Global Oil Production Cut by 5% and Market Yawned:

- To be fair, the oil market did react on the attack by Iran (or its proxies) on Saudi Arabia’s largest oil blending facility at Abqaiq: prices moved up almost 15% over the weekend from $54.85 to $62.90 per barrel. However, the markets gave back almost half that increase the next day and more as the week

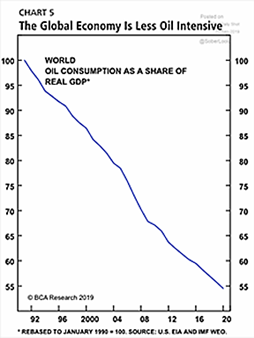

finished out and into the end of the month to close at $54.07. Why the reversal? Supply and demand. On the supply side, the Saudis quickly announced that they would return the lost 5.7 million barrels per day (mbpd) by the end of the month, for total-country potential output of 11 mbpd – which they did achieve via partial repairs and opening other fields. Furthermore, they promised to reach 12 mbpd maximum capacity by the end of November, building out more excess capacity and redundancy. In the meantime, their 150 million in oil storage reserves were available. While some shipments were delayed by seven to ten days and the blends of crude were not always to original specifications, the barrels were delivered. Keep in mind that OPEC+ had excess capacity due to the under-production over the last year. Even war-torn Libya said it added 500,000 barrels of crude oil capacity to the Ras Lanuf port in September, reaching the highest level since 2016. The US made its strategic reserve barrels available, but none were taken. Meanwhile, slowing economic conditions, particularly in Europe, reduced the demand side of the equation. China announced that it reached 80 days of oil in its strategic reserve, close to its goal of 90. While the country does normally import about 15% of its oil from Saudi Arabia, it could turn to other suppliers (e.g., Russia, Iraq, Angola and Brazil) that can expand output or have excess capacity. Overall, the world has become much less energy intensive as a share of GDP than twenty-five years ago as measured by the BCA Research chart to the right – oil is important, even vital, but not as critical as during the 1970s oil crisis or the Iran-Iraq wars.

finished out and into the end of the month to close at $54.07. Why the reversal? Supply and demand. On the supply side, the Saudis quickly announced that they would return the lost 5.7 million barrels per day (mbpd) by the end of the month, for total-country potential output of 11 mbpd – which they did achieve via partial repairs and opening other fields. Furthermore, they promised to reach 12 mbpd maximum capacity by the end of November, building out more excess capacity and redundancy. In the meantime, their 150 million in oil storage reserves were available. While some shipments were delayed by seven to ten days and the blends of crude were not always to original specifications, the barrels were delivered. Keep in mind that OPEC+ had excess capacity due to the under-production over the last year. Even war-torn Libya said it added 500,000 barrels of crude oil capacity to the Ras Lanuf port in September, reaching the highest level since 2016. The US made its strategic reserve barrels available, but none were taken. Meanwhile, slowing economic conditions, particularly in Europe, reduced the demand side of the equation. China announced that it reached 80 days of oil in its strategic reserve, close to its goal of 90. While the country does normally import about 15% of its oil from Saudi Arabia, it could turn to other suppliers (e.g., Russia, Iraq, Angola and Brazil) that can expand output or have excess capacity. Overall, the world has become much less energy intensive as a share of GDP than twenty-five years ago as measured by the BCA Research chart to the right – oil is important, even vital, but not as critical as during the 1970s oil crisis or the Iran-Iraq wars.

Who benefits from higher oil prices?

- If Iran and Saudi Arabia do start attacking each other’s oil facilities, then Russia will reap the biggest rewards as the top producer strategically located next to China, India and Europe. The US would also be a winner, now that it is a net energy exporter. Other politically-stable producers should also benefit, including Canada, Norway and Brazil. Who loses? Asia primarily – particularly Japan, China, South Korea and India (in that dollar value order of amounts purchased). Keep an eye on India‘s oil demand as OPEC projected that it will rise the most in 2019 and 2020, more barrels than China, the world‘s second-biggest oil consumer at 13.1 mbpd in 2019.

OPEC Oil Production

- fell to an eight-year low after the attacks on the Saudi oil blending facilities, but only by 0.75 million barrels per day (mbpd). The Reuters survey data indicated unsurprisingly that the biggest drop was from Saudi Arabia, which supplied 9.05 mbpd, or 0.70 mbpd less than in August. Although estimated production was lower at about 8.5 mbpd, Aramco released oil from storage to make up the difference. By month-end, the Saudis increased capacity to 11.3 mbpd from raising production from unaffected sites, though full repairs at the Abqaiq facility will takes months to complete. The quick response inspired Aramco to move forward with its IPO plans, selecting the main banks to run the offering as well as soliciting orders from large pension funds in Europe, Japan and Canada. Iraqi oil exports fell slightly and Venezuelan shipments fell to the lowest level in seventy years at 0.5 mbpd. OPEC+ was looking to cut more barrels at its meeting before the attack as the cartel cut its forecast for growth in world oil demand in 2020 due to an economic slowdown, saying oil demand worldwide would expand by 1.08 million barrels per day, 60,000 bpd less than previously estimated. Iraq was beset by anti-corruption protests prompting the PM Mahdi to use live fire to kill several protestors and shut down the internet – so far, there has been no reaction in crude oil prices. Ecuador, one of OPEC’s smallest members, said it will leave the bloc next year so it can increase crude production to raise more income. A US appeals court let Crystallex International Corp. restart a $1.4 billion debt-collection lawsuit targeting Venezuela’s PDVSA’s holdings of US refiner and distributor Citgo. Non-OPEC Brazil continued increasing oil production in August, hitting another record high of 3 mbpd.

US Crude Oil

- weekly numbers indicated maintained production at 12.4 mbpd of crude oil despite a continuing decline in operating drilling rigs from 742 on August 30th to 713 on

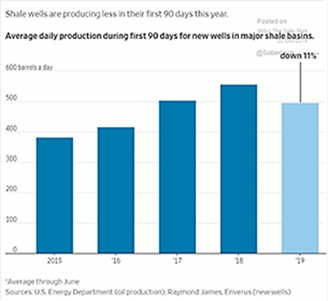

September 27th. US crude oil production is expected to rise by 1.25 mbpd in 2019 to a record of 12.24 mbpd, the Energy Information Administration (EIA) said, slightly lower than its previous forecast for a rise of 1.28 mbpd. The output in 2020 is forecast to rise by 990,000 bpd to 13.23 million bpd. Output from the seven major shale formations was forecasted to rise by 74,000 bpd in October to a record high 8.84 mbpd, with the largest change in the Permian Basin of Texas and New Mexico. The climb of ~71,000 bpd to a record high 4.48 mbpd for October would be the ninth consecutive month of increases. There is a concern that new wells are not producing at the same rate as before, as they may be drilled too close to each other and the best sites are taken (see graph to the right from the WSJ). The US imposed penalties on a handful of Chinese shipping firms for continuing to carry Iranian oil after sanctions waivers lapsed in May. The Asian country took 5.4 million barrels of crude from Iran in August, compared with a monthly average of 16 million barrels last year. The US’ sanctions against Iran had some effect on China, with its state oil company has pulled out of a $5 billion deal to develop a portion of Iran’s massive offshore natural gas field.

September 27th. US crude oil production is expected to rise by 1.25 mbpd in 2019 to a record of 12.24 mbpd, the Energy Information Administration (EIA) said, slightly lower than its previous forecast for a rise of 1.28 mbpd. The output in 2020 is forecast to rise by 990,000 bpd to 13.23 million bpd. Output from the seven major shale formations was forecasted to rise by 74,000 bpd in October to a record high 8.84 mbpd, with the largest change in the Permian Basin of Texas and New Mexico. The climb of ~71,000 bpd to a record high 4.48 mbpd for October would be the ninth consecutive month of increases. There is a concern that new wells are not producing at the same rate as before, as they may be drilled too close to each other and the best sites are taken (see graph to the right from the WSJ). The US imposed penalties on a handful of Chinese shipping firms for continuing to carry Iranian oil after sanctions waivers lapsed in May. The Asian country took 5.4 million barrels of crude from Iran in August, compared with a monthly average of 16 million barrels last year. The US’ sanctions against Iran had some effect on China, with its state oil company has pulled out of a $5 billion deal to develop a portion of Iran’s massive offshore natural gas field.

China’s Customs Office

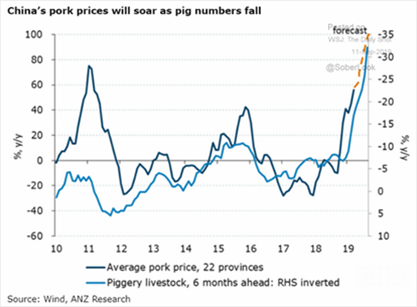

- announced that it had granted export licenses to some Argentine meat-processing plants, as they continued

to battle massive herd losses from African Swine Fever (ASF). As the graph to the left shows, pork prices have skyrocketed as herd sizes has been decimated. South Korean officials confirmed the first five cases of ASF in that country. The disease was discovered in a region bordering North Korea, which has already announced cases of ASF. It has spread across both Koreas, Vietnam, Laos and the Philippines since first being detected in China in mid-2018. Meanwhile US piglets per litter continue to make new highs, reaching over 11.1 per litter from 9.3 ten years ago. As a reminder, the Chinese are buying record amounts of pork from the US, despite increasing their tariff to 25% on US pork in 2018. Recently, however, the government suspended tariffs on certain agricultural products including pork as food inflation undermined the 70th anniversary of Communist rule in China celebrated at the beginning of October.

to battle massive herd losses from African Swine Fever (ASF). As the graph to the left shows, pork prices have skyrocketed as herd sizes has been decimated. South Korean officials confirmed the first five cases of ASF in that country. The disease was discovered in a region bordering North Korea, which has already announced cases of ASF. It has spread across both Koreas, Vietnam, Laos and the Philippines since first being detected in China in mid-2018. Meanwhile US piglets per litter continue to make new highs, reaching over 11.1 per litter from 9.3 ten years ago. As a reminder, the Chinese are buying record amounts of pork from the US, despite increasing their tariff to 25% on US pork in 2018. Recently, however, the government suspended tariffs on certain agricultural products including pork as food inflation undermined the 70th anniversary of Communist rule in China celebrated at the beginning of October.

Global Grains

- continue to put up strong production numbers, despite fears of frost in North America and dryness in South America. US corn and soybean production will be 1% smaller than previously forecast this fall per the USDA, with both crops still well behind their typical development schedule after late planting. Meanwhile, despite a slower start to soybean planting in Brazil, the country’s 2019/20 corn crop, most of which is planted after the soy harvest, is expected to surpass the 100 million metric ton mark for the first time. According to the average estimate of nine forecasters, Brazil’s corn crop in the current season is likely to yield 102.3 million tonnes, a +2.3% increase from the government’s estimate for the prior harvest. Strategie Grains increased its forecasts sharply for EU soft wheat production and exports for the second month in a row, pointing to strong harvest results in France and Britain and brisk shipments from Romania and Bulgaria. The French-based consultancy now sees 2019/20 soft wheat production in the European Union at 144.5 million tonnes, up from 142.9 million tonnes projected in August and about 14% above last year’s drought-hit crop. Russia’s agricultural minister raised his estimate of the 2019 Russian wheat crop to 78 MMTs due to the late recovery in spring wheat yields with exports of 36-38 MMTs, above last year.

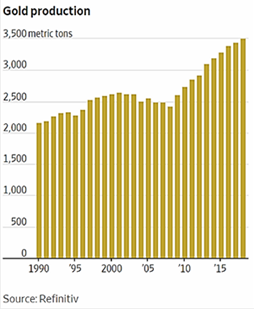

- Other commodity news of note included the largest wind turbines are being installed off the coasts of New Jersey and Maryland – these 853-foot (260-meter) turbines are almost

as tall as New York’s Chrysler Building! Meanwhile the cost to install residential rooftop solar in the US has fallen to below $3 per watt, 20% lower than in 2015. Global gold production is increasing, with prices now averaging $1,500 per ounce, as per the graph to the right from Refinitiv (formerly a division of Reuters). With negative interest rates more pervasive, alternative currencies like gold are gaining more investor interest.

as tall as New York’s Chrysler Building! Meanwhile the cost to install residential rooftop solar in the US has fallen to below $3 per watt, 20% lower than in 2015. Global gold production is increasing, with prices now averaging $1,500 per ounce, as per the graph to the right from Refinitiv (formerly a division of Reuters). With negative interest rates more pervasive, alternative currencies like gold are gaining more investor interest.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource