COVID-19

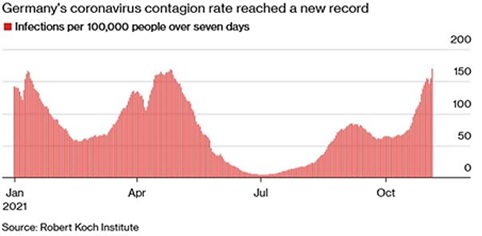

- US Case Count continued slowing, reaching less than half the level of the late summer peak. While that may be welcome, Japan recently reported only 300-ish new cases (basically zero on a per capita basis), while India posted about 20% of the US new case count (13k vs 70k), again very low on a population-weighted basis. What is the US doing wrong? Actually looking at Europe (see Germany year-to-date to the right), what are they doing even more wrong? Those countries generally have as high if not higher dosage rates than

the US and stricter lockdown restrictions. Japan can be partially explained on being an island nation with tough immigration policies but India at about half the injection rate of the US stands out a source to learn from. Note that India suffers from a greater prevalence of gene LZTFL1 that doubles the risk of respiratory failure from COVID-19, as identified by the University of Oxford (60% of people of South Asian ancestry have this genetic format versus 15% of European and 2% of Afro-Caribbean heritage). While not a sole determinate of course, it stands against the one-size-fits-all approach that dominates medical policy.

the US and stricter lockdown restrictions. Japan can be partially explained on being an island nation with tough immigration policies but India at about half the injection rate of the US stands out a source to learn from. Note that India suffers from a greater prevalence of gene LZTFL1 that doubles the risk of respiratory failure from COVID-19, as identified by the University of Oxford (60% of people of South Asian ancestry have this genetic format versus 15% of European and 2% of Afro-Caribbean heritage). While not a sole determinate of course, it stands against the one-size-fits-all approach that dominates medical policy.

- Other Notable News included that The Lancet (the UK’s primary medical journal) on October 28th published a study concluding “fully vaccinated individuals with breakthrough infections [both Alpha and Delta] have peak viral load similar to unvaccinated cases and can efficiently transmit infection in household settings.” Recall that the US’ CDC similarly stated on July 30th, “Delta infection resulted in similarly high SARS-CoV-2 viral loads in vaccinated and unvaccinated people. High viral loads suggest an increased risk of transmission and raised concern that, unlike with other variants, vaccinated people infected with Delta can transmit the virus.” In short, receiving shots does not appear to inhibit transmission, further underscoring the endemic nature of this disease. Coupled with the data in the first paragraph, perhaps policymakers should step back and reconsider their decisions so far.

- Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully. Recalling that about 90% of hospitalizations suffer from one or more co-morbidities (obesity, high blood pressure, etc.), one should take active steps to get into the best baseline health possible.

Macro: US

- US Q3 GDP came in at +2.0% annualized, much higher than the Atlanta Federal Reserve’s last estimate of +0.2% but lower than the street forecast

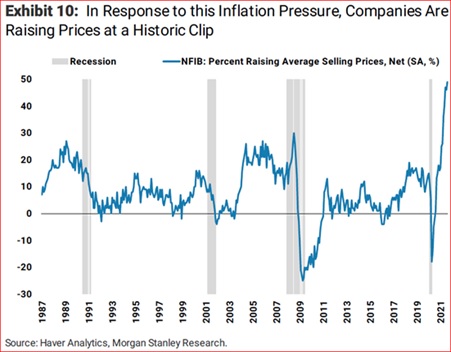

of +2.6%. The Atlanta Fed did give the love to the Q4 GDP forecast of +8.5% based primarily on personal consumption growth. Pricing in bounteous holiday spending, it seems. Prices certainly look bounteous, but not to the advantage of consumers per the graph to the right. We are not talking ‘70s-style numbers which would be double this (or more), but one should expect these prices to be less transitory than what the Fed said. For example, the Social Security Cost-Of-Living Adjustment (COLA) will be +5.9% in 2022, the biggest boost to Social Security beneficiaries’ checks in about forty years. In 2021, the Social Security COLA

of +2.6%. The Atlanta Fed did give the love to the Q4 GDP forecast of +8.5% based primarily on personal consumption growth. Pricing in bounteous holiday spending, it seems. Prices certainly look bounteous, but not to the advantage of consumers per the graph to the right. We are not talking ‘70s-style numbers which would be double this (or more), but one should expect these prices to be less transitory than what the Fed said. For example, the Social Security Cost-Of-Living Adjustment (COLA) will be +5.9% in 2022, the biggest boost to Social Security beneficiaries’ checks in about forty years. In 2021, the Social Security COLA  was +1.3%. This increase will affect 72 million people, just under 20% of the US population. Second, at the gas pump, every state in the country now has an average gas price over $3.00 per gallon with California the highest at $4.55 and Oklahoma the lowest at $3.01. Next, employment costs registered the highest increase in twenty years at +1.2%, which was not enough to keep up with inflation, to be clear. High profile strikes over pay and working conditions started to appear in the news, such as 1,400 Kellogg employees walking off the job, halting operations at all six of their cereal plants. However, the damage to commercial real estate seems to be delayed though we at Coloma are moving offices a few blocks and expect to cut our rent in half. The San Francisco region had just 25% of employees back in their offices in the week ended Oct. 20th, the lowest share among 10 U.S. metropolitan areas. The region is the only one where apartment rents have not returned to pre-pandemic levels. Finally, the graph to the left indicated that about half of US companies are increasing prices – when will this stop and will it reset consumer expectations higher?

was +1.3%. This increase will affect 72 million people, just under 20% of the US population. Second, at the gas pump, every state in the country now has an average gas price over $3.00 per gallon with California the highest at $4.55 and Oklahoma the lowest at $3.01. Next, employment costs registered the highest increase in twenty years at +1.2%, which was not enough to keep up with inflation, to be clear. High profile strikes over pay and working conditions started to appear in the news, such as 1,400 Kellogg employees walking off the job, halting operations at all six of their cereal plants. However, the damage to commercial real estate seems to be delayed though we at Coloma are moving offices a few blocks and expect to cut our rent in half. The San Francisco region had just 25% of employees back in their offices in the week ended Oct. 20th, the lowest share among 10 U.S. metropolitan areas. The region is the only one where apartment rents have not returned to pre-pandemic levels. Finally, the graph to the left indicated that about half of US companies are increasing prices – when will this stop and will it reset consumer expectations higher?

- Misses Marked the recent economic data – pending home sales fell -2.3% instead of rising +0.5% in September, industrial production was -1.3% rather than +0.1%, and productivity fell by the most since 1981 in the third quarter, reflecting a sharp pullback in economic growth and an increase in hours worked. Nonfarm business employee output per hour decreased at a 5% annualized rate in the third quarter. On the plus side, unemployment fell to 4.6% on stronger payroll growth of +531,000 in October, both better than estimates. Automakers added to payrolls as evidence that the computer chip shortage *may* be turning around. Retail sales also were strong (+0.7% month-on-month in September and an upward revision for August to +0.9%).

- Fed Confirmed Tapering (buying fewer bonds) at its November 2-3rd gathering but underscored patience before actually raising rates until 2H 2022 at the soonest. Biden also weighed Powell’s re-nomination for Fed Chair, though a more accommodative (“dovish”) successor may be more to his liking. The President was busy sparring with Congress over details for the second supplemental spending package which was $3.5 trillion by itself and now looking like half that amount (plus the $1.2 trillion spending from the first supplemental spending bill which passed the House on November 8th). Broad tax hikes and the amount of additional debt seemed to be the core of the wrangling, with each politician fighting for their own special interests.

Macro: Asia

- The Chinese Economy moved slightly higher in September with retail sales improving versus August (+4.4% versus +2.5% y/y), but industrial production at +3.1% rose at the slowest annual rate in eighteen months. China’s GDP grew +4.9% y/y in Q3, implying seasonally adjusted growth of +0.2% q/q which was the weakest quarterly growth since a contraction in Q1 2020. Power shortages (recently corrected), production cuts in heavy industries (e.g., crude steel production fell -21.2% y/y) and lower auto sales (-19% y/y, the fifth consecutive monthly contraction) all weighed on the numbers. Shipbuilding was a bright spot (+6.2% increase y/y in tonnage produced, new orders tonnage up +223% y/y) which indicate the possibility of logistical normalization at some point. Trade was another bright spot as exports surged both in September and October from a year prior in dollar terms (+27.1% and

+28.1% y/y, respectively). October hit a record monthly surplus after thirteen months of double-digit export growth. Energy imports, particularly coal (double versus a year ago) and natural gas (+22% for the first ten months of the year), did increase. The country is still struggling with its property developers with Evergrande, Modern Land, Sinic, Fantasia and Kaisa all missing payments. Looking at the graphic to the right, Evergrande faces relentless pressure to generate cash flow. When will the real write-down come? Actually the real write-down will be when the $385 billion “Belt and Road” debt comes due from the more than forty countries that have 10% or more of their GDP owed to China (total BnR debt equals about $843 billion to 165 countries for context). So far, about $3.4 billion has been written off and $15 billion restructured – a drop in the bucket. With 44% of the portfolio collateralized, when will the collections begin?

+28.1% y/y, respectively). October hit a record monthly surplus after thirteen months of double-digit export growth. Energy imports, particularly coal (double versus a year ago) and natural gas (+22% for the first ten months of the year), did increase. The country is still struggling with its property developers with Evergrande, Modern Land, Sinic, Fantasia and Kaisa all missing payments. Looking at the graphic to the right, Evergrande faces relentless pressure to generate cash flow. When will the real write-down come? Actually the real write-down will be when the $385 billion “Belt and Road” debt comes due from the more than forty countries that have 10% or more of their GDP owed to China (total BnR debt equals about $843 billion to 165 countries for context). So far, about $3.4 billion has been written off and $15 billion restructured – a drop in the bucket. With 44% of the portfolio collateralized, when will the collections begin?

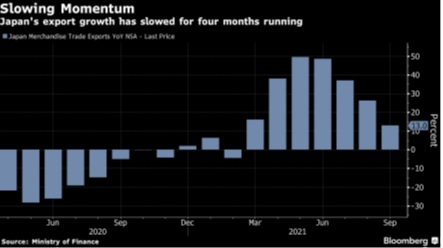

- Japan’s Export Recovery continued slowing (see graphic) as auto exports slumped on chip tightness (-40% y/y, primarily to the US). Import costs increased on higher oil, medical supply and coal prices. The new Prime Minister, Fumio Kishida, pledged billions (current expectations are $265 billion) in new stimulus as core machine orders missed expectations for August. Singapore’s factory output also missed per the latest figures. South Korea’s Q3 GDP improved slightly to deliver a +4.0% y/y growth.

Macro: Europe

- The German Government Cut its economic growth forecast for this year to +2.6%, but lifted its estimate for next year to +4.1% as supply problems delayed the recovery in Europe’s largest economy. European industrial output contracted by -1.6% in August, broadly in line with consensus (-1.7%). However, inflation picked up in Europe as prices rose +4.1% in October from a year earlier, with core inflation hitting +2.1%, a level not seen in nearly two decades. Germany led the way at +4.5% as energy prices rose +18.6%. The ECB chose to hold back from adjusting rates or the levels of Q€ using the same language of the US Fed: “transitory.” With natural gas from Russia well under their usual levels, one wonders how “transitory” European GDP growth will be too.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource