Ukraine: Summer Offensive?

The Ukraine-Russia Conflict continued with its on-the-ground stalemate with the Ukrainian military making little progress despite the infusion of US/EU equipment. By necessity to avoid higher casualty rates, the attack tempo slowed – recall that Ukraine has one-third the population of Russia and its soldiers (and citizens) have continually punch above their weight. Not that Russia is doing particularly well – it needed to increase the upper limit of its conscription age from 27 to 30, adding an additional 2.4 million to the draft pool. In addition, Putin signed a law raising the age from 60 to 65 at which senior reserve officers can be sent to fight. A lot more killing before peace.

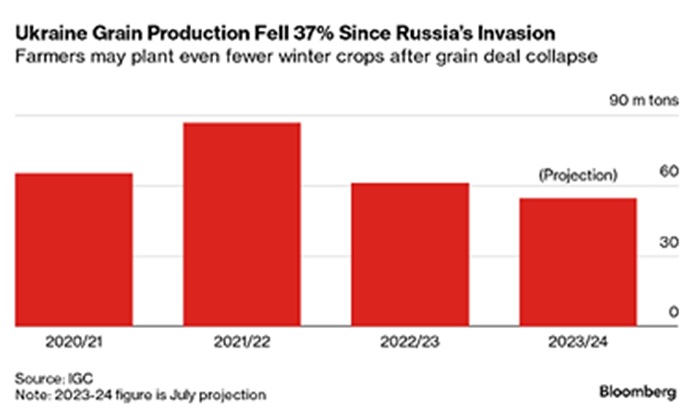

Russia Ending the UN Grain Export Deal was the more important strategic news, which resulted in a series of attacks on Ukrainian ports and grain silos on the Black Sea and Danube River. Russia announced that grain ships were now valid military targets. With harvest underway, the question now becomes a question of storage and logistics. There was limited capacity into Romania and into the Baltic Sea via Poland (with additional cost). Soon the question will be winter planting. So far, the exact acreage impact on wheat, barley and rapeseed was unclear as rains delayed harvest. August and September are the key period for Ukraine’s winter-crop plantings. Russia has two motivations – one the obvious to hobble the Ukrainian economy any way it can, but also Russia was enjoying a bumper crop that it can use to capture Ukrainian markets. Ukraine responded by attacking Russia’s oil export infrastructure, using a drone strike to damage a Russian naval vessel outside the port of Novorossiysk and an oil tanker in a second attack. Novorossiysk is Russia’s main Black Sea oil port, exporting about 0.6 million barrels per day (mbpd). It is also the main export point for oil from Kazakhstan, with its 1.2 mbpd pipeline terminating there, which is not limited by sanctions.

on Ukrainian ports and grain silos on the Black Sea and Danube River. Russia announced that grain ships were now valid military targets. With harvest underway, the question now becomes a question of storage and logistics. There was limited capacity into Romania and into the Baltic Sea via Poland (with additional cost). Soon the question will be winter planting. So far, the exact acreage impact on wheat, barley and rapeseed was unclear as rains delayed harvest. August and September are the key period for Ukraine’s winter-crop plantings. Russia has two motivations – one the obvious to hobble the Ukrainian economy any way it can, but also Russia was enjoying a bumper crop that it can use to capture Ukrainian markets. Ukraine responded by attacking Russia’s oil export infrastructure, using a drone strike to damage a Russian naval vessel outside the port of Novorossiysk and an oil tanker in a second attack. Novorossiysk is Russia’s main Black Sea oil port, exporting about 0.6 million barrels per day (mbpd). It is also the main export point for oil from Kazakhstan, with its 1.2 mbpd pipeline terminating there, which is not limited by sanctions.

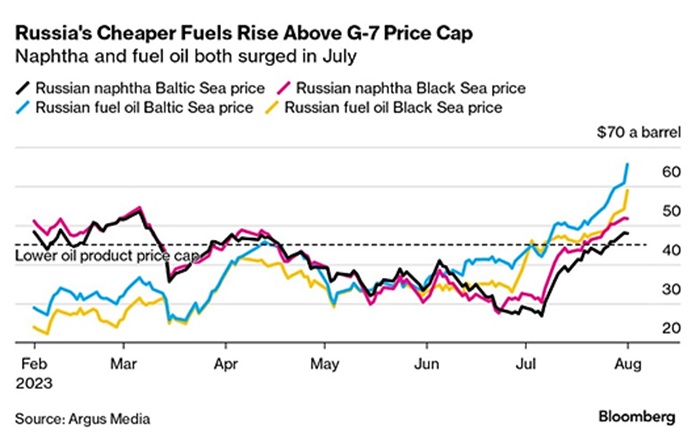

Russia’s Energy Prices have increased in line with the global markets, even breaking though the EU/US “price caps.” Since February, there have been two caps on the sale of Russian refined fuels, one for higher value products at $100 a barrel and another for lower ones at $45. Argus Media said naphtha and fuel oil are trading above the lower cap, while diesel is trading above the higher one. While products at Russia’s western ports have not yet breached the cap, gasoil and gasoline are both approaching that ceiling. What will the consequences be, if any?

Since February, there have been two caps on the sale of Russian refined fuels, one for higher value products at $100 a barrel and another for lower ones at $45. Argus Media said naphtha and fuel oil are trading above the lower cap, while diesel is trading above the higher one. While products at Russia’s western ports have not yet breached the cap, gasoil and gasoline are both approaching that ceiling. What will the consequences be, if any?

Macro: Asia

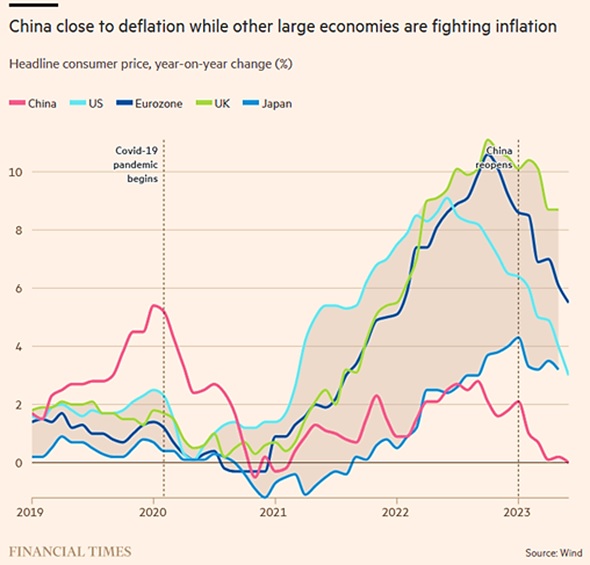

China’s Exports fell the most in three years in June, slumping a worse-than-expected -12.4% year on year as signs of stress mount from the struggling global economy and Chinese policymakers faced growing pressure for stimulus measures. Imports also fell  more than expected, down -6.8% over the same period. A Reuters poll of economists forecasted exports to shrink -9.5% and imports to have fallen -4.0%. However, crude oil imports in June rose by +45.3% year on year, a pace of 12.7 mbpd. Reportedly the oil was going into inventory as domestic demand remained sluggish. China’s headline real GDP increased +6.3% year-on-year in Q2, missing expectations for a +7.3% uplift. Fixed asset investment growth year-to-date decelerated further to +3.8% from +4.0% in May. Industrial production was relatively positive, up +4.4% year-on-year (versus +3.5% in May and +2.7% consensus), while retail sales increased +3.1% year-on-year (versus +12.7% in May) and downward revisions were made to the historical series. Unlike other large economies, China battled deflation – in July revealing that consumer prices were flat over the last twelve months through June (see comparison graph to the left). Weakness in China’s property sector recovery remained a significant part of the situation, with home sales by value down -33% year-on-year in July. The drop was the second in a row, after four months

more than expected, down -6.8% over the same period. A Reuters poll of economists forecasted exports to shrink -9.5% and imports to have fallen -4.0%. However, crude oil imports in June rose by +45.3% year on year, a pace of 12.7 mbpd. Reportedly the oil was going into inventory as domestic demand remained sluggish. China’s headline real GDP increased +6.3% year-on-year in Q2, missing expectations for a +7.3% uplift. Fixed asset investment growth year-to-date decelerated further to +3.8% from +4.0% in May. Industrial production was relatively positive, up +4.4% year-on-year (versus +3.5% in May and +2.7% consensus), while retail sales increased +3.1% year-on-year (versus +12.7% in May) and downward revisions were made to the historical series. Unlike other large economies, China battled deflation – in July revealing that consumer prices were flat over the last twelve months through June (see comparison graph to the left). Weakness in China’s property sector recovery remained a significant part of the situation, with home sales by value down -33% year-on-year in July. The drop was the second in a row, after four months of gains. In specific property developer news, defaulted developer Shimao Group Holdings failed to find a buyer for a $1.8 billion project at a forced auction, even at a 20% discount to its appraised value. Sino-Ocean Group Holding Ltd. saw its yuan bonds tumble as much as 35% on news that the state-backed builder told some creditors it’s been negotiating with two major shareholders on its debt load. Finally, China’s vaunted cheap labor versus the US was no more, as research house TS Lombard estimated that labor costs for China caught up to the US ten years ago and the two have been moving in lockstep since (US the black line, China the blue).

of gains. In specific property developer news, defaulted developer Shimao Group Holdings failed to find a buyer for a $1.8 billion project at a forced auction, even at a 20% discount to its appraised value. Sino-Ocean Group Holding Ltd. saw its yuan bonds tumble as much as 35% on news that the state-backed builder told some creditors it’s been negotiating with two major shareholders on its debt load. Finally, China’s vaunted cheap labor versus the US was no more, as research house TS Lombard estimated that labor costs for China caught up to the US ten years ago and the two have been moving in lockstep since (US the black line, China the blue).

Japan’s Annual Inflation Outpaced the US’ for first time in eight years, increasing +3.3% in June (versus +3.0% for the US). Of course the US overall price increases have been larger – see the dark blue line in the above graph, but Japan’s older (and declining) population weighs on aggregate demand and thus on overall price increases. The Bank of Japan finally joined other G-7 central banks in increasing rates, which for the island nation meant allowing 10-year bonds to incrementally reach 1% yield (still well below the 4% rate in the US for that tenor).

Macro: US

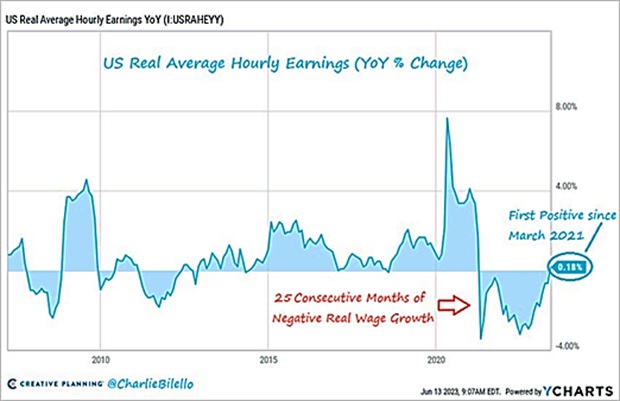

The Fed Agreed to a +0.25% Increase at the July 25-26th meeting and QT continued on its usual rate. Chair Powell indicated another hike was possible, but the chances remain “data dependent.” The next Fed meeting is September 19th-20th but in August Chair Powell will host the annual central bank symposium at Jackson Hole from the 24th to 26th. While no direct policies will be made, statements will be closely parsed for clues. 2Q US GDP came in above expectations at +2.4% versus the +1.8% expected and the Atlanta Fed projected annualized US real (after-inflation) GDP for Q3 as a massive +3.9% annualized rate, well above the upper end of consensus. With no obvious sign of recession and June headline inflation lower at 3.0% (though the core rate was 4.8%), another hike is certainly in the cards. July inflation should see a higher number as the tailwind of calmer prices from a year ago started to fall off and recently energy prices moved higher – be aware. The consumer is still tightly strapped, with the share of US adults who said they could cover a surprise $400 bill in the third quarter without taking on debt dropped two percentage points to 46%. Given that the 44 million student debt borrowers should expect to resume payments at the beginning of October (the new US government fiscal year) and the average payment is over $300 per month, this “surprise bill” will be arriving soon… Home foreclosures jumped 13% year-over-year in the first half of 2023, real estate data firm ATTOM reported, the highest from 2019. At least with inflation calming down, real wages are starting to improve (see graph right), but labor has still a long way to go before catching up with the cost of living. July payrolls increased below expectations at an estimated 187,000 people but the unemployment rate fell to 3.5% as the participation rate stalled out at 62.6%, still below pre-COVID levels. Average hourly earnings were up +0.4% from June and +4.4% from a year earlier, both stronger than forecast. Retail sales were barely positive year-on-year (+0.5%), which puts them still down in real terms (-2.5%).

and June headline inflation lower at 3.0% (though the core rate was 4.8%), another hike is certainly in the cards. July inflation should see a higher number as the tailwind of calmer prices from a year ago started to fall off and recently energy prices moved higher – be aware. The consumer is still tightly strapped, with the share of US adults who said they could cover a surprise $400 bill in the third quarter without taking on debt dropped two percentage points to 46%. Given that the 44 million student debt borrowers should expect to resume payments at the beginning of October (the new US government fiscal year) and the average payment is over $300 per month, this “surprise bill” will be arriving soon… Home foreclosures jumped 13% year-over-year in the first half of 2023, real estate data firm ATTOM reported, the highest from 2019. At least with inflation calming down, real wages are starting to improve (see graph right), but labor has still a long way to go before catching up with the cost of living. July payrolls increased below expectations at an estimated 187,000 people but the unemployment rate fell to 3.5% as the participation rate stalled out at 62.6%, still below pre-COVID levels. Average hourly earnings were up +0.4% from June and +4.4% from a year earlier, both stronger than forecast. Retail sales were barely positive year-on-year (+0.5%), which puts them still down in real terms (-2.5%).

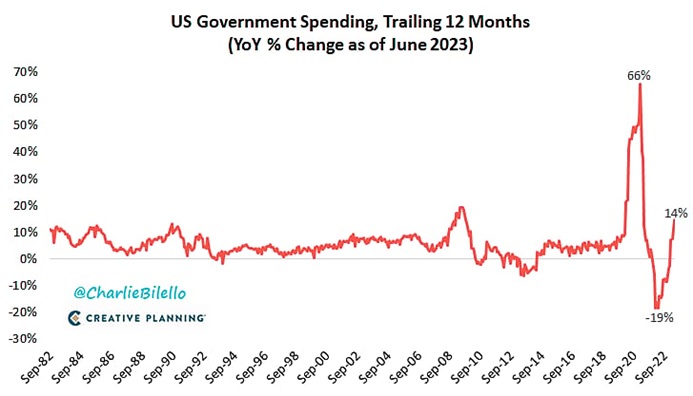

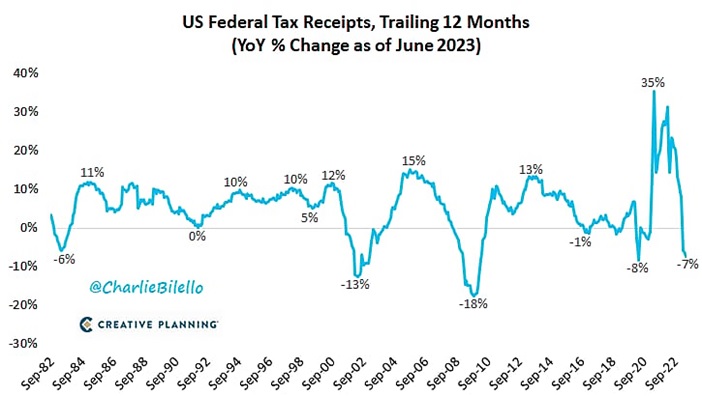

The US Debt Trend remained relentless, with post-COVID twelve-month accumulated deficit hitting $2.25 trillion last month (an increase of about $250 billion). With tax receipts down year-on-year (blue graph) and spending up (red graph), this should be of no surprise. No wonder Fitch downgraded the US to AA+ from AAA, citing fiscal deterioration over the next three years and repeated down-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills. Recall that S&P stripped the US of its triple-A rating in 2011, which leaves only Moody’s keeping the highest level. With today’s Treasury rates ranging from 5.5% at the

graph), this should be of no surprise. No wonder Fitch downgraded the US to AA+ from AAA, citing fiscal deterioration over the next three years and repeated down-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills. Recall that S&P stripped the US of its triple-A rating in 2011, which leaves only Moody’s keeping the highest level. With today’s Treasury rates ranging from 5.5% at the front end out to about 4.25% at the 30-year maturity, current Federal government interest payments will soon past the $1 trillion mark. With Congress out for August recess, September will see the political budget battles heat up as Republicans generally want to cut spending to get the deficit lower while Democrats want to spend more to stimulate the economy. Going to be ugly.

front end out to about 4.25% at the 30-year maturity, current Federal government interest payments will soon past the $1 trillion mark. With Congress out for August recess, September will see the political budget battles heat up as Republicans generally want to cut spending to get the deficit lower while Democrats want to spend more to stimulate the economy. Going to be ugly.

Macro: Europe

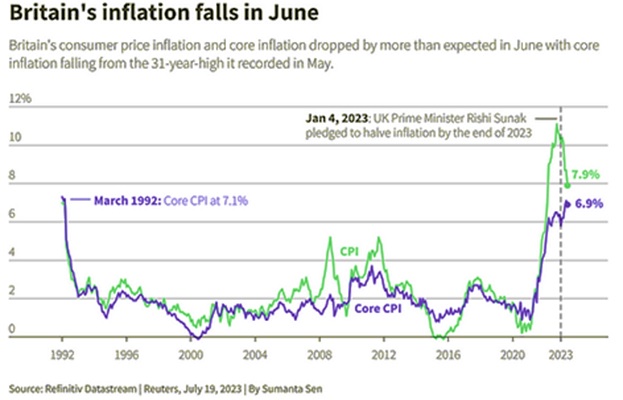

European Central Bank Raised Rates for the 9th straight time, to 3.75%, matching the high of 2001, though traders began to place bets that there was only a 50-50 chance for another in September. Eurozone inflation price pressures remained as both core and headline inflation matched each other at 5.5%. EU unemployment hit a low of 6.4% with record participation of 74% – but can it be maintained with higher interest rates? German factory orders jumped +7.0% month-on-month in June, up from a +6.2% month-on-month increase in May; however, it was due to a large aerospace order so not evidence of a genuine turnaround. More relevantly, Germany’s industrial production fell -1.5% for the month of June, weaker than expectations (-0.5%) and following a downward revision of May’s data (to -0.1% month-on-month). This is the third negative month this year so far, with June’s data weighed down by lower output in the automotive industry. After showing flat growth in May, German industrial production on an annual basis declined -1.7% year-on-year. At least UK inflation is disinflating per the graph right, though the Bank of England still raised rates at the beginning of August. Capital Economics noted that 700,000 UK mortgages are coming up for renewal over the remainder of this year, and over 95% of them are on interest rates of 2.5% or less. The increased payments hit to disposable incomes will likely be “grievous” to pocketbooks and generate more demand for higher wages.

large aerospace order so not evidence of a genuine turnaround. More relevantly, Germany’s industrial production fell -1.5% for the month of June, weaker than expectations (-0.5%) and following a downward revision of May’s data (to -0.1% month-on-month). This is the third negative month this year so far, with June’s data weighed down by lower output in the automotive industry. After showing flat growth in May, German industrial production on an annual basis declined -1.7% year-on-year. At least UK inflation is disinflating per the graph right, though the Bank of England still raised rates at the beginning of August. Capital Economics noted that 700,000 UK mortgages are coming up for renewal over the remainder of this year, and over 95% of them are on interest rates of 2.5% or less. The increased payments hit to disposable incomes will likely be “grievous” to pocketbooks and generate more demand for higher wages.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource