- OPEC Stuck to Production Increases for May and June, with another increase of 841,000 barrels per day (bpd) in July. Iran and the US/EU incrementally moved forward to a deal, though disagreement over nuclear enrichment after revelations that Iran already violated the current agreement by moving forward on increasing its atomic production. With the rise of a more conservative leader expected, after Rouhani steps down in August talks may go nowhere until that timeframe.

- US Production Stayed Constant in May at around 10.9 million barrels per day (mbpd) while operating rigs continued higher, moving to 359 as of May 28th from April 30th (see the red

line to the right). As reference, this is about half the rigs operating before the pandemic. Interestingly, the US imported just over 1 million barrels of oil from Iran in March, only the second time since 1991 – however, this was in relation to the Iranian ship that was seized under the sanctions months ago. US oil output from seven major shale formations was expected to climb by 26,000 bpd in June to 7.73 million bpd, the first rise in three months, mainly from the Permian basin, with declines expected in nearly every other large basin such as the Bakken and the Eagle Ford. In another view of the economic recovery, US refinery utilization rates rose to 88.7% of capacity last week, the highest since Feb. 2020. Finally, interestingly enough the US government recovered “millions” in bitcoin from the cyberhackers that shut down the Colonial pipeline – how and how much were not disclosed. Perhaps bitcoin is not as secure as made out to be.

line to the right). As reference, this is about half the rigs operating before the pandemic. Interestingly, the US imported just over 1 million barrels of oil from Iran in March, only the second time since 1991 – however, this was in relation to the Iranian ship that was seized under the sanctions months ago. US oil output from seven major shale formations was expected to climb by 26,000 bpd in June to 7.73 million bpd, the first rise in three months, mainly from the Permian basin, with declines expected in nearly every other large basin such as the Bakken and the Eagle Ford. In another view of the economic recovery, US refinery utilization rates rose to 88.7% of capacity last week, the highest since Feb. 2020. Finally, interestingly enough the US government recovered “millions” in bitcoin from the cyberhackers that shut down the Colonial pipeline – how and how much were not disclosed. Perhaps bitcoin is not as secure as made out to be.

- China’s Crude Imports in May fell to the lowest level this year to 9.6 mbpd between the rise in oil prices and an increase in more refinery capacity off-line in May versus April. More interesting was that China’s banking regulator told lenders to stop selling investment products linked to commodities futures to mom-and-pop buyers per Reuters to curb investment losses amid volatile commodity prices. It has also asked lenders to completely unwind their existing books for these products. In addition, China stepped up its fight against soaring commodities prices by threatening top executives with severe punishment for violations ranging from excessive speculation to spreading fake news. Obviously any convictions would have serious consequences for the accused. Finally, we need to monitor China floods this year as 71 rivers have exceeded warning levels. Last year’s floods forced increased agricultural purchases from North and South America, not to mention fears related to the Three Gorges Dam’s structural integrity. China’s soybean imports rose in May (+29%) from the previous month, as more cargoes from top supplier Brazil cleared customs.

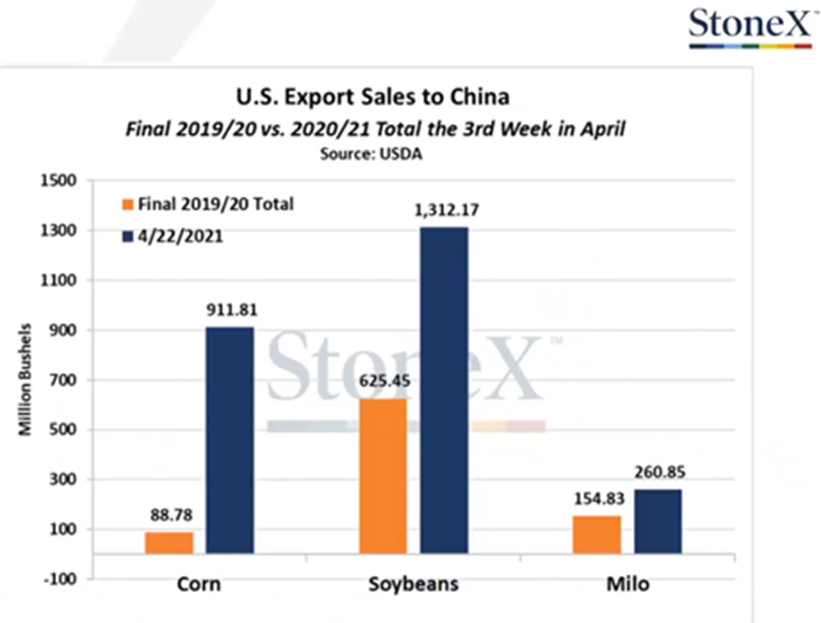

- US Grain Production looks on track with Corn and Soy basically complete. However, recent conditions for Corn slipped in quality though there is still a lot of summer left to go. US

grain exports to China this season are tremendous as seen in the graph to the right and China has already pre-bought over one-third of the 2021-22 crop as well. Oddly enough, timing and logistical issues have caused the US to import soybeans from Brazil with 7.6 million bushels already shipped or expected to ship to support livestock operations. Meanwhile, obese pigs in China are being blamed for worsening a sudden rout in the country’s pork prices with weights of more than 200 kilos for animals instead of the usual 125 kilos. Chinese wholesale pork prices have plunged more than 40% since mid-January amid sluggish demand, increased imports and panic selling by farmers after fresh outbreaks of African swine fever. Meanwhile, China is sourcing corn as far away as Ukraine as their corn sales to China could reach as much as 11 million tons in the season that starts in September, an all-time high. Given China’s dependence on US (and global) meat, at least we can be confident that they were not behind the cyberhack on JBS’ US, Canadian and Australian meatpacking plants.

grain exports to China this season are tremendous as seen in the graph to the right and China has already pre-bought over one-third of the 2021-22 crop as well. Oddly enough, timing and logistical issues have caused the US to import soybeans from Brazil with 7.6 million bushels already shipped or expected to ship to support livestock operations. Meanwhile, obese pigs in China are being blamed for worsening a sudden rout in the country’s pork prices with weights of more than 200 kilos for animals instead of the usual 125 kilos. Chinese wholesale pork prices have plunged more than 40% since mid-January amid sluggish demand, increased imports and panic selling by farmers after fresh outbreaks of African swine fever. Meanwhile, China is sourcing corn as far away as Ukraine as their corn sales to China could reach as much as 11 million tons in the season that starts in September, an all-time high. Given China’s dependence on US (and global) meat, at least we can be confident that they were not behind the cyberhack on JBS’ US, Canadian and Australian meatpacking plants.

Finally, our award for the most interesting use of a commodity goes to Nippon Paper Industries which announced plans to use cellulose nanofiber — materials produced by refining wood pulp to the size of hundredths of a micron or smaller, and currently used in products like diapers or food additives — with the aim of creating supercapacitors that could store and release energy with vastly improved performance, and less environmental impact, than existing batteries. Furthermore, this technology in theory could replace all lithium-ion batteries… A demonstration system is targeted for 2025 and commercialization a decade later.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource