Odd Thing Happened

- on the way to an oil crisis… nobody came! Events a few years ago that would have sent the markets soaring or collapsing are absorbed and taken in stride. A proto-shooting war between a superpower and regional belligerent that included oil tanker sabotage and seizures, heightened sanctions, a $150-million drone shot down and a rumored cyberattack on missile systems have basically been blips on the screen. Cuts from OPEC and Russia, the two largest oil producers collectively extended another nine months into 2020 caused only a short-term bounce. Oil pipeline contamination by Russia into one of its two largest client networks – a yawn. How about an explosion and fire permanently disabling a major US east-coast refinery as it sank into bankruptcy? Superpower trade war? Keep trying. The only reasonable takeaway is that the world is trapped in a complacent status quo of slow growth despite (or because of?) the best efforts of governments and central banks.

OPEC Oil Production

- maintained its May level at about 30.2 million barrels per day (mbpd), reaching cuts of 1.2 mbpd or about 300,000 bpd lower than their target of 812,000 bpd. This is the lowest level since 2015. Oil prices did bounce in June, but basically from $53 per barrel to $57, so OPEC+ confirmed their production restraint by extending cuts by nine months into March 2020. Part of this move is justified by their reduced global oil demand increase expectations, which is now more or less in line with other prominent agencies (see right).

Saudi production stayed low in May to 9.7 mbpd, which is more than 900,000 bpd below the cut baseline and three times as much as their target of 322,000 bpd. British Petroleum raised estimates for Saudi Arabia’s crude oil reserves by 12%, marking the first major change to the country’s estimated reserves since 1989. Saudi Aramco resurrected its IPO plans; we shall see how long this time it drags out. Russian oil production rose to 11.15 mbpd in June from 11.11 mbpd it produced in May (Reuters). Russian pipeline monopoly Transneft said it had fully resumed European oil supplies via the Druzhba pipeline following a major oil contamination earlier this year but stories of new pollution surfaced in early July. Damages paid by Russia are expected in $100s of millions as the corrosive liquids can severely damage refinery equipment and pipelines. For example, Russia is to pay Kazakhstan alone compensation of $15 per barrel for a total sum of $76 million. Venezuela’s oil exports recovered in June from a sharp drop the month before, helped by increased deliveries to address shortfalls in paying off debts to China. China is also buying from Iran despite US sanctions (reportedly via Malaysia) as well as from the US directly despite the trade war (US crude oil has no Chinese tariff). Meanwhile, Iran is in the process of breaching their uranium limits set in the nuclear accord, setting up more tension. Finally, crude oil and condensate in long-term floating storage hit its highest in May since August 2017 at 24 million barrels, as US sanctions against Venezuela and Iran hindered the export ability of these OPEC members. Floating storage rose 15 million barrels in May versus average levels of May 2018, and June levels have already reached 26 million barrels. Finally, fighting continued in Libya.

Saudi production stayed low in May to 9.7 mbpd, which is more than 900,000 bpd below the cut baseline and three times as much as their target of 322,000 bpd. British Petroleum raised estimates for Saudi Arabia’s crude oil reserves by 12%, marking the first major change to the country’s estimated reserves since 1989. Saudi Aramco resurrected its IPO plans; we shall see how long this time it drags out. Russian oil production rose to 11.15 mbpd in June from 11.11 mbpd it produced in May (Reuters). Russian pipeline monopoly Transneft said it had fully resumed European oil supplies via the Druzhba pipeline following a major oil contamination earlier this year but stories of new pollution surfaced in early July. Damages paid by Russia are expected in $100s of millions as the corrosive liquids can severely damage refinery equipment and pipelines. For example, Russia is to pay Kazakhstan alone compensation of $15 per barrel for a total sum of $76 million. Venezuela’s oil exports recovered in June from a sharp drop the month before, helped by increased deliveries to address shortfalls in paying off debts to China. China is also buying from Iran despite US sanctions (reportedly via Malaysia) as well as from the US directly despite the trade war (US crude oil has no Chinese tariff). Meanwhile, Iran is in the process of breaching their uranium limits set in the nuclear accord, setting up more tension. Finally, crude oil and condensate in long-term floating storage hit its highest in May since August 2017 at 24 million barrels, as US sanctions against Venezuela and Iran hindered the export ability of these OPEC members. Floating storage rose 15 million barrels in May versus average levels of May 2018, and June levels have already reached 26 million barrels. Finally, fighting continued in Libya.

US Crude Oil

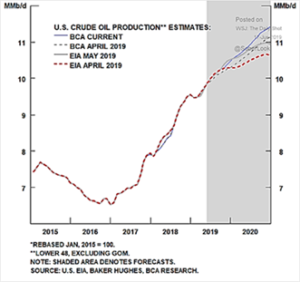

- weekly numbers indicated decreased production to 12.2 mbpd of crude oil, as drilling rigs in operation fell from 800 of May 31st to 793 on June 28th. US crude oil production was revised to rise 1.36 million barrels per day to 12.32 million bpd for 2019, 140,000 bpd less than previously forecast, according to the latest monthly Energy Department report.

In 2020, US crude production is expected to rise 94,000 bpd, 1,000 bpd more than previously forecast. Note that other forecasts are even higher (see graph to right from BCA Research).

In 2020, US crude production is expected to rise 94,000 bpd, 1,000 bpd more than previously forecast. Note that other forecasts are even higher (see graph to right from BCA Research).

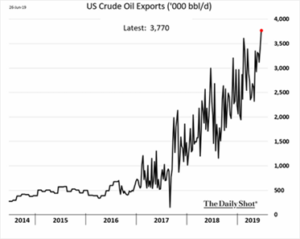

- US oil output from the seven major shale formations was expected to rise by about 70,000 barrels per day (bpd) in July to a record 8.52 million bpd per the US government. The largest change is forecast in the Permian Basin of Texas and New Mexico, where output is expected to climb by 55,000 bpd to a fresh peak at 4.23 million bpd in July. US crude exports (below) hit an all-time high of 3.8 mbpd in the week ended June 21, breaking the previous record high of 3.7 mbpd set during the week ended on February 15 (see below). Sufficient pipes to service an additional 1 mbpd in exports are coming on line this year and into 2020.

Royal Bank of Canada forecasted that 21 oil tankers, were loaded in June along the US Gulf Coast, well above the 2019 monthly average of 13 ships and the record of 17 reached in March. North Dakota crude oil production was flat in April, just below a record set earlier this year, state regulators said, but natural gas production again set an all-time record. Philadelphia Energy Solutions indicated that it will permanently shut its oil refinery after a massive fire caused substantial damage to the complex. Shutting the refinery, the largest and oldest on the U.S. East Coast, will cost hundreds of jobs and squeeze gasoline supplies in the busiest, most densely populated corridor of the United States. Exports from Europe, common already during the summer, leapt in response as well as the shipment of refined products from US refineries on the Gulf of Mexico.

Royal Bank of Canada forecasted that 21 oil tankers, were loaded in June along the US Gulf Coast, well above the 2019 monthly average of 13 ships and the record of 17 reached in March. North Dakota crude oil production was flat in April, just below a record set earlier this year, state regulators said, but natural gas production again set an all-time record. Philadelphia Energy Solutions indicated that it will permanently shut its oil refinery after a massive fire caused substantial damage to the complex. Shutting the refinery, the largest and oldest on the U.S. East Coast, will cost hundreds of jobs and squeeze gasoline supplies in the busiest, most densely populated corridor of the United States. Exports from Europe, common already during the summer, leapt in response as well as the shipment of refined products from US refineries on the Gulf of Mexico.

In Other North American Oil News

- Canada’s cabinet approved TransMountain’s expansion project over environmental group opposition. Federal officials said construction of the $7.4 billion pipeline is likely to resume in 2019 despite expected legal challenges. Mexican state oil firm Pemex produced an average of 1.68 mbpd of crude oil in June, slightly above the 1.66 mbpd registered in May. President Obrador wanted to increase production to 2.4 mbpd by 2024, a challenge given the slump in Mexican production since 2006 when production peaked at 3.5 mbpd.

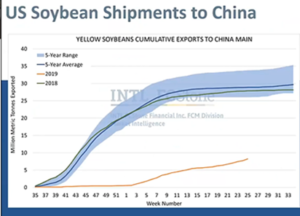

US Grain Planting

- made further progress hitting closer to full planting on smaller acreage – though the USDA indicated that the decline in area was much smaller than what traders have beenexpecting – a bearish surprise. Soy planting basically finished but on -4.7% fewer acres than previously estimated. Cool/wet weather played its part though some expected an acreage shift from corn. The next update comes in mid-July. Of course, demand for soy is much less from recent destination China due to the trade conflict, drastically lower Chinese hog herd and increasing South American production (see graph right from FC Stone). Interestingly, a private importer in China bought US rice for the first time ever despite the trade war, buying two containers (40 tonnes) of medium-grain rice from California’s Sun Valley Rice.

Overseas

- Germany was on course for a larger winter wheat crop in 2019 after drought caused massive harvest damage last year. Germany will harvest about 24.1 million tonnes, up from 19.6 million tonnes. Ukrainian wheat production could jump by +17% to 28.8 million tonnes this year, with favorable growing weather expected to result in record yields. This forecast would be almost 12% above the average five-year production level. Argentine farmers were expected to plant 6.6 million hectares (16.3 million acres) of wheat in the 2019-20 season, citing good rains and high prices as reasons for increasing the previous forecast of 6.4 million hectares. Australia (the world’s fourth-largest wheat exporter) lowered its forecast of the grain’s production by nearly -18% from drought. Brazilian farmers will export a record 38 million tonnes of corn this year, as their crop becomes more competitive thanks to a record harvest and historic U.S. planting delays, which is an increase from 31 million tonnes. China’s May soybean imports from top supplier Brazil fell -31% from the same month last year (6.3 versus 9.1 million tonnes) as African swine fever reduced the nation’s pig herds. China’s pork imports surged nearly +63% in May from the same month last year as the world’s top consumer of the meat stocked up on supplies ahead of an anticipated shortage. May imports came in at 187,459 tonnes, the largest volume since 192,348 tonnes in August 2016. Thailand banned pig imports from Laos for 90 days after its neighbor confirmed the first outbreak of deadly African swine fever, following a similar ban by China.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource