Ukraine: Winter & Sanctions Impact

The Ukraine-Russia Conflict settled into winter, with Russia targeting electrical infrastructure and limited spoiling attacks to keep the Ukrainians from extending their gains. Russia’s additional mobilization of 300,000 or so recruits are likely spending the winter training for spring operations. Putin’s generals need to go big or go home – so going big in 2023 is the only real option. Sticking with the war of wills and logistical attrition for the next three to six months.

War by Other Means extended to the commodities front as Ukraine’s battlefield success caused Russia to back out temporarily of the UN-brokered grain export deal before reversing course a few days later. Last minute diplomacy managed to reach a 120-day extension before the November 19th expiration. However, the two belligerents are still at loggerheads over re-opening an ammonia pipeline, a vital ingredient to make fertilizer. If terms are not negotiated, then next growing season in Europe could be serious. Ukraine exported almost 18.1 million tonnes of grain so far in the current season, down 29.6% from the 25.8 million tonnes exported by the same time the previous season, agriculture ministry data showed, including more than 6.9 million tonnes of wheat, 9.7 million tonnes of corn and about 1.5 million tonnes of barley. In the first half of November, Russian crude and condensate production rose to a nine-month high of 10.85 million barrels a day, according to figures from consultant OilX. If that increase held for the rest of the month, Russia pumped only 200,000 barrels a day below prewar levels, a decline of less than -2%. The most recent hike in output follows the restart of the Sakhalin-1 project in Russia’s Far East, which Exxon Mobil managed until it left the country earlier this year. State-controlled oil giant Rosneft PJSC now leads the development, which is also supported by several Japanese companies, with Tokyo encouraging its firms to stay put in Russia while Washington and London told theirs to exit. Their dependency is self-apparent.

The EU Sanctions and $60 Price Cap on Russian oil went into effect in early December. Russia reiterated it will not sell under terms of the cap, and so far, key non-EU buyers, including China, India and Turkey, showed no signs of signing up to it. Russia’s challenge is that their oil tankers have to travel 1,000’s of more miles to deliver their crude, costing valuable time and money. Despite this, Bloomberg reported that three-quarters of the crude loaded at Russia’s Baltic ports was now headed to Asia. China and India now account for 2/3 of Russian seaborne crude exports. Bloomberg also noted that China and India demanded discounts of as much as $33.28 per barrel. In comparison, the discount pre-war was only $2.85. In short, Russia will continue to make money from oil, but not as much.

Macro: China

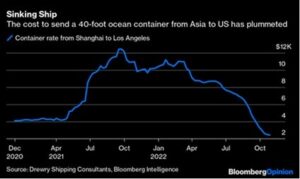

Reopening Underway? China was making a lot of noise about it but staying at home for mild cases instead of shipped off to a detention center is not really “open.” More understanding came out regarding unintended draconian lockdown consequences. For example, farmers had to dump otherwise healthy crops because they cannot ship their harvest. Local and state media reported that fields of vegetables were being destroyed in major producing regions such as Shandong and Henan provinces also to make way for the sowing of the next crop. The destruction of fresh food is happening at a time when many Chinese are under lockdown and bracing for food shortages and other supply disruptions. It also threatens to drive up already elevated food costs. More directly, COVID lockdowns and supply chain issues caused US manufacturing orders in China to fall -40% versus a year ago. Asia-based shipping firm HLS recently told clients it is a “very bad time for the shipping industry” as China-to-US container volume was down -21% between August and November, despite lower costs (see right). Finally, Chinese factories are shutting down two weeks earlier than usual ahead of Chinese New Year. Will Xi’s $65 billion in new real estate stimulus money be enough to keep the Chinese economy running a little bit longer?

example, farmers had to dump otherwise healthy crops because they cannot ship their harvest. Local and state media reported that fields of vegetables were being destroyed in major producing regions such as Shandong and Henan provinces also to make way for the sowing of the next crop. The destruction of fresh food is happening at a time when many Chinese are under lockdown and bracing for food shortages and other supply disruptions. It also threatens to drive up already elevated food costs. More directly, COVID lockdowns and supply chain issues caused US manufacturing orders in China to fall -40% versus a year ago. Asia-based shipping firm HLS recently told clients it is a “very bad time for the shipping industry” as China-to-US container volume was down -21% between August and November, despite lower costs (see right). Finally, Chinese factories are shutting down two weeks earlier than usual ahead of Chinese New Year. Will Xi’s $65 billion in new real estate stimulus money be enough to keep the Chinese economy running a little bit longer?

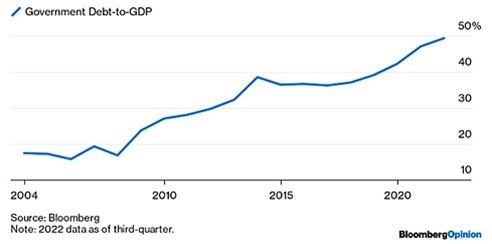

China’s October Economic Indicators fell short of expectations, as industrial production rose +5% y/y, down from +6.3% y/y in September. Retail sales actually contracted -0.5% y/y, dropping from +2.5% in the prior month. Fixed asset investment year to date eased to +5.8% y/y, from +5.9% y/y. Meanwhile, China electricity generation rose +1.3% y/y, despite hydro power dropping -18% y/y, with electricity consumption up +2.2% y/y. China’s budget deficit neared a record $1 trillion – almost three times last year’s number as slumping land sales and tax cut stimulus hurt government revenue. The impact on government debt can be seen in the graph to the right (remember that the GDP denominator is growing too). Weaker than expected Chinese trade data further demonstrated Xi’s shaky foundations with exports in October falling by -0.3% from the 2021 level versus economist predictions to grow by +4.5%. Imports into China likewise fell by -0.7%, which Bloomberg says was the first decline since August 2020. In corporate news, US firm Oaktree Capital sold a large plot of land in Hong Kong that it seized from Evergrande used as collateral for a loan. In a similar move, Chinese lenders took over Evergrande’s Hong Kong headquarters building to cover a $968 million dollar loan and Evergrande’s chairman lost his luxury Hong Kong mansion to another Chinese bank. It seems that Hong Kong property markets at least still follow the rule of law.

with electricity consumption up +2.2% y/y. China’s budget deficit neared a record $1 trillion – almost three times last year’s number as slumping land sales and tax cut stimulus hurt government revenue. The impact on government debt can be seen in the graph to the right (remember that the GDP denominator is growing too). Weaker than expected Chinese trade data further demonstrated Xi’s shaky foundations with exports in October falling by -0.3% from the 2021 level versus economist predictions to grow by +4.5%. Imports into China likewise fell by -0.7%, which Bloomberg says was the first decline since August 2020. In corporate news, US firm Oaktree Capital sold a large plot of land in Hong Kong that it seized from Evergrande used as collateral for a loan. In a similar move, Chinese lenders took over Evergrande’s Hong Kong headquarters building to cover a $968 million dollar loan and Evergrande’s chairman lost his luxury Hong Kong mansion to another Chinese bank. It seems that Hong Kong property markets at least still follow the rule of law.

Macro: US

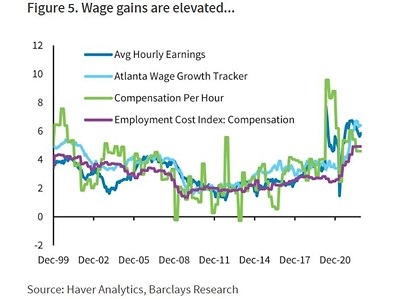

The Federal Reserve continued their hawkish stance regarding interest rates with a +0.75% at the November 1-2nd meeting to reach 3.75%. The pace of balance sheet decline (quantitative tightening) stayed at $95 billion per month. The market was hoping for some dovish noises during Powell’s presentation but it was all hawk. Strong US employment figures should delay the easing of rates, though Chair Powell strongly hinted at the pace of rate increases to slow in December (+0.5%) and early 2023 (at least one more +0.25%). The graph to the right underscores the risk for a classic wage–price spiral, where higher prices cause workers to demand higher wages which raises prices and so on. There are signs that inflation may be coming under control, however. The Fed’s supposedly-favored inflation index, the PCE Price Index, moved down to 6%, its lowest level since last December (the peak was 7% in June). Another is a swath of physical good prices that the Federal Reserve cannot directly influence are off their highs: rents fell 1% in November, the 3rd straight monthly decline, global container freight rates moved down to their lowest levels since two years ago (as graphically demonstrated on the previous page), fertilizer prices peaked in late March and are down 43% since and gasoline prices shifted lower to about 30% below their all-time high in mid-June.

+0.25%). The graph to the right underscores the risk for a classic wage–price spiral, where higher prices cause workers to demand higher wages which raises prices and so on. There are signs that inflation may be coming under control, however. The Fed’s supposedly-favored inflation index, the PCE Price Index, moved down to 6%, its lowest level since last December (the peak was 7% in June). Another is a swath of physical good prices that the Federal Reserve cannot directly influence are off their highs: rents fell 1% in November, the 3rd straight monthly decline, global container freight rates moved down to their lowest levels since two years ago (as graphically demonstrated on the previous page), fertilizer prices peaked in late March and are down 43% since and gasoline prices shifted lower to about 30% below their all-time high in mid-June.

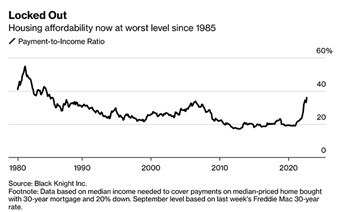

US Inflation Cooled in October by more than forecast with monthly rate of  increase of +0.3% for the cores and +0.4% for the overall consumer index. With dropping off the old print, the 12-month rate was +7.7% versus the +8.2% from September. The roughly 65 million retirees who collect Social Security benefits in the US will get a +8.7% increase next year, the largest bump since 1981, to compensate for the highest inflation in decades. Note that this increase simply accelerates the declining financial ability for Social Security to pay out full benefits (without changes to the program or higher taxes). Switching to a higher paying job seems to be a disappearing alternative despite unemployment of 3.7% (steady with October). Per a Bloomberg survey of 1000 working adults, over half of working Americans have considered holding multiple jobs to pay their living expenses with 38% of workers having looked for a second job, while an additional 14% with plans to do so. To add to the pressure on households, as the graph to the left shows, affordable housing payments basically disappeared for most Americans. In reaction, sales of previously-owned homes fell for a record ninth straight month in October, by -5.9%.

increase of +0.3% for the cores and +0.4% for the overall consumer index. With dropping off the old print, the 12-month rate was +7.7% versus the +8.2% from September. The roughly 65 million retirees who collect Social Security benefits in the US will get a +8.7% increase next year, the largest bump since 1981, to compensate for the highest inflation in decades. Note that this increase simply accelerates the declining financial ability for Social Security to pay out full benefits (without changes to the program or higher taxes). Switching to a higher paying job seems to be a disappearing alternative despite unemployment of 3.7% (steady with October). Per a Bloomberg survey of 1000 working adults, over half of working Americans have considered holding multiple jobs to pay their living expenses with 38% of workers having looked for a second job, while an additional 14% with plans to do so. To add to the pressure on households, as the graph to the left shows, affordable housing payments basically disappeared for most Americans. In reaction, sales of previously-owned homes fell for a record ninth straight month in October, by -5.9%.

Macro: Europe

Eurozone Inflation fell in November for the first time since mid-2021 as energy prices dropped. Consumer prices were +10% higher than a year earlier, down from the +10.6% annual rate of inflation recorded in October. Retail sales in the euro area suffered their biggest monthly fall of the year (-1.8%) as high inflation weighed on shoppers’ activity, adding to signs that the bloc entered a recession in the fourth quarter. The Financial Times reported that European food banks are at the breaking point due to the influx of new recipients – one-third of Germany’s food charities cannot accept more needy people (effectively capped at 2 million) due to a lack of available food. “Fuel poverty” – defined as spending more than 10% of income on energy – has risen from 15% of the German population to over 25%, with pan-Europe at higher percentages. With median pay in help-wanted ads up 5.2% versus a year ago, wages are not keeping up with inflation. Let us see if Europe can avoid a power crisis this winter – not just from a lack of natural gas from Russia but also with only half of France’s nuclear power plants in operation as strikes and unplanned maintenance delayed many restarts from November to January (or later).

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource