Commodities: Global

OPEC Oil Output ticked higher to 26.7 million barrels per day (mbpd) in February, as Libyan production recovered. OPEC+ agreed to maintain their -2.2 mbpd output cuts through June. The Saudis additionally extended their voluntary cut of -1.0 mbpd through the same date. Russia pledged to hold their crude oil and fuel export cuts by a combined -0.5 mbpd, and damage from Ukrainian attacks on refineries made this a certainty. Global oil demand was expected to grow at a significantly weaker pace this year, while soaring output from the Americas will help boost supply despite output curbs from OPEC and its allies, the International Energy Agency said in their February report. Their forecast for oil-demand growth this year remained unchanged at +1.2 mbpd, down from +2.3 mbpd in 2023 due to slower economic growth. Total demand was expected to average 103 mbpd. “Spare capacity has reached a multi-year high, which will keep overall market sentiment under pressure over the coming months,” the senior analyst at Kpler wrote. The IEA estimates that OPEC’s total spare capacity is 5.1 mbpd. India’s gasoline consumption rose +8.9% year-on-year to 0.9 mbpd, while distillate demand also rose by +6.2% year-on-year to 1.9 mbpd in February. “Diesel demand is almost guaranteed to hit a new record this year (in June), surpassing the 2 mbpd mark for the first time in history”, per Kpler.

US Oil Production moved back higher to the record set last month to 13.3 mbpd as operating oil rigs increased from 499 as of February 2nd to 500 as of March 1st. US oil output from top shale-producing regions will rise in March to its highest in four months, the Energy Information Administration said, with production from the top basins rising to 9.7 mbpd, the highest since December. US February oil exports were expected to hit a record 4.8 mbpd. Per AAA, US average regular unleaded gasoline prices continued higher to $3.33 (+18¢) as of the end of the month. California prices increased 11¢ to $4.40 per gallon for regular unleaded.

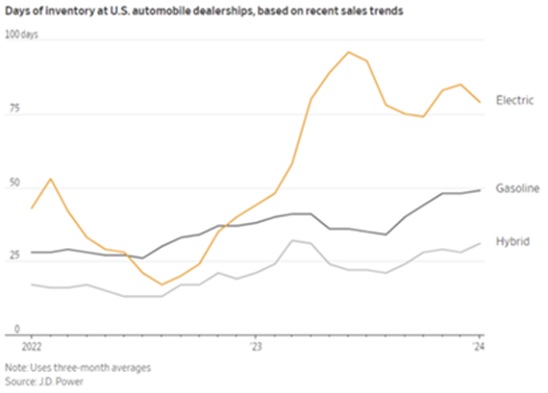

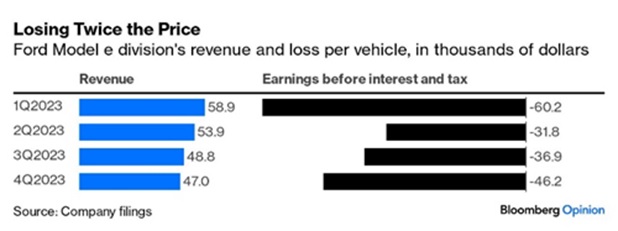

March 1st. US oil output from top shale-producing regions will rise in March to its highest in four months, the Energy Information Administration said, with production from the top basins rising to 9.7 mbpd, the highest since December. US February oil exports were expected to hit a record 4.8 mbpd. Per AAA, US average regular unleaded gasoline prices continued higher to $3.33 (+18¢) as of the end of the month. California prices increased 11¢ to $4.40 per gallon for regular unleaded.  In electric vehicle news, days of inventory of EVs on dealers’ lots (an indicator of lower demand / overproduction) moved much higher in 2023 (see graph right) causing production cutbacks and losses (see graphic below showing declining revenue and same/ higher loss per vehicle at Ford’s EV division). Moreover, EV sales as a percent of all sales fell from over 9% to about 7.5% in January. Another data point is that the price of a used Tesla fell from the high of $67,900 in late 2022 to $32,880 in January per CarGurus. While cheaper Chinese EVs have not come into the US (yet), the consumer saturation point appears to be approaching rapidly.

In electric vehicle news, days of inventory of EVs on dealers’ lots (an indicator of lower demand / overproduction) moved much higher in 2023 (see graph right) causing production cutbacks and losses (see graphic below showing declining revenue and same/ higher loss per vehicle at Ford’s EV division). Moreover, EV sales as a percent of all sales fell from over 9% to about 7.5% in January. Another data point is that the price of a used Tesla fell from the high of $67,900 in late 2022 to $32,880 in January per CarGurus. While cheaper Chinese EVs have not come into the US (yet), the consumer saturation point appears to be approaching rapidly.

China’s Crude Oil Imports rose +5.1% in the first two months of 2024 from a year earlier, as refiners ramped up purchases to meet fuel sales during the Lunar New Year holiday. Imports during January and February amounted to 10.7 mbpd. China’s unwrought copper imports rose +2.6% in the first two months of 2024, as domestic demand improved from the previous year when pandemic restrictions had just been lifted. Finally, China’s coal imports in the first two months of 2024 rose +23% from the corresponding period a year earlier, rising to the highest level for the period, totaling 74.5 million metric tons (mmt), up from 60.63 mmt in the first two months of 2023. Still consuming!

Brazil’s Association of Grain Traders Decreased their soybean production estimate to 153.8 mmt, down from the 156.1 mmt it forecast in February and the 159 mmt produced in 2023. These are still record levels. Brazil’s largest farm cooperative entered 2024 with grain stocks over 50% higher than in 2023 driven by a bumper crop last season and sluggish farmer selling. Plentiful rains in Argentina’s main growing regions provided much-needed relief to the country’s soy and corn crops, bringing some estimates up to 52 million metric tons of soy and a record 59 million tons of corn for the season. Cocoa output in top grower Ivory Coast, which has been beset by unfavorable weather, was expected to slump more than -20% this season to 1.75 million tons, the worst season in eight years. Last season’s output was 2.23 mmt.

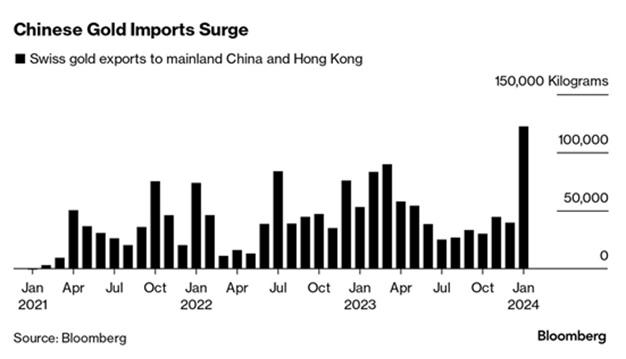

Swiss exports to China – a proxy of Chinese demand for gold – nearly tripled in January as consumers sought a hedge against turmoil in the country’s stock market and property sector. Chinese buying may be partially behind bullion’s jump to an all-time high to over $2100 as their central bank bought 390,000 troy ounces or another +0.5% to their holdings last month.

demand for gold – nearly tripled in January as consumers sought a hedge against turmoil in the country’s stock market and property sector. Chinese buying may be partially behind bullion’s jump to an all-time high to over $2100 as their central bank bought 390,000 troy ounces or another +0.5% to their holdings last month.

In unusual news, Russia put the Estonian prime minister on its most-wanted list – no charges were cited though Russian law enforcement had been investigating Estonian removal of Soviet-era war monuments. Given that Russia/Soviet Union had to crush a rebellion in Estonia after WWII, one can understand how Estonians would view the USSR as not liberating them from Nazi Germany.

Years of rising prices have made everyday food and drink items a lucrative target for criminals. Late last year, a van delivering 10,000 Krispy Kreme donuts was stolen in southeast Australia. Around the same time, criminals snatched 200 hams thousands of miles away in Spain. Thefts of foods and beverages accounted for more than 20% of all incidents globally last year, according to a supply chain intelligence company, up from 17% a year earlier and 14% in 2021. Hold onto that apple fritter!

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource