COVID-19

- Operation Warp Speed and the continued efforts under the new administration pushed another 12% of the US population to having received at least one dose to reach 45.3% with the UK at over 52%. Europe also moved higher from last month to reach 27%+ with one dose as vaccine approval and production delays look more in the past. The fighting with the UK over vaccine exports also looked over. Johnson’s political position strengthened with Conservative victories in early May which would bolster his negotiating position.

- The number of vaccines and therapeutics continued to increase. For example, GlaxoSmithKline and Vir Biotechnology said their Covid-19 antibody therapy showed a significant reduction of hospitalization and death for at-risk patients in an advanced-stage trial that progressed faster than expected. The companies said that they will seek US emergency-use authorization. The treatment, VIR-7831, reduced the numbers of patients who were hospitalized or died by 85% compared to a placebo, the companies said. The French company Valneva announced its vaccine would enter trials – it is unique as it used the “old-school” 100-year-old technology of relying on an inactivated version of the virus which should also make it more effective against future mutations.

- The US announced it would share its entire contracted supply of 60 million AstraZeneca Covid-19 vaccine doses with other countries and readied an aid package for India. So far the US had sent 4.2 million shots to Mexico and Canada and the 10 million already produced could be exported in the near future.

- The most concrete sign that the disease was turning behind us was that Kimberly-Clark cut its sales forecast as toilet paper sales plunged. The company’s consumer tissue unit saw a -12% decline, while operating profit fell by -26%. In North America, the company’s biggest market, sales of tissue dropped -14%. As at-home consumption wanes, the company expected revenue to contract amid rising commodity costs.

- COVID claimed another casualty – all but one of the CME’s historic trading pits. The only part of CME’s trading floor that will remain open is the Eurodollar options pit, which the exchange operator reopened in August 2020. Otherwise, the trading pits that it closed temporarily a year ago in March would not be reopened including the pit for the trading of futures and options on the S&P 500. I truly enjoyed visiting the floor to catch up with my livestock brokers when visiting Chicago and fondly recall other visits to long-gone trading venues. The raw energy that bordered on desperation was something to experience, even if seen as archaic nowadays.

- Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- Q1 GDP Growth Came In Strong at +6.4% annualized, due to re-openings (fully/partially) by locked-down states. Personal spending was robust, contributing +7.0% and capital spending was also solid, contributing +1.8%. Inventories did draw taking away -2.6% and net exports were also a headwind (-0.9%). Unsurprisingly, government spending added to growth (+1.1%). Recall that Q4 2020 had a nice +4.3% increase and looking ahead, the Atlanta Fed is projecting 11.0% annualized with the economist survey at +9.0%. With recent good weather, American consumers did what they do best after being cooped up for a year and federal government spending (even before two additional packages totaling over $4 trillion are finalized).

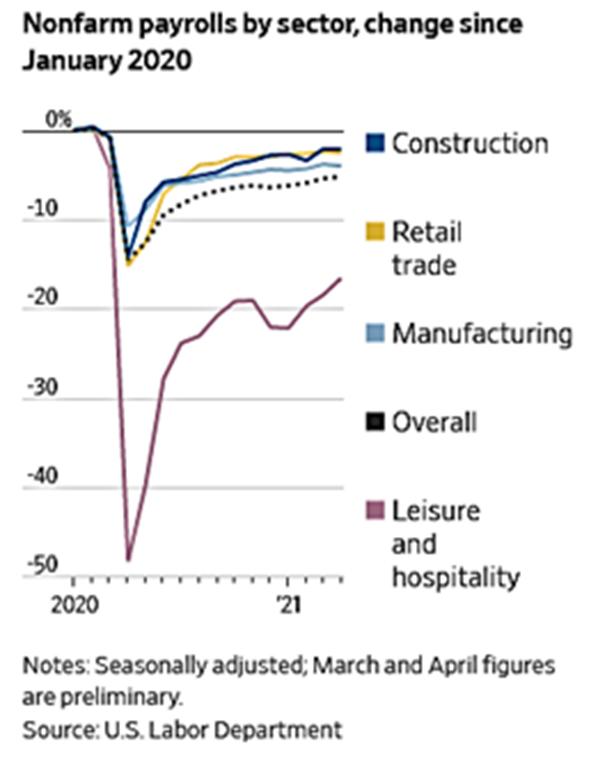

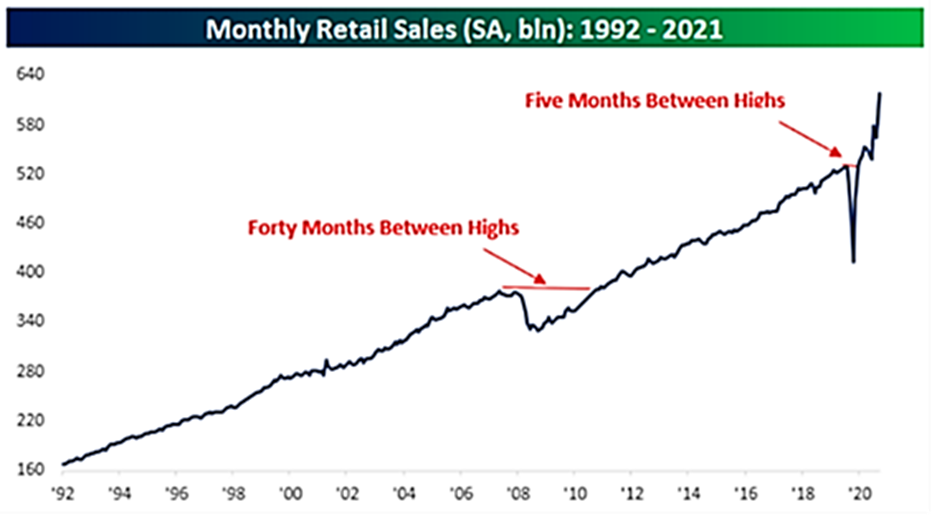

- Underlying Economic Data Also Looks Good as vaccinated shoppers headed back to the mall – foot traffic at 50 malls in March was up 86% from the same month last year. Unemployment ticked up in April to 6.1% from 6.0% but labor force participation increased more to 61.7% form 61.5%. Payrolls missed expectations badly (+266k versus 1 million estimated) but hourly earnings rose +0.7% versus expectations of no growth month-on-month. March factory orders rose +1.1% and February’s decline was revised upward. Industrial production also increased by +1.4% month-on-month, though both of these results were under estimates (most likely because of bad weather in March). March retail sales ramped higher (see graph right) by +9.8% as business re-openings, increased hiring and a fresh round of stimulus checks emboldened shoppers. Like with industrial activity, February’s decline was adjusted higher. US consumer prices climbed in March by the most since 2012, adding to fears of budding inflationary pressures.

The consumer price index increased +0.6% from the prior month after a +0.4% gain in February, according to Labor Department data. A jump in the cost of gasoline accounted for almost half the overall March advance. Excluding food and energy components, the so-called core CPI increased +0.3% from February, the most in seven months, reflecting rising rents and auto insurance. The year-on-year increase is +2.6% (+1.6% for the core), still below the Federal Reserve’s desired level.

The consumer price index increased +0.6% from the prior month after a +0.4% gain in February, according to Labor Department data. A jump in the cost of gasoline accounted for almost half the overall March advance. Excluding food and energy components, the so-called core CPI increased +0.3% from February, the most in seven months, reflecting rising rents and auto insurance. The year-on-year increase is +2.6% (+1.6% for the core), still below the Federal Reserve’s desired level.

- Powell Reiterated His Dovish View at the April meeting that the US economy is not overheating and that inflation was not close to causing him and the Open Market Committee to consider tapering their government bond purchases or other interest rate adjustments. Given their statements about letting the economy “run hot” for an unspecified period, I do not see

any Fed action this year – a 2022 question at the soonest. The deficit in March was $659.6 billion, the third-largest on record and biggest since last June, swelling the total from October to March to $1.71 trillion, according to the US Treasury. The six-month total compares with $743.5 billion in the prior-year period. Looking ahead, the US Treasury more than quadrupled its borrowing estimate for the quarter through June, and expects to need some $1.3 trillion over the second half of the fiscal year to help pay for a raft of fresh pandemic relief spending. This included the $1.9 trillion COVID bill passed in March but does not include either of the two new packages which total $4 trillion or so over the next number of years (nor the estimated revenue associated with them). With that forecast aiming for a cash balance of $750 billion at the Fed, there is still room to draw down that balance, which implies that incremental borrowing is unlikely (until the two packages are passed). In the meantime, the US Treasury sold $40 billion of each of four-week T-bills at 0% interest and eight-week bills at 0.01% in the latest auction and the longer-dated auctions were well bid in April. Mid-May will be the test for the 10-year and 30-year bonds. Finally, we noted that inflation does not seem likely from all this spending in 2021 given the slack in the labor market and weakness in the commercial real estate market, but interest rates would increase as the government needs to borrow more to finance the additional spending plans. For perspective, the US will run, this year, well over a trillion in off-budget deficit spending and even more in regular budget deficit. This would put the country at $40 trillion in debt by 2025 or 180% debt to GDP. Japanification is coming soon at this rate.

any Fed action this year – a 2022 question at the soonest. The deficit in March was $659.6 billion, the third-largest on record and biggest since last June, swelling the total from October to March to $1.71 trillion, according to the US Treasury. The six-month total compares with $743.5 billion in the prior-year period. Looking ahead, the US Treasury more than quadrupled its borrowing estimate for the quarter through June, and expects to need some $1.3 trillion over the second half of the fiscal year to help pay for a raft of fresh pandemic relief spending. This included the $1.9 trillion COVID bill passed in March but does not include either of the two new packages which total $4 trillion or so over the next number of years (nor the estimated revenue associated with them). With that forecast aiming for a cash balance of $750 billion at the Fed, there is still room to draw down that balance, which implies that incremental borrowing is unlikely (until the two packages are passed). In the meantime, the US Treasury sold $40 billion of each of four-week T-bills at 0% interest and eight-week bills at 0.01% in the latest auction and the longer-dated auctions were well bid in April. Mid-May will be the test for the 10-year and 30-year bonds. Finally, we noted that inflation does not seem likely from all this spending in 2021 given the slack in the labor market and weakness in the commercial real estate market, but interest rates would increase as the government needs to borrow more to finance the additional spending plans. For perspective, the US will run, this year, well over a trillion in off-budget deficit spending and even more in regular budget deficit. This would put the country at $40 trillion in debt by 2025 or 180% debt to GDP. Japanification is coming soon at this rate.

Macro: Asia

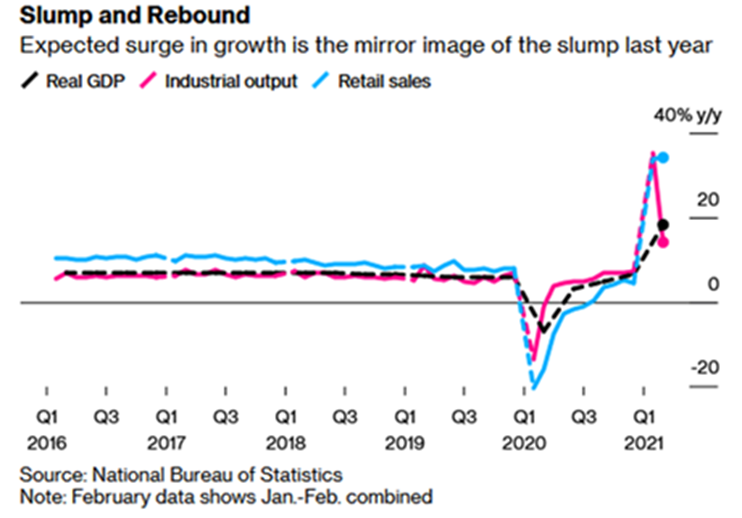

- Chinese March Industrial Output Grew +14.1% year-on-year, slowing from a +35.1 per cent surge in the January-February period and lagging a forecasted +17.2% on-year rise. Looking at the graph to the right, retail sales increased +34.2% year-on-year in March, beating a +28.0% gain expected by analysts and stronger than the +33.8% jump seen in the first

two months of the year. Gross domestic product climbed +18.3% in the first quarter from a year earlier, largely in line with the +18.5% Bloomberg survey, but that huge number comes off the decline from year ago during the pandemic. Headline trade growth picked up last month thanks to favorable base effects. But in seasonally-adjusted terms, exports continued to level off (+30.6% y/y in March to +32.3% last month in US dollar terms) and the rebound in imports stalled. In particular, shipments were held back by a further decline in electronics exports, which appears to reflect supply chain constraints caused by the global shortage of semiconductors. With exports to the US and Europe not growing, some speculated that this may be a seasonal peak, or, with the declining demographics, a secular peak.

two months of the year. Gross domestic product climbed +18.3% in the first quarter from a year earlier, largely in line with the +18.5% Bloomberg survey, but that huge number comes off the decline from year ago during the pandemic. Headline trade growth picked up last month thanks to favorable base effects. But in seasonally-adjusted terms, exports continued to level off (+30.6% y/y in March to +32.3% last month in US dollar terms) and the rebound in imports stalled. In particular, shipments were held back by a further decline in electronics exports, which appears to reflect supply chain constraints caused by the global shortage of semiconductors. With exports to the US and Europe not growing, some speculated that this may be a seasonal peak, or, with the declining demographics, a secular peak.

- Japanese Machine Tool Orders exploded off their pandemic base in March at +65% versus a year earlier and preliminary data showed Japanese industrial production rebounded +2.2% m/m in March, compared to -1.3% m/m drop in February. South Korean Q1 GDP rose by +1.6% q/q and +1.8% y/y, handily beating expectations of +1.1% and +1.2% respectively. Growth was driven by exports and facility investment, which rose +1.9% and +6.6% q/q respectively.

Macro: Europe

- Eurozone GDP Contracted again in Q1 2021, triggering a double-dip recession as quarterly GDP fell -0.6% after the -0.7% fall in Q4 2020. On the other hand, markets looked past this to an economic reopening during the rest of 2021, with Germany, for example, raising their full-year growth forecast by +0.5% to +3.5% (more than making up the decline of -1.7% in Q1). German factory orders in March continued their incremental rise, with growth increasing from +1.4% m/m in February to +3% m/m in March. This is the largest increase in new orders since last October, with both domestic and export orders rising +4.9% and +1.6% respectively. The ECB said last month it was going to accelerate government bond purchases but still total €1.85 trillion ($2.2 trillion) until March 2022 to address rising bond yields in the euro zone. What the markets more eagerly await is the additional €150-200 billion in additional spending at the EU level over each of the next five years, though that pales in comparison to the US.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource