Global

- Recession Warnings came fast and furious in September with the OECD cutting 2019 GDP growth by -0.3% to +2.9% for the year, the IMF reducing growth to +3.2% and IHS Markit’s

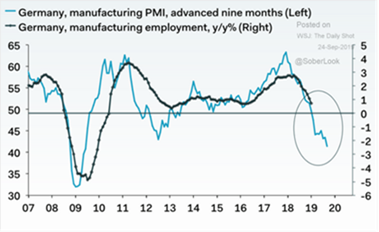

Purchasing Managers’ Index (PMI) indicating contractions in manufacturing in a majority of countries. OECD 2020 projections look weaker too, with GDP growth estimates for the US falling from +2.9% to +2.0% and China from +6.6% to +5.7%. In early October, PMIs took center stage as the indices indicated contracting activity for the fifth month in a row. The Eurozone from 47.0 in August to 45.7 in September (a number below 50 indicates lower activity) and the US fell to 47.8, its worst level in a decade. The implication for manufacturing employment can be seen in the graph to the left. Manufacturing output for the 36 OECD countries fell 1.3% year-on-year, led by lower machinery, metal and automobile production. Again, the numbers in Germany as shown to the left best exemplify this trend.

Purchasing Managers’ Index (PMI) indicating contractions in manufacturing in a majority of countries. OECD 2020 projections look weaker too, with GDP growth estimates for the US falling from +2.9% to +2.0% and China from +6.6% to +5.7%. In early October, PMIs took center stage as the indices indicated contracting activity for the fifth month in a row. The Eurozone from 47.0 in August to 45.7 in September (a number below 50 indicates lower activity) and the US fell to 47.8, its worst level in a decade. The implication for manufacturing employment can be seen in the graph to the left. Manufacturing output for the 36 OECD countries fell 1.3% year-on-year, led by lower machinery, metal and automobile production. Again, the numbers in Germany as shown to the left best exemplify this trend.

- Trade Conflict Gave and Took as both China and the US backed off from the latest round of conflict. Thirty Chinese delegates came to the US in late September where the two sides discussed agricultural issues and intellectual property protection. Beforehand, the Chinese suspended tariffs on certain agricultural items while the US postponed imposing additional tariffs two weeks so that they began after the 70th anniversary celebrations of the Communist rule in China. Late September saw the US and Japan signed a partial deal on electronic products, machinery and agricultural products, though automobiles remain an outstanding issue. Finally, the World Trade Organization ruled against the EU in a 15-year fight against the US over Airbus subsidies. This decision allows the US to levy tariffs starting next year against $25 billion of French, German, British and Spanish products to generate $7.5 billion annually in compensation. The WTO should judge early next year a reciprocal case that would partially offset this amount against the US over its support for Boeing. Further negotiations continued.

North America

- Q2 US Growth Held at +2.0% annualized, with the Atlanta branch of the Federal Reserve forecasting a +1.8% annualized rate for Q3, an uptick from last month. Payrolls grew at +136,000 for September, a little lower than expected, but unemployment rate reached a fifty-year low to 3.5%. Underemployment fell as well to 6.9% versus 7.1% average over the last few months, the lowest on record (which began in 1994). Hourly earnings rose a little less than expected (+2.9%) but for lower wage workers, higher than expected (+3.5%).

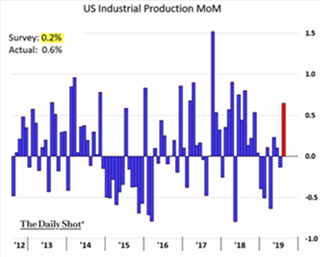

Labor force participation was a little higher at 63.2. US retail sales were steady in August although Forever 21 filed for bankruptcy, joining the list of fashion retailers felled by heavy competition, high rents and the defection of shoppers to online outlets. Over 200 of its 800 stores are slated to close, affecting about a quarter of its 30,000 full- and part-time employees. HP is slated to lay off 16% of its workforce (7,000-9,000 people) and everyone speculated how many would face the ax from WeWork’s failed IPO attempt. The US saw overall positive results from industrial measures: August industrial production handily beat expectations (+0.6% month-on-month versus +0.2% – see right) and durable goods and factory goods orders were better as well. On the negative side, automobile sales disappointed for the nine-months through September and rail traffic fell -6.4% year-on-year in September.

Labor force participation was a little higher at 63.2. US retail sales were steady in August although Forever 21 filed for bankruptcy, joining the list of fashion retailers felled by heavy competition, high rents and the defection of shoppers to online outlets. Over 200 of its 800 stores are slated to close, affecting about a quarter of its 30,000 full- and part-time employees. HP is slated to lay off 16% of its workforce (7,000-9,000 people) and everyone speculated how many would face the ax from WeWork’s failed IPO attempt. The US saw overall positive results from industrial measures: August industrial production handily beat expectations (+0.6% month-on-month versus +0.2% – see right) and durable goods and factory goods orders were better as well. On the negative side, automobile sales disappointed for the nine-months through September and rail traffic fell -6.4% year-on-year in September.

- The Federal Reserve is expected to lower interest rates further at its October 29th-30th meeting by -0.25%. When he last spoke Powell stated that the US economy was in a “favorable place” but faced risks from trade policy. On the other hand, lower interest rates helped August’s pending home sales, which also improved versus forecast (+1.6% month-on-month versus +1.0%). Inflation is still low.

Asia

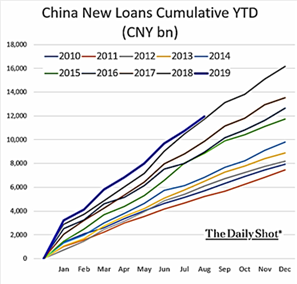

- China Continued to Stimulate the Economy by lowering their one-year lending rate for the second month in a row but otherwise we note that new lending is on the same path as

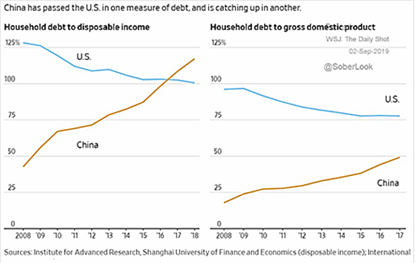

last year (which was a record year for lending) as seen on the right. Shadow loans (i.e., loans from non-banks) were allowed to increase dramatically in the mix, with 39% of total lending in Q3 and 45% in Q2, the highest levels since 2013. The end result is that Chinese households are more in debt than American as a percentage of disposable income and are narrowing the gap relative to GDP (see graph below). A number of key economic measures slipped in August with industrial output growth falling to a new 17-year low of +4.4%. Retail sales expanded +7.5%, and fixed-asset investment slowed to +5.5% year-on-year, all lower than expectations. CCP 70th anniversary celebrations notwithstanding, China faces many developed nations problems.

last year (which was a record year for lending) as seen on the right. Shadow loans (i.e., loans from non-banks) were allowed to increase dramatically in the mix, with 39% of total lending in Q3 and 45% in Q2, the highest levels since 2013. The end result is that Chinese households are more in debt than American as a percentage of disposable income and are narrowing the gap relative to GDP (see graph below). A number of key economic measures slipped in August with industrial output growth falling to a new 17-year low of +4.4%. Retail sales expanded +7.5%, and fixed-asset investment slowed to +5.5% year-on-year, all lower than expectations. CCP 70th anniversary celebrations notwithstanding, China faces many developed nations problems.

Rest of Asia Also Slowed as South Korea’s exports fell for the tenth straight monthly decline in September, though a lower decline than in August. Their industrial production also fell more than expected (-2.9% year-on-year versus -0.2%). Japan (-4.7% vs. -3.8%) and Singapore (-8.0% vs. -0.6%) also badly missed their year-on-year industrial production expectations.

Rest of Asia Also Slowed as South Korea’s exports fell for the tenth straight monthly decline in September, though a lower decline than in August. Their industrial production also fell more than expected (-2.9% year-on-year versus -0.2%). Japan (-4.7% vs. -3.8%) and Singapore (-8.0% vs. -0.6%) also badly missed their year-on-year industrial production expectations.

Europe

- Brexit Battles Continue as the EU and the UK (and within the UK) try to best each other in willpower. Basically the EU is going to try to punish the UK by not agreeing to any

reasonable deal. Therefore, the UK will either be no-deal out by October 31st (or some other date) or eventually capitulate. How this gets resolved in the UK Parliament is unknown given the nature of British democracy.

reasonable deal. Therefore, the UK will either be no-deal out by October 31st (or some other date) or eventually capitulate. How this gets resolved in the UK Parliament is unknown given the nature of British democracy.

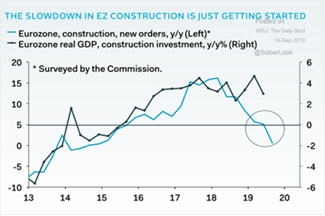

- Meanwhile, The EU Still Stumbles as the graph to the right indicates – slowing Eurozone new orders in construction often translate into economic weakness. German crude oil imports hit lowest level since 1992, further warning on Europe’s largest economy. German factory orders in August were 6.7% lower than a year earlier as Germany faces a slowdown in demand, including in its giant car manufacturing sector. 12-month factory orders have now fallen 15 months in a row. At least European unemployment is continuing its trend lower, reaching 7.4%, although that is the level last reached in 2008!

- Outgoing ECB Head Mario Draghi announced a restart of QE in November at a buying pace of €20 billion per month without an end date specified. He also pushed deposit rates further into negative territory by 0.1% though smaller deposit amounts will not be affected, thus reducing the cost to banks by €3 billion to €6 billion. Finally, he offered cheap term loans to banks under the TLTRO program. With the end of his term in November, the baton will then be passed to Christine Lagarde, fresh from heading the IMF. More of a political figure than Draghi, she faces the tough decisions on how to use the ineffective inherited monetary policies to revive Europe’s economy.

A final note on the trade war is a reminder that in the first week of October China celebrated the 70th anniversary after its founding, an event that will undoubtedly demonstrate the strength of both the country and the leader. A sluggish economy and antigovernment protests in Hong Kong are not part of that image. Unless there is a large concession by Trump, then do not expect a deal in the next few months despite the current visit by Chinese officials to the US.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource