North America

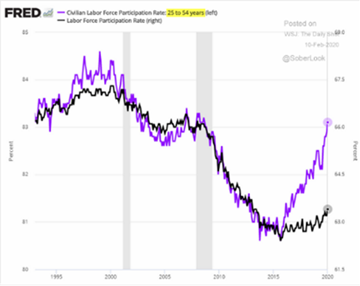

- Q4 US Growth came in at +2.1% annualized for a full-year 2019 growth of +2.3%. This was below 2018’s rate but still decent. All sectors apart from inventories contributed with a particularly strong showing by net exports which contributed 1.5% annualized – the most since 2009. The latest estimate of Q1 2020 from the Atlanta Fed is +2.7%. December retail sales (ex-autos) were strong at +0.7% versus +0.5% expected. Payrolls were particularly strong so far in Q1 2020, with the January report at +225,000 with an upward revision for December. Unemployment ticked up to 3.6% but average hourly earnings climbed +3.1% versus a year ago. The labor participation rate increased to 63.4%, dragged higher by the

prime-year participation (see graph right).

prime-year participation (see graph right).

- Existing Home Sales increased year-on-year to one of the strongest numbers for the end of the year. December manufacturing output surprised with a small gain of +0.2% versus the expected -0.1%. Core inflation (i.e., no food and energy) matched expectations with stay at +2.3% year-on-year with the same for overall consumer inflation. This is the fastest price level increase since 2007. Looking ahead, Macy’s plans to close 125 stores (about 25% of its total) over the next three years and lay off 2,000 workers as it consolidates operations. Bose announced that it would close its entire retail footprint in North America, Europe, Japan, and Australia, or 119 stores to focus solely on on-line sales. US shopping mall vacancies hit a new record of about 10% of units lying empty – note that the last recession highs that peaked in 2010 were 9.5%.

- The Federal Reserve’s meeting on January 28th and 29th went as expected – no rate changes and more provisions for bank liquidity via lending in the repo markets. “Phase One” trade talks with China concluded with China halving tariffs on $75 billion of US goods from February 14th and more quickly removing foreign ownership caps on securities firms, which includes investment banking, underwriting and brokerage operations. The centerpiece was a pledge by China to purchase at least an additional $200 billion worth of US farm products and other goods and services over two years, above a baseline of $186 billion in purchases in 2017. This could be tough to fulfill for 2020 given the virus exposure but perhaps medicinal purchases can make up for slower agricultural and energy buying. US corporate debt as a % of GDP and as a % of profits is at the point of a business cycle, underscoring the stretched nature of the economy. Also in January, the US ratified the USMCA deal (the post-NAFTA agreement) with Canada the last to approve the deal.

Asia

- China Already Stumbling at the end of 2019 with car sales down -8.2% year-on-year to 25.8 million vehicles. December was the 18th down month out of the past 19. Ford was

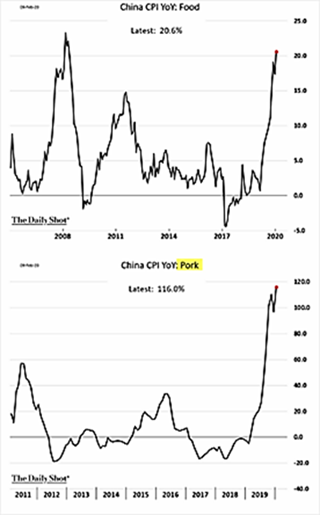

particularly hard hit, falling a third consecutive year, by -26.1% in its second-biggest market. China’s exports rose for the first time in five months in December and by more than expected, signaling a modest recovery in demand as Beijing and Washington agreed to defuse their prolonged trade war. Imports also beat expectations, jumping +16.3% from a year earlier, though boosted in part by higher commodity prices. GDP grew by +6.1 per cent last year, China’s worst performance since 1990, down from +6.6% in 2018. Industrial output grew +6.9% in December from a year earlier, the strongest pace in nine months. Fixed-asset investment and retail sales rose in line with the rest of 2019. However, consumer inflation surprised to the upside, driven by food prices (+5.4% versus +4/9% expected year-on-year) and by pork particularly (see right). There were some more notable defaults last month, with government-backed Qinghai province investment authority missing a $9.6 million payment due on $300 million bond due in 2021 and China’s largest lithium producer Tianqi indicated that it unable to repay a $2.2 billion loan due in November 2020 as lithium prices collapsed 30% in 2019. What happened to electric car demand?

particularly hard hit, falling a third consecutive year, by -26.1% in its second-biggest market. China’s exports rose for the first time in five months in December and by more than expected, signaling a modest recovery in demand as Beijing and Washington agreed to defuse their prolonged trade war. Imports also beat expectations, jumping +16.3% from a year earlier, though boosted in part by higher commodity prices. GDP grew by +6.1 per cent last year, China’s worst performance since 1990, down from +6.6% in 2018. Industrial output grew +6.9% in December from a year earlier, the strongest pace in nine months. Fixed-asset investment and retail sales rose in line with the rest of 2019. However, consumer inflation surprised to the upside, driven by food prices (+5.4% versus +4/9% expected year-on-year) and by pork particularly (see right). There were some more notable defaults last month, with government-backed Qinghai province investment authority missing a $9.6 million payment due on $300 million bond due in 2021 and China’s largest lithium producer Tianqi indicated that it unable to repay a $2.2 billion loan due in November 2020 as lithium prices collapsed 30% in 2019. What happened to electric car demand?

- Wuhan Virus Impacts started to move to other counties. Hyundai decided to close all of its seven plants in South Korea as parts are lacking from their Chinese supplier. Fiat-Chrysler might be forced to halt production at one of its European plants if the virus does not clear up by the end of February. Four of the automaker’s suppliers have been impacted by China’s decision to shut down much of its industrial sector as part of a quarantine. Toyota, Kia, Volvo and PSA warned that the factory closures in China risk disrupting production. US automakers have not voiced similar supply-chain issues so far. As China gets back to work after the New Year holiday, the government announced that it will offer force majeure protection to companies that fail due to the disease to fulfill international contracts. How broadly that will sweep through global markets is unknown at this time.

Europe

- Brexit Official Took Place on January 31st and now the UK is to negotiate a new economic deal with the EU by the end of 2020. The EU will undoubtedly try to extend and delay this

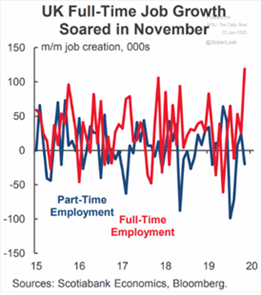

process like it did against PM May so Johnson has his work cut out for him. Britain’s economy grew at +0.6% in November versus a year before, the weakest expansion since June 2012, a slowdown from annual growth of 1.0% in October but still better than +0.1% Q4 2019 growth seen in the EU. The UK unemployment rate is holding near multi-year lows at 3.8% with wage growth highest since 2008 at a +3.2% 3-month-average, year-on-year. As the graph to the right shows, UK job growth is holding up well with the highest job creation figures in the last five years.

process like it did against PM May so Johnson has his work cut out for him. Britain’s economy grew at +0.6% in November versus a year before, the weakest expansion since June 2012, a slowdown from annual growth of 1.0% in October but still better than +0.1% Q4 2019 growth seen in the EU. The UK unemployment rate is holding near multi-year lows at 3.8% with wage growth highest since 2008 at a +3.2% 3-month-average, year-on-year. As the graph to the right shows, UK job growth is holding up well with the highest job creation figures in the last five years.

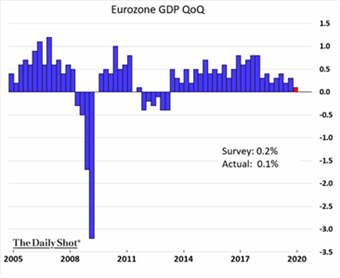

- The EU 2019 GDP growth was the worst in six years at +1.2% as Q4 growth (mentioned above) missed expectations, dragged lower by France and Italy (both economies surprised to the downside, falling -0.1% and -0.3% respectively). Eurozone industrial production missed expectations, falling -1.5% year-on-year instead of a decline of -1.0%. Germany, Italy and France all completely missed forecasts. Eurozone

retail sales also missed their numbers, growing +1.3% instead of +2.3% year-on-year. The EU had some positive news, with its unemployment falling to a twelve-year low of 7.4% in December. Greece sold €2.5 billion ($2.75 billion) in 15-year bonds at a 1.88% yield, below the 2% target. That’s the first time Greece has issued that long of a maturity since 2009. The ECB is still engaged in QE and, as EU business loans declined for the first time in six years, there were more concerns over the health of the economy. Finally the auto industry added to the gloomy prognosis as Germany started to shift more decisively to electric vehicles, which is expected to eliminate 400,000 jobs by 2030 due to the simpler manufacturing processes. That may solve emissions problems (especially after the diesel cheating scandals recently) but is a tall order. If Germany wants to avoid EU fines, then it has to ramp up production in the next 24 months. Germany also is looking to stop using coal by 2038 and is looking to pay €40 billion to its utilities to get there. This decision will reduce employment by about 60,000 jobs between mining and utilities.

retail sales also missed their numbers, growing +1.3% instead of +2.3% year-on-year. The EU had some positive news, with its unemployment falling to a twelve-year low of 7.4% in December. Greece sold €2.5 billion ($2.75 billion) in 15-year bonds at a 1.88% yield, below the 2% target. That’s the first time Greece has issued that long of a maturity since 2009. The ECB is still engaged in QE and, as EU business loans declined for the first time in six years, there were more concerns over the health of the economy. Finally the auto industry added to the gloomy prognosis as Germany started to shift more decisively to electric vehicles, which is expected to eliminate 400,000 jobs by 2030 due to the simpler manufacturing processes. That may solve emissions problems (especially after the diesel cheating scandals recently) but is a tall order. If Germany wants to avoid EU fines, then it has to ramp up production in the next 24 months. Germany also is looking to stop using coal by 2038 and is looking to pay €40 billion to its utilities to get there. This decision will reduce employment by about 60,000 jobs between mining and utilities.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource