Commodities: Global

OPEC+ Decided to Cut Production at their June 3rd meeting but it would not be effective until 2024. The headline number was a decline by 1.4 million barrels per day (mbpd) with a production target of 40.46 mbpd for 2024. This is lower than the 41.86 mbpd production target set back in October last year, which runs from November 2022 to December 2023. Separately but relatedly, Saudi Arabia announced that they will unilaterally cut output by 1 mbpd (just over 10% of their production) in July, which may be extended monthly. Many of the OPEC+ reductions will have little real impact, however, as the lower targets for Russia, Nigeria and Angola only bring them into line with their actual production levels. Bucking the move, the United Arab Emirates was allowed to raise production by 200,000 barrels a day, one of the few states with the capacity to do so. Also, Libya still aimed to boost oil production by about 8% to 1.3 mbpd by December, the highest level in more than a decade. The next full OPEC+ meeting is not until late November but there will be update meetings every two months. While many forecasters are projecting a supply deficit later this year (e.g., ING Bank at 2 mbpd in 2H), a global recession could upend that prognosis and extend the Saudi decline.

US Oil Production Decreased slightly to 12.2 mbpd as companies rapidly withdrew operating oil rigs, lowering units from 591 as of April 28th to 555 as of June 2nd. Per AAA, US average regular gasoline prices slipped slightly to $3.57 per gallon as of May 31st, 4¢ lower than last month. US oil output from the seven biggest shale basins is due to rise in June to the highest on record, by 41,000 bpd to 9.33 million bpd, the EIA said. US crude exports fell to a 3-month low of 3.715m b/d in April, down 16% from the previous month but up 19% from a year earlier. Canadian oil sands production was expected to reach 3.7 mbpd by 2030, S&P Global, raising the overall outlook for the country for the first time in half a decade. Finally, in a nuclear perspective, Dr. Michael Goff of the Biden administration stated at a recent investment conference that “In the United States, we’ve had the largest fleet of reactors during our entire 60-plus years of operating commercial plants. We’ve only generated 83,000 metric tons of commercial spent fuel, which depending how you stack it… if that was just on the ground stored, it’s a little bit larger than a football field. This is not a lot of waste we’re talking about generating. And I’ll point out from that 83,000 metric tons of spent fuel that we’ve generated we’ve saved the production of 400 million metric tons of CO2. [In short,] we’ve generated very little waste and we’ve saved a lot of CO2 emissions through that time.” Meanwhile, “[Fusion research] has happened very quietly, there is about $5 billion invested into what’s now about 100 fusion companies, most of that over the last few years.” Will these investments bear fruit?

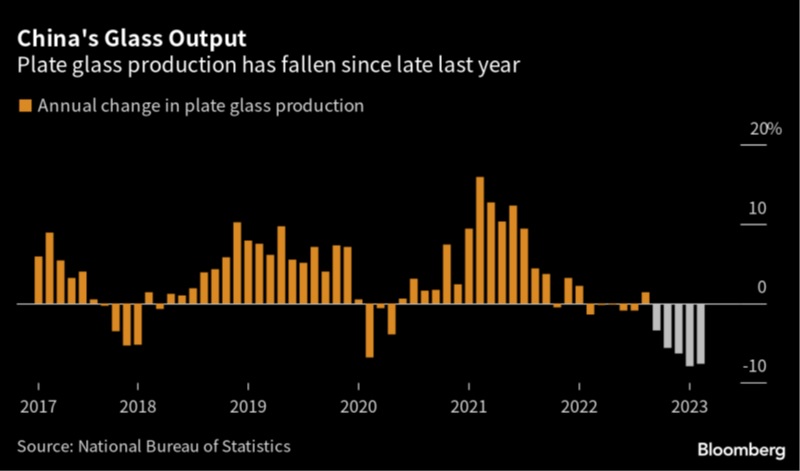

Chinese Crude Imports in April fell to 10.3 mbpd, the lowest level since January, as high inventories, refinery maintenance and a weaker domestic economic rebound weighed on demand. Beyond energy, the commodities related to China’s vaunted industrial production all were under pressure. Iron ore prices hit a five-month low. Other exotic Chinese future contracts looked weak – glass futures down -20% in May on weaker property and automobile markets, styrene monomer (used in plastics and rubber) off due to a -5% drop in home appliance sales and corn starch, a thickening agent for sauces… and baby formula – not needed as much if the population is declining.

production all were under pressure. Iron ore prices hit a five-month low. Other exotic Chinese future contracts looked weak – glass futures down -20% in May on weaker property and automobile markets, styrene monomer (used in plastics and rubber) off due to a -5% drop in home appliance sales and corn starch, a thickening agent for sauces… and baby formula – not needed as much if the population is declining.

US Crop Planting Basically Finished putting corn, wheat and soybeans in the ground, ahead of schedule versus last year, albeit with worse conditions to start (69% corn good-to-excellent versus 73% last year) due to dryness. However, with shoots emerging already, the plants are better conditioned to reach aquafers. On the other hand, China’s largest wheat-growing province of Henan has been hit by heavy rains, complicating efforts to harvest grain damaged by abnormally heavy precipitation in late May. The country’s wheat imports have surged 80% so far in 2023 on this and low international prices, primarily from Australia. China’s corn imports fell -8.4% in the first four months from a year earlier, due to the narrowing price gap between wheat and corn, which is mainly used as animal feed. Finally, China’s soybean imports rose +6.8% in the first four months from a year earlier, behind normal rates as stricter import inspections slowed processing of cargos. Finally, Conab, Brazil’s food supply and statistics agency, raised its forecast for Brazilian soybean and corn production, citing favorable conditions in spite of the effects of the La Niña weather pattern, which caused drought in the south of the country early in the season. In its May forecast report, Conab predicted Brazilian farmers will harvest a record 154.8 million tonnes of soybeans, +23.3% more than in the previous season, and a record 125.5 million tonnes of corn, +11% above last year. Brazil even exported 178,800 tonnes of soybeans to the United States (the world’s #2 producer) as Brazilian prices were such a bargain.

And to close out, some funny (or not-so-funny) cartoons from the UK…

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource