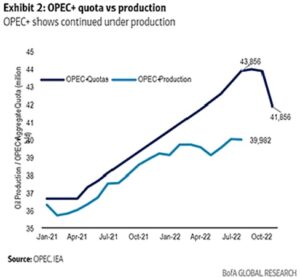

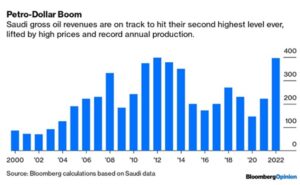

OPEC Production Was Basically Flat at 29.98 million barrels per day (mbpd) during October (Bloomberg), still much less than current quotas of 33.4 mbpd. Recall that OPEC+ announced a 2 mbpd cut for November 2022 but that will have minimal actual effect given the lack of production versus quota. Apart from Saudi Arabia, the UAE and Kuwait, there is little ability to raise production beyond current levels. Iran remained rocked by riots over the death of a woman at the hands of the country’s “morality police” and an oil deal seemed further away than ever. Reportedly Iran was storing around 60 million barrels of sanctioned oil on board tankers, utilizing 80% of its fleet for storing oil while the rest of its tankers transport crude from deep-water anchorages in Malaysia to China. Saudi Arabia, as the graph shows, remained in the driver’s seat with revenues at highs. Biden just cannot bully the Kingdom in this situation.

announced a 2 mbpd cut for November 2022 but that will have minimal actual effect given the lack of production versus quota. Apart from Saudi Arabia, the UAE and Kuwait, there is little ability to raise production beyond current levels. Iran remained rocked by riots over the death of a woman at the hands of the country’s “morality police” and an oil deal seemed further away than ever. Reportedly Iran was storing around 60 million barrels of sanctioned oil on board tankers, utilizing 80% of its fleet for storing oil while the rest of its tankers transport crude from deep-water anchorages in Malaysia to China. Saudi Arabia, as the graph shows, remained in the driver’s seat with revenues at highs. Biden just cannot bully the Kingdom in this situation.

US Oil Production fell slightly to 11.9 mbpd while companies increased operating rigs from 604 as of September 30th to 610 as of October 28th. Per AAA, US average regular gasoline prices declined fractionally, reaching $3.76 per gallon on October 31th, 4¢ lower from last month. Californian average regular gasoline prices declined from $6.38 to $5.51 – better than before. The DOE statistics showed crude exports to be a record of 5.1 mbpd with total exports of crude oil and products at a record 11.4 mbpd. JP Morgan projected that the additional 26 million barrels of congressionally mandated sales required in FY 2023 will be delivered in October to December 2022. If so, crude oil stocks in US strategic petroleum reserve (SPR) will exit start 2023 at 348 million barrels, the lowest since July 1983, and almost half of the stocks year ago. Congress mandates a minimum SPR inventory of 252.4 million barrels, although it can adjust this level as needed: the most recent adjustment took place in the 2021 Bipartisan Infrastructure Bill. However, the President has the right to drain the SPR below that specific level if he declares a “severe energy supply interruption,” as Biden did in spring 2022 to trigger the 180 million barrels sale. One should expect more SPR sales as oil companies remain focused on returning profits to shareholders, not expanding drilling. Thank also the politicians supported by environmentalists that demonized their existence.

required in FY 2023 will be delivered in October to December 2022. If so, crude oil stocks in US strategic petroleum reserve (SPR) will exit start 2023 at 348 million barrels, the lowest since July 1983, and almost half of the stocks year ago. Congress mandates a minimum SPR inventory of 252.4 million barrels, although it can adjust this level as needed: the most recent adjustment took place in the 2021 Bipartisan Infrastructure Bill. However, the President has the right to drain the SPR below that specific level if he declares a “severe energy supply interruption,” as Biden did in spring 2022 to trigger the 180 million barrels sale. One should expect more SPR sales as oil companies remain focused on returning profits to shareholders, not expanding drilling. Thank also the politicians supported by environmentalists that demonized their existence.

China’s Crude Oil Imports in October rebounded to the highest level since May, up 1+4% from a low base a year earlier in their first annual growth in five months, as two new refineries prepared to start operations. The world’s largest crude importer brought in 10.16 mbpd. September coal production jumped +12.3% from a year earlier to 390 million tonnes, reaching record average daily levels as mines resumed operation after heavy rainfall in the summer months. Just in time for winter.

Harvest Was Almost Compete in North America as corn reached 76% done at the end of October and soy 88% brought in. Both crops were well ahead the five-year averages and last year’s progress – frost will not be an issue this year! A near-relentless drought threatened soybean and corn growing in Argentina as well as the upcoming wheat harvest. China may start importing corn from Brazil as early as December, part of a drive by the world’s top buyer to reduce dependence on the US and replace supplies from Ukraine cut off by the Russian invasion. Ukraine exported almost 14.3 million tonnes of grain so far in the current season, down -31% from the 20.6 million tonnes exported by the same stage of the previous season. With the UN grain agreement up for renewal on November 19th, one wonders if they will make more progress.

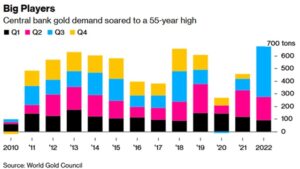

Central banks Bought Record Amount of gold last quarter as they diversified foreign-currency reserves, with a large chunk of the purchases coming from as-yet unknown buyers (believed to be China, India and Russia). Almost 400 tons were scooped up, more than quadruple the amount a year earlier, according to the World Gold Council. As the graph to the right shows, such purchases look to set an annual record once Q4 is finalized.

(believed to be China, India and Russia). Almost 400 tons were scooped up, more than quadruple the amount a year earlier, according to the World Gold Council. As the graph to the right shows, such purchases look to set an annual record once Q4 is finalized.

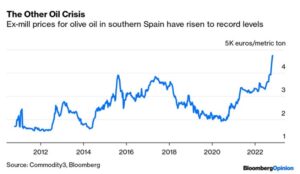

Finally, worried about oil prices? It’s not just black gold that is running short — the green stuff is in trouble, too. Drought across the Mediterranean has pushed olive oil prices up 50% over the past year, to record levels not far below €5,000 ($4,966) a ton. European output this season will be 25% lower than in 2021, as Spain’s Andalusia region may harvest its second-smallest crop ever. Italy’s industry is warning of a truly dystopian scenario — empty shelves in the extra virgin aisle.

Mediterranean has pushed olive oil prices up 50% over the past year, to record levels not far below €5,000 ($4,966) a ton. European output this season will be 25% lower than in 2021, as Spain’s Andalusia region may harvest its second-smallest crop ever. Italy’s industry is warning of a truly dystopian scenario — empty shelves in the extra virgin aisle.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource