Americas

- While US Economic Data showed slowing but positive Q2 growth at a projected +1.5% annualized. Payrolls surprised to the upside at +224,000 versus the +160,000 projected by the economist survey. Official unemployment was rounded up to the very low 3.7% and underemployment also ticked up (from 7.1% to 7.2%). Year-on-year wage growth held at a

generally strong +3.1% for the last twelve months with rank-and-file workers up +3.4% (see right). The participation rate moved up to 62.9%. The bond market swiftly reacted, eliminating bets that there will be a -0.50% drop at the end-of-July Fed meeting for a 100% perceived chance of -0.25%. Jobless claims for unemployment benefits remained at the lowest level in eight years. US retail sales shot higher by +0.5% in May and April’s decline was revised upward to +0.3%, also a sign of decent economic activity. Consumer credit (credit cards, school and car loans, etc.) moved up well in May, maintaining the pace from April (+5% year-on-year in May versus +5.2% for April). US existing home sales perked up finally on the low mortgage rates to +0.9% year-on-year. Industrial activity was positive in May, with industrial production up +0.4% as well as factory goods orders and durable goods orders (without military and aircraft) both rose (+0.5% and +0.4%, respectively).

generally strong +3.1% for the last twelve months with rank-and-file workers up +3.4% (see right). The participation rate moved up to 62.9%. The bond market swiftly reacted, eliminating bets that there will be a -0.50% drop at the end-of-July Fed meeting for a 100% perceived chance of -0.25%. Jobless claims for unemployment benefits remained at the lowest level in eight years. US retail sales shot higher by +0.5% in May and April’s decline was revised upward to +0.3%, also a sign of decent economic activity. Consumer credit (credit cards, school and car loans, etc.) moved up well in May, maintaining the pace from April (+5% year-on-year in May versus +5.2% for April). US existing home sales perked up finally on the low mortgage rates to +0.9% year-on-year. Industrial activity was positive in May, with industrial production up +0.4% as well as factory goods orders and durable goods orders (without military and aircraft) both rose (+0.5% and +0.4%, respectively).

- The Federal Reserve Looks Ready to lower interest rates at its upcoming July 30th-31st meeting after dropping the “patient” language from its official communique at its mid-June gathering. The stock market reached new highs with bonds also bullish. However, given the above economic data, more voices raised caution as one could argue that there is no need to stimulate the economy. Our view agrees with this assessment – the only supposedly-legitimate rationale is that other countries have been / will be lowering their rates and the dollar may become too strong as the US attracts financial flows. That

argument seems self-serving given that those that make it are often (levered?) long financial assets that are supported by the already-low rates. Lurking in the background is the lack of a budget deal for the new fiscal year starting in October and that the borrowing capacity under the debt limit will have run out by then. Do not be surprised to see some nasty partisan politics over this issue, particularly as the election approaches. China has been decreasing their holdings of US Treasury bonds which should increase rates but the changes have been measured and modest. Perhaps they do not want to rock the boat during the ongoing trade negotiations.

argument seems self-serving given that those that make it are often (levered?) long financial assets that are supported by the already-low rates. Lurking in the background is the lack of a budget deal for the new fiscal year starting in October and that the borrowing capacity under the debt limit will have run out by then. Do not be surprised to see some nasty partisan politics over this issue, particularly as the election approaches. China has been decreasing their holdings of US Treasury bonds which should increase rates but the changes have been measured and modest. Perhaps they do not want to rock the boat during the ongoing trade negotiations.

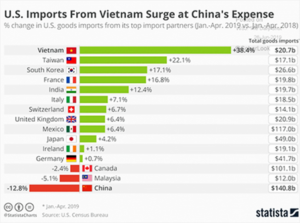

- US-China Trade Negotiations sputtered to a restart after the G20 meeting in early July with a small win-win agreement for the US to allow limited businesses with blacklisted Hauwei in exchange for Chinese buying large amounts of US agricultural goods. I would describe the practical effect of this thaw as minimal. Meanwhile, it is interesting to see some evidence of China substitution by other countries, led by Vietnam, Taiwan, and South Korea (see graph left). Vietnam in particular shows evidence of trans-shipping goods from China to the United States – adding costs but presumably less cost than by tariffs. For example, per WSJ data, Vietnam’s imports of computers and electronics from China are up +81% year-on-year and that category of products exported to the US is correspondingly up +72%. Meanwhile, the US decided to remove India’s preferential import status on $6 billion of goods (of a total of $142 billion of bilateral trade in 2018), causing the country to raise its tariffs on 20 products. Given the value of the affected merchandise, this may cause some tension but is not economically impactful.

Asia

- China Continued to Stimulate the Economy as industrial production growth fall to +5.0% year-on-year in May, the lowest since 2002 and missing analysts’ expectations of 5.5% and

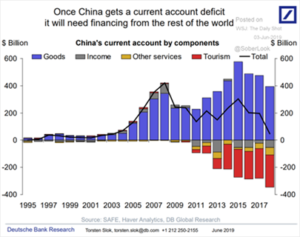

well below April’s 5.4%. Likewise, growth in fixed asset investment rolled over to +5.6% – the second lowest in 20 years. Retail sales grew by +8.1%, in line with expectations but also showing lower gains. Total debt-to-GDP continued to stay high at 275%. More interesting is the foreign currency generation machine that everyone knows showed signs of sputtering as the country’s high goods surplus is almost offset by outflows on tourism, services and investment income (see graph to the left from Deutsche Bank). Assuming it flips negative, then that will be a draw on the country’s financial assets, potentially accelerating their decline in US Treasury investments.

well below April’s 5.4%. Likewise, growth in fixed asset investment rolled over to +5.6% – the second lowest in 20 years. Retail sales grew by +8.1%, in line with expectations but also showing lower gains. Total debt-to-GDP continued to stay high at 275%. More interesting is the foreign currency generation machine that everyone knows showed signs of sputtering as the country’s high goods surplus is almost offset by outflows on tourism, services and investment income (see graph to the left from Deutsche Bank). Assuming it flips negative, then that will be a draw on the country’s financial assets, potentially accelerating their decline in US Treasury investments.

- May car sales fell -12.5% versus a year ago, hitting local brands disproportionately (-26.5% year-on-year). In response, Beijing pushed auto-finance companies, primarily arms of domestic carmakers, to start extending interest-free loans along with other perks to lure buyers. Early signs showed delinquencies already rising, albeit from very low levels. Sound similar to sub-prime auto lending here in the US? Smartphone unit sales are down -20% over the last twelve months to May per South Bay Research, collapsing to 2013 levels. They also noted that silicon wafer production has fallen for the first time in four years, signaling the start of the more typical historical boom-and-bust cycle. Finally, as the Chinese economy continues to underperform, Premier Li Keqiang announced plans for lower bank reserve requirements (in other words, more bank leverage) – will that end well?

- Other Asian Countries are trying to get through this slowdown, with Australia lowering interest rates again and leaving the door open for additional easing. Like everyone else, policy makers were attempting to support a slowing economy and try to rekindle dormant inflation – Reserve Bank Governor Philip Lowe lowered the key rate by a quarter-point to 1 per cent as expected.

Europe

- Unemployment May Be Falling close to the lows seen in 2008 (pre-crash) at 7.5% but still the global growth slowdown is showing in the bellwether German industrial orders, which

declined far more than expected in May (-2.2% versus estimated -0.2%). Their Economy Ministry warned that this sector of Europe’s largest economy was likely to remain weak in the coming months with drops in demand by export orders and investment goods. Industrial production (seen right) also slipped lower than expected, taking the Eurozone as a whole lower. Wage growth for the Eurozone, on the other hand, accelerated to +2.5% annualized in Q1, well above inflation of 1.2%. ECB head Mario Draghi again promised to ease financial conditions, causing Reuters to call his comments “unexpectedly dovish.” As he is leaving soon, the next central banker is under consideration and IMF head Lagarde is the expected winner. Bond investors believe that she will continue the easy money conditions, piling on negative-yielding fixed income assets to higher quantities. It was no help for Deutsche Bank, which finally faced up to reality and started cutting assets and employees in its worst-performing divisions, ten years on from the financial crisis. 18,000 jobs (totaling 20% of its workforce) and $80 billion in risk assets ($320 billion in notional value) were to be cut, hitting earnings by a cumulative $8 billion. A big mess, now a little smaller. BASF, the chemical giant, announced a reduction of 6,000 jobs worldwide (about 5% of payroll), with half coming in Germany. In the UK, Boris Johnson is expected to be the next Prime Minister in the late July vote – a “hard Brexit” is definitely on the table and perhaps that is the best thing at this stage. Rip off the bandage and move on – certainly the EU has made the negotiations with May as difficult as they could be.

declined far more than expected in May (-2.2% versus estimated -0.2%). Their Economy Ministry warned that this sector of Europe’s largest economy was likely to remain weak in the coming months with drops in demand by export orders and investment goods. Industrial production (seen right) also slipped lower than expected, taking the Eurozone as a whole lower. Wage growth for the Eurozone, on the other hand, accelerated to +2.5% annualized in Q1, well above inflation of 1.2%. ECB head Mario Draghi again promised to ease financial conditions, causing Reuters to call his comments “unexpectedly dovish.” As he is leaving soon, the next central banker is under consideration and IMF head Lagarde is the expected winner. Bond investors believe that she will continue the easy money conditions, piling on negative-yielding fixed income assets to higher quantities. It was no help for Deutsche Bank, which finally faced up to reality and started cutting assets and employees in its worst-performing divisions, ten years on from the financial crisis. 18,000 jobs (totaling 20% of its workforce) and $80 billion in risk assets ($320 billion in notional value) were to be cut, hitting earnings by a cumulative $8 billion. A big mess, now a little smaller. BASF, the chemical giant, announced a reduction of 6,000 jobs worldwide (about 5% of payroll), with half coming in Germany. In the UK, Boris Johnson is expected to be the next Prime Minister in the late July vote – a “hard Brexit” is definitely on the table and perhaps that is the best thing at this stage. Rip off the bandage and move on – certainly the EU has made the negotiations with May as difficult as they could be.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource