Commodities: Global

OPEC Oil Production Rose in March by about 0.2 million barrels per day (mbpd) to 29.1 mbpd. The real news was announced over the first weekend in April as OPEC+ lowered the quotas by 1.6 mbpd assuming Russia adds its reduction portion to its existing 0.5 mbpd cut announced last month. Note that the actual production decline is estimated to be only 0.7 mbpd as a number of members are already producing below their quotas (e.g., Iraq and Kazakhstan). Russia’s Deputy Prime Minister Alexander Novak has said that Moscow was already close to reaching the first target cut of 0.5 mbpd, which would put production to about 9.5 mbpd. Russian oil exports were lower slightly in March but diesel exports were expected to hit the highest levels since 2016. Iranian oil exports to China rose to almost 1.2 mbpd in February, the second-highest pace since the start of 2017, according to oil consultant Kpler. Iranian oil for May arrival is being sold at about $12-a-barrel discount to ICE Brent on a delivered basis, while Russia’s Urals is being offered at no more than $10 below the same benchmark. Saudi Aramco’s Jizan refinery is set to increase output of ultra-low sulphur diesel (ULSD) as it ramps up production in the second quarter – this output would be bound for Europe. Brazil, Latin America’s largest producer, is slated to add about 300,000 bpd this year as five new platforms arrive to drill the country’s prolific offshore fields. Production is set to hit a record 3.4 mbpd this year and was projected to keep rising for a few years and reach 4.6 mbpd in 2030.

US Oil Production Increased slightly to 12.2 mbpd as companies reduced operating oil rigs from 600 as of February 24th to 592 as of March 31st. Per AAA, US average regular gasoline prices jumped, hitting $3.50 per gallon on March 31st, 14¢ higher than last month. Vehicle travel started the year +5.6% higher than last year, leading to a drop in gasoline stockpiles to their lowest for this time of the year since 2015. The Biden administration sold an additional 26 million barrels of crude oil from the Strategic Petroleum Reserve, with deliveries between April and June to comply with a law passed in 2015. This will put the SPR at 345 million barrels, half of its high of 727 million barrels reached in 2009. Note that the Biden administration auctioned off oil-drilling rights in the Gulf of Mexico, in addition to approving an Arctic exploration project (though also closed leasing in Arctic and Alaska areas). The 73 million acre GOM offering was one of the nation’s largest ever. Finally (or perhaps partially because of these decisions), the US’ EIA saw supply outstripping demand by around 530,000 barrels a day in 2024 – perhaps hoping for an election surprise?

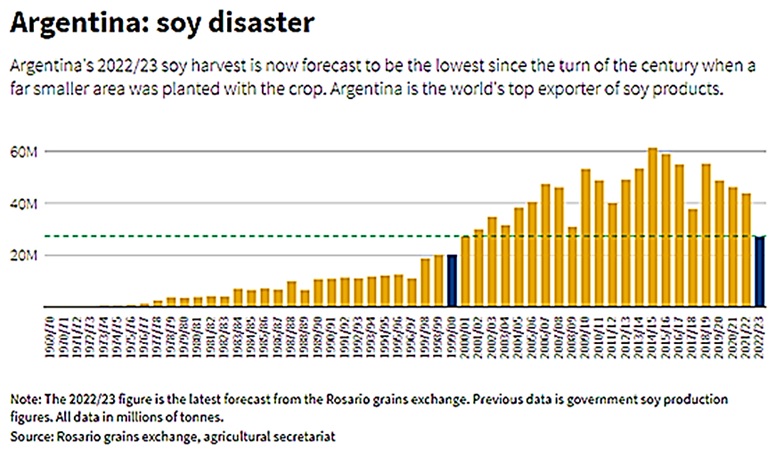

The Buenos Aires Grain Exchange Slashed its soy forecast by another -14% to 25 million metric tons, which would be the smallest harvest since it began keeping records in 2001. The figure is also the lowest yet among other top prognosticators as yields tumbled to half the levels from a few years ago. The output history is just amazing to behold (see graph below). In Brazil, the corn crop looks to be the best ever, reaching 125 million metric tonnes, almost +10% higher than last year. Ukraine’s Agriculture Ministry saw the 2023 grain harvest falling by -17% y/y to 44.3m tons, as farmers reduced areas under crops and with average yields lower. On the demand side, China is battling a resurgence of African swine fever, the deadly disease that’s previously wiped out almost half of its hogs, potentially pushing up prices and prompting imports from the US and other

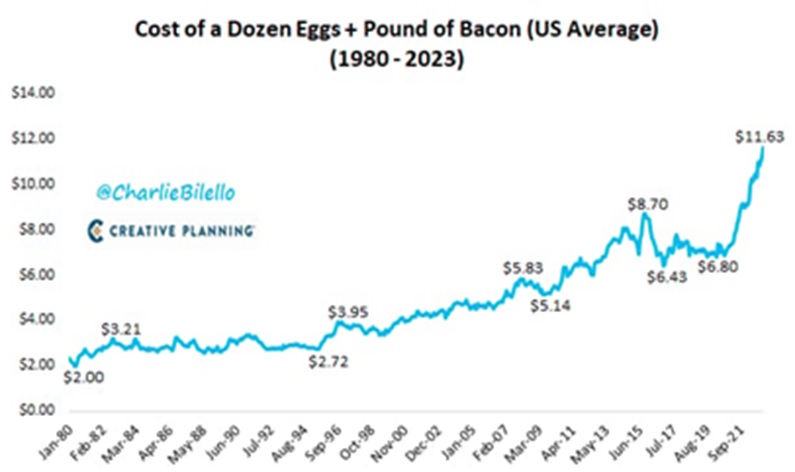

among other top prognosticators as yields tumbled to half the levels from a few years ago. The output history is just amazing to behold (see graph below). In Brazil, the corn crop looks to be the best ever, reaching 125 million metric tonnes, almost +10% higher than last year. Ukraine’s Agriculture Ministry saw the 2023 grain harvest falling by -17% y/y to 44.3m tons, as farmers reduced areas under crops and with average yields lower. On the demand side, China is battling a resurgence of African swine fever, the deadly disease that’s previously wiped out almost half of its hogs, potentially pushing up prices and prompting imports from the US and other  countries. Analysts considered that the outbreak was pretty severe in January and February, especially in the northern producing regions, and affected 10% of the nationwide sow herd. For those of you wanting relief from high egg and meat prices, wait longer as the cost of a dozen eggs and pound of bacon reached the highest level by far in 2023 (see right). Finally, sugar prices extended gains to a fresh six-year high in New York as prospects for limited Indian exports added to worries about tight global supplies. Cocoa and coffee prices also have rallied though not quite to the same extreme levels.

countries. Analysts considered that the outbreak was pretty severe in January and February, especially in the northern producing regions, and affected 10% of the nationwide sow herd. For those of you wanting relief from high egg and meat prices, wait longer as the cost of a dozen eggs and pound of bacon reached the highest level by far in 2023 (see right). Finally, sugar prices extended gains to a fresh six-year high in New York as prospects for limited Indian exports added to worries about tight global supplies. Cocoa and coffee prices also have rallied though not quite to the same extreme levels.

We leave with some conclusions from the Manhattan Institute’s research into moving towards an electric infrastructure:

It costs at least $30 to store the energy equivalent of one barrel of oil using lithium batteries, which explains why batteries cannot compensate for the unreliable nature of wind and solar power even for days, let alone weeks.

It costs at least $30 to store the energy equivalent of one barrel of oil using lithium batteries, which explains why batteries cannot compensate for the unreliable nature of wind and solar power even for days, let alone weeks.

The time cost alone of recharging an electric vehicle makes such vehicles uncompetitive, even apart from the costs of the batteries and other problems.

International Energy Agency estimates that only a partial energy transition would require increases in the supplies of lithium, graphite, nickel, and rare earths by 4,200%, 2,500%, 1,900%, and 700%, respectively, by 2040.

https://www.manhattan-institute.org/the-energy-transition-delusion

Is it possible to transition away from fossil fuels? Certainly. Is the cost worth it? Depends on who you ask.

“What we anticipate seldom occurs: but what we least expect generally happens” – Benjamin Disraeli

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource