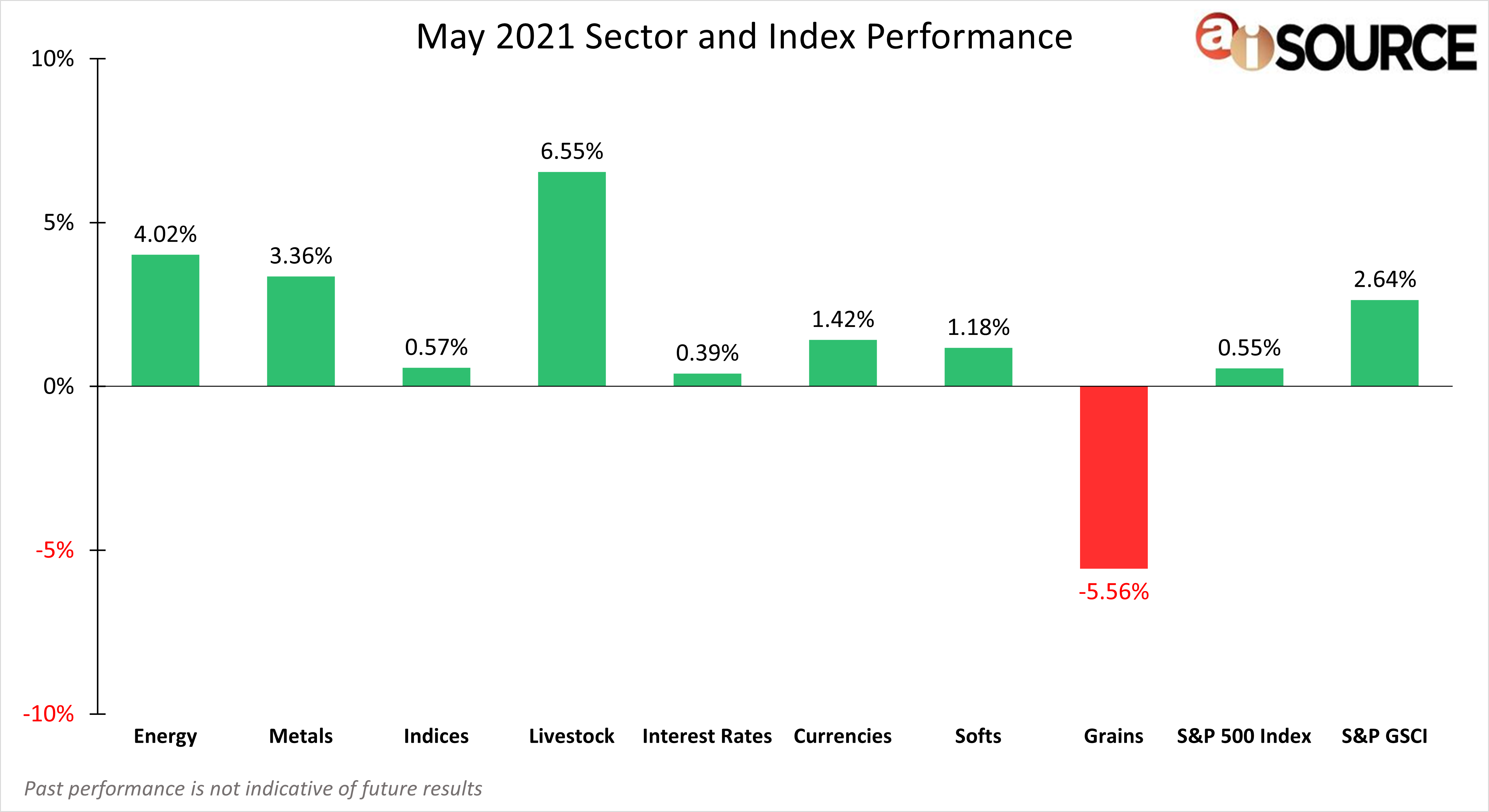

During the month of May, the top 3 performing sectors were: livestock (+6.55%), energy (+4.02%), and metals (+3.36%). The bottom 3 sectors were: grains (-5.56%), interest rates (+0.39%) and the financial indices (+0.57%). Overall, markets were fairly green across the board. Investor sentiment remains strong as financial indices lock in their fourth consecutive month of gains. According to the CDC, 50% of Americans have received at least 1 dose of the Covid-19 vaccine and just over 40% of Americans have been fully vaccinated. Jobless claims hit a post-pandemic low as restrictions for businesses are slowly lifted and things start reverting back to the pre-pandemic normal. Looking into the commodity markets, the grain rally exhausted and pulled off its’ 7-year highs. Livestock outperformed a majority of the markets with feeder cattle up +13.29% and lean hogs up +6.47%. And, oil broke its’ 2019 highs amidst a gas shortage scare that occurred early in the month on the East coast.

For month to date and year to date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. S&P 500 Index – data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.