

US Planting of Corn, Wheat and Soybeans was completed and conditions, while not particularly good, have improved. The corn and soybean crops are still in majority dry environments (technically “drought”), but an upgrade from 70% and 63%, respectively, to 57% and 51%, respectively – see graph right. Futures prices were well off highs, reminding us that weather changes fast. Nearly three-quarters of the US corn crop was suffering from drought just a few weeks ago. Fast forward to now, rains have turned fields around (and prices down). US farmers were raising the fewest beef cows since at least 1971 as drought conditions whittled herds, likely boosting costs for meatpackers that slaughter the animals into steak and hamburgers. There were 29.4 million beef cows as of July 1, down -2.6% from a year earlier, the U.S. Department of Agriculture said in a biannual report and reflected a fifth year of declining beef cow numbers.

from 70% and 63%, respectively, to 57% and 51%, respectively – see graph right. Futures prices were well off highs, reminding us that weather changes fast. Nearly three-quarters of the US corn crop was suffering from drought just a few weeks ago. Fast forward to now, rains have turned fields around (and prices down). US farmers were raising the fewest beef cows since at least 1971 as drought conditions whittled herds, likely boosting costs for meatpackers that slaughter the animals into steak and hamburgers. There were 29.4 million beef cows as of July 1, down -2.6% from a year earlier, the U.S. Department of Agriculture said in a biannual report and reflected a fifth year of declining beef cow numbers.

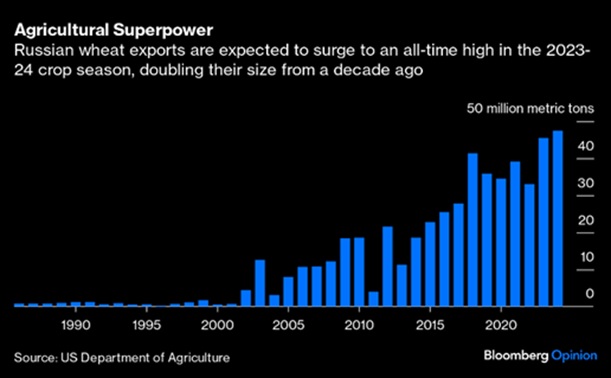

On a Positive Note, Global food prices are down more than a fifth from their 2022 peak, according to the United Nations. Wheat prices have halved; the cost of corn has fallen -33%, and soybean prices are down -15%. The only worry is the cost of rice, which has surged to a two-year high, up +30% from a year ago. Rice prices in Asia jumped to the highest level in more than three years after top shipper India banned a hefty chunk of its exports, raising concerns about supplies of the food staple for people around the world.

worry is the cost of rice, which has surged to a two-year high, up +30% from a year ago. Rice prices in Asia jumped to the highest level in more than three years after top shipper India banned a hefty chunk of its exports, raising concerns about supplies of the food staple for people around the world.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource