OPEC+ Again Considered Raising Production in response to higher oil prices but decided not to – they have budget deficits to cover! Inst ead the cartel will stick to increasing production by 400,000 barrels per day, reaching 2 million barrels per day (mbpd) by the end of 2021. Then in May 2022, the baseline for cuts will reset higher, allowing for the UAE to produce about 500,000 bpd more (its reward for going along with the summer 2021 deal). Irony was not lost on the markets with Biden calling for greater oil production from OPEC+ to lower prices while at the COP26 climate conference! I wonder what Greta thought about that. Furthermore, OPEC+ made only about half their planned increase for October as Angola and Nigeria under-produced and Saudi Arabia and other Gulf countries elected to not make up the difference. Iran has been increasing production little-by-little (currently at 2.7 mbpd with over 3.5 mbpd capacity) and has stored almost 140 million barrels (mb) of oil and condensate should there be a nuclear deal when talks restart on November 29th. An offer too tempting for Biden as he scrambles to reduce US energy prices? While US winter weather is expected to be mild to average, a cold gust could cause political trouble for him. As the dashed line to the right via JPMorgan showed, OECD countries have not seen inventories this low in recent history.

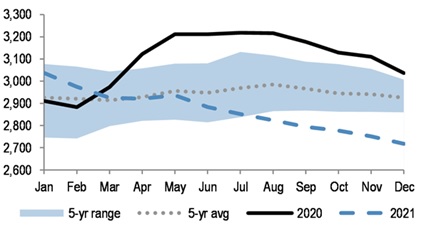

ead the cartel will stick to increasing production by 400,000 barrels per day, reaching 2 million barrels per day (mbpd) by the end of 2021. Then in May 2022, the baseline for cuts will reset higher, allowing for the UAE to produce about 500,000 bpd more (its reward for going along with the summer 2021 deal). Irony was not lost on the markets with Biden calling for greater oil production from OPEC+ to lower prices while at the COP26 climate conference! I wonder what Greta thought about that. Furthermore, OPEC+ made only about half their planned increase for October as Angola and Nigeria under-produced and Saudi Arabia and other Gulf countries elected to not make up the difference. Iran has been increasing production little-by-little (currently at 2.7 mbpd with over 3.5 mbpd capacity) and has stored almost 140 million barrels (mb) of oil and condensate should there be a nuclear deal when talks restart on November 29th. An offer too tempting for Biden as he scrambles to reduce US energy prices? While US winter weather is expected to be mild to average, a cold gust could cause political trouble for him. As the dashed line to the right via JPMorgan showed, OECD countries have not seen inventories this low in recent history.

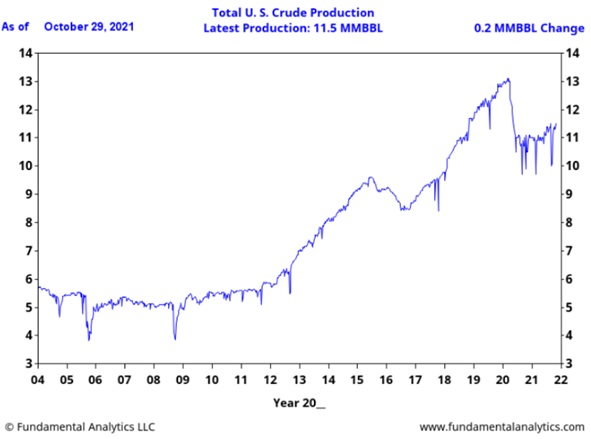

US Oil Production increased versus last month to 11.5 mbpd while operating rigs continued higher from 428 as of October 1st to 444 as of October 29th. See the graph on the next page for a visual of the slow recovery and the potential of US production. US oil reserves inched up from a month ago (426 mb to 434 mb).

US average regular gasoline prices at the pump jumped higher from $3.19 to $3.40 per gallon from AAA last month – it was just under $5.00 per gallon close to my home in San Francisco. Meanwhile, stockpiles at the biggest US crude depot in Cushing, OK, approached critically low levels, reaching 26 mb – a minimum of 20 mb is needed to ensure smooth functioning of the facilities. The last time we saw these levels, crude cost more than $100 a barrel. For reference, the inventory was just under 60 mb at the beginning of the year. Looking ahead, BP announced they will increase their spending on US shale in 2022 while both Chevron and Exxon indicated that they are looking to add rigs in the Permian Basin. OPEC and other energy-related agencies see a production surplus in 2022 which has kept a lid on prices.

US average regular gasoline prices at the pump jumped higher from $3.19 to $3.40 per gallon from AAA last month – it was just under $5.00 per gallon close to my home in San Francisco. Meanwhile, stockpiles at the biggest US crude depot in Cushing, OK, approached critically low levels, reaching 26 mb – a minimum of 20 mb is needed to ensure smooth functioning of the facilities. The last time we saw these levels, crude cost more than $100 a barrel. For reference, the inventory was just under 60 mb at the beginning of the year. Looking ahead, BP announced they will increase their spending on US shale in 2022 while both Chevron and Exxon indicated that they are looking to add rigs in the Permian Basin. OPEC and other energy-related agencies see a production surplus in 2022 which has kept a lid on prices.

China’s September Crude Oil Imports fell -15.3% from a year earlier as companies drew on inventories amid rising global prices and as tightened import quotas continued to constrain purchases. Meanwhile, natural gas imports rose to the highest since January at 10.62 million tonnes. A mid-October freeze sent their coal futures to record prices, though they fell off 50% from that level as the government dictated higher coal production to ensure warmth and electricity – COP26 ignored when push came to shove. Reportedly the government looked for an additional 100 million tons by year-end, and by the end of October 25 million tons had already been delivered to power plant stockpiles.

Looking At Europe, eleven British energy suppliers have ceased trading as companies struggle with record wholesale energy prices. Pure Planet, in which oil major BP holds a stake of about 24% and which has around 235,000 customers, and Colorado Energy, with 15,000 customers, exited the market in mid-October. Putin still limited natural gas exports to Europe, though there was some relief in the beginning of November.

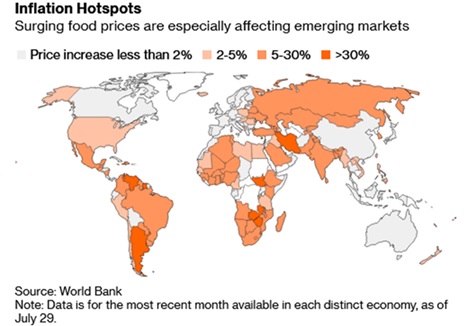

Food Costs Hit Emerging Markets as seen in the Bloomberg graphic to the right – not just the US. Dwindling foreign currency reserves would hamper the ability of some nations to import food. Will we see a resurgence of unrest similar to the last time this happened? Recall the Arab Spring protests?

US Crop Harvests are moving smoothly with corn 84% completed versus 78% on average and soybeans 87% in the bin versus 88% on average. Soy did deliver a shocker in the latest US government reports as estimated yields severely missed at 51.2 bushels per acre instead of the industry expectations of 51.9 bushels. Corn yeilds were at expectations. Brazilian planting reached 67% of expected area as good weather allowed progress versus 56% completed at this time last year. Favorable weather could also help Ukraine to harvest a record 80.3 million tonnes of grain this year, up from 65 million tonnes in 2020 – its harvest is 87% finished. Argentina is seeing lower demand for their soy crop this year so far with 33.1 million tonnes sold versus 34.4 last year. Heavy rain across northern China in early November delayed the corn harvest, submerged fields in water and raised concerns about the quality of the crop in the world’s second largest producer. China is expected to harvest one of its largest corn crops in years this season after tight supply last year pushed prices to record levels.

Kellogg’s Faced $5 Million Lawsuit for not having enough strawberries in its strawberry Pop-Tarts. We all know that these “food” products are unhealthy but not sure what is going on if one can say that there is fruit in non-fruit merchandise…

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource