Wuhan Virus

- Still Early but so far, the virus seems under control apart from the area most deeply affected in China (city of Wuhan / province of Hubei). Information suppression (included redefining the definition of who is technically “infected”) and the uncertainty of those affected but forced to stay home still can lead to wild speculation. Officially as of February 10th, the dead surpassed 1,000 and the disease has a 1% mortality rate, though anecdotally the rate is much worse for those over 60 years old. Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care, which seems to improve the odds dramatically.

- The Damage expressed in economic terms should not be understated, but at this stage seems manageable. The extreme talk of a global recession looked very unlikely, given the definition of “recession” is two quarters of negative growth. Recent estimates were a lowering of Q1 global GDP growth from about 2.5% annualized down to 2.2% or as low as 0.0%, with a bounce back in Q2 and beyond, assuming (1) the usual flu peak in March~ May, (2) the primary impact stays limited to retirees (non-workers), (3) massive Chinese government stimulus (underway) and (4) the disease geographically contained to mainland China. Capital Economics, which had one of the more pessimistic independent estimates, expected Q1 China GDP to be cut in half from 6% annualized to 3% annualized but a recovery to full GDP activity in Q2 – still China growth so therefore no recession. All the key eastern manufacturing provinces extended the New Year’s holiday to mid-February including Guangdong (primarily electronics) and across the border from Hong Kong, Shanghai (China’s largest port and a newly-built Tesla plant), Jiangsu, (clothing including Nike shoes) and Henan (iPhone factory run by Foxconn). The damage from falling tourism, supply chain disruption with workers unable to return from the New Year’s holiday and commodity demand destruction would hit the rest of Asia hard, with Q1 GDP up to 4% annualized lower in Thailand, Taiwan, Malaysia, South Korea, Singapore, Vietnam, Japan and Australia.

- Outside Asia Effects included OPEC+ with Brent oil prices approaching the lows from September 2019 (~$58 per barrel) and to the EU (particularly Germany) which was just coming out of an industrial production / export slump. The S&P GSCI Total Return and the Bloomberg Commodity Index were both crushed in January, losing -10.8% and -7.4% respectively. Every sector was negative with only Precious Metals (+3.7%), benefiting from risk-off moves. While the US had mostly side-stepped the worst, the Chinese agricultural purchases agreed to in Phase One of the trade deal signed in January for 2020 look now unobtainable. The SARS epidemic in 2003 knocked Chinese GDP for one quarter by 2% and we have already surpassed that disease impact now in terms of deaths. China’s importance to global GDP is about 4x than what it was back then (from about 4% of global GDP to 16% in 2019) so although the negative shock may be limited to Q1, we are only halfway through the quarter. Further economic details will be spread throughout the commentary.

Global Commodities

- 2020 Oil Supplies look to be plentiful as oil refineries across China cut the amount of crude they’re turning into products by around 15% as the coronavirus cut fuel demand. State-owned and private plants have pared back refining by at least 2 million barrels a day (mbpd) by the end of January. State-owned refiners stated in early February that they would be cutting throughput in that month by about 10%. China’s aviation fuel sales slumped by 25% by the end of January (year-on-year) as domestic and international air traffic collapsed. Demonstrating the unexpected impact of the virus, China’s crude oil imports in 2019 surged +9.5% from a year earlier (10.1 mbpd on average), setting a record for a 17th straight year. This affirmed its status as the world’s largest oil importer in time for demand to collapse. China accelerated gasoline exports as they surged 27% in 2019, setting a seventh straight annual record as an increase in new refineries was met with a slump in vehicle sales to produce a domestic fuel surplus. OPEC+ convened an emergency technical meeting the first week of February to try to get agreement on an additional cut in oil output of 600,000 bpd from the January target of 44.0 mbpd. However, Russia backed away from contributing to such a commitment, leaving in question the idea of an earlier general meeting in mid-February. As of the end of January OPEC+ production was 44.1 mbpd, basically complying with the 2020 production level. Libya’s oil output essentially fell to zero after rebel commander Khalifa Haftar blocked oil exports at ports under his control (Libya does not have an OPEC+ production quota). Iraq set a record for nationwide annual oil production in 2019, averaging 4.8 mbpd. Brazil announced OPEC membership talks in Saudi Arabia in July. Brazil’s Petrobras hit a new production record in the fourth quarter, of over 3 million barrels of oil equivalent per day, up 13.7% year-on-year. The UK will ban the sale of new petrol, diesel and hybrid cars from 2035, five years earlier than planned, in an attempt to reduce air pollution. Global car sales declined roughly -4% year-on-year in 2019, the strongest decline rate seen since the financial crash in 2008, led by China (-9.4%) and India (-12.7%). Sales were stronger in Brazil (+7.6%).

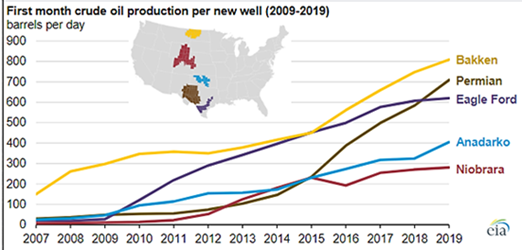

- US Crude Oil estimated January production shifted to 13.0 mbpd of crude oil as operating drilling rigs basically held steady, shifting from 677 on December 27th to 675 on January 31st. The Energy Information Agency sees US crude production at 13.3 mbpd (was 13.5) in December 2020 and still at 14.1 mbpd in December 2021. US crude oil exports rose to 3.7

mbpd in December from 3.0 mbpd in November. Most shale fields are enjoying increased production efficiency, helping them break even at lower oil prices (see right). Per Rystad Energy, US shale breakeven is about $46 per barrel, lower than the $50 per barrel in today futures market. US exports of Liquefied Natural Gas looked to surpass the current leaders (Australia and Qatar) by the end of 2024 as aggressive export capacity buildout and low prices propel volumes (under the new trade deal, China is to spend $52.4 billion on energy, including LNG).

mbpd in December from 3.0 mbpd in November. Most shale fields are enjoying increased production efficiency, helping them break even at lower oil prices (see right). Per Rystad Energy, US shale breakeven is about $46 per barrel, lower than the $50 per barrel in today futures market. US exports of Liquefied Natural Gas looked to surpass the current leaders (Australia and Qatar) by the end of 2024 as aggressive export capacity buildout and low prices propel volumes (under the new trade deal, China is to spend $52.4 billion on energy, including LNG).

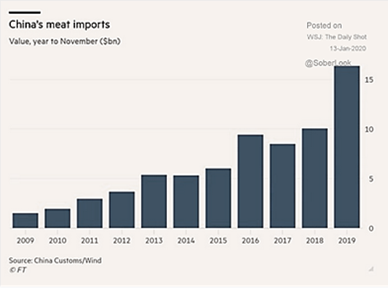

African Swine Flu moved to the back page, but China announced that December’s sow herd rose +2.2% month-on month. China announced that 5% of Chinese hog processing facilities tested positive for ASF. China, the world’s biggest pork consumer, produced 42.55 million tonnes of the meat last year, down -21.3% from 2018, and the lowest output since 2003. 2019 imports were notably higher (see graph left) with US pork exports for 2019 +7.1% higher than year ago according to the USDA. Their forecast for 2020 is +12.8% higher than 2019. Brazilian beef exports rose by 9.84% in January driven by a surge in sales to China. Meanwhile, Beijing certified two Russian beef producers for export to China.

African Swine Flu moved to the back page, but China announced that December’s sow herd rose +2.2% month-on month. China announced that 5% of Chinese hog processing facilities tested positive for ASF. China, the world’s biggest pork consumer, produced 42.55 million tonnes of the meat last year, down -21.3% from 2018, and the lowest output since 2003. 2019 imports were notably higher (see graph left) with US pork exports for 2019 +7.1% higher than year ago according to the USDA. Their forecast for 2020 is +12.8% higher than 2019. Brazilian beef exports rose by 9.84% in January driven by a surge in sales to China. Meanwhile, Beijing certified two Russian beef producers for export to China.

- Brazil’s Soy Harvest was 16% done at the end of January, vs 26% last year (which was exceptional), but was slightly ahead of the five year average. Yields, except for the southern state of Rio Grande do Sul, looked very good, so a record production was still on track. Ukraine’s grain exports were up +30.4% to 36.8 million tonnes so far in the 2019/20 July-June season. The country harvested a record 75.1 million tonnes of grain in 2019, compared with 70 million tonnes in 2018. This competition will make it very difficult if not virtually impossible for China to purchase the $40 billion in agricultural products under the Phase One trade deal with the US. In reaction to this (or at least to low prices), the US was set to plant the least amount of wheat acreage since 1909(!) and other crops will face similar pressures.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource