Commodities: Global

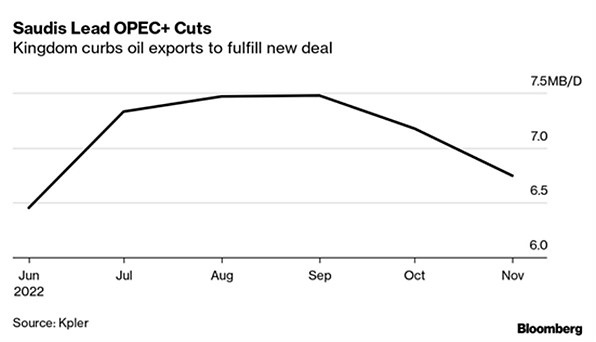

OPEC Production Fell as Expected, reaching 29.0 million barrels per day (mbpd) during November (Bloomberg), still much less than the lowered quotas of 31.4 mbpd. OPEC+ announced no quota change at their December meeting but reserved the expectation to adjust production based on the impact of sanctions against Russia. Regardless, apart from Saudi Arabia, the UAE and Kuwait, there is little ability to raise production beyond current levels. In fact, Saudi Arabia led the way lower in November per the graph on the right. Iran remained rocked by riots over the death of a woman at the hands of the country’s “morality police” and an oil deal looked dead due to their misogynistic policies and weapons support for Russia against Ukraine. Also hindering prospective negotiations, Iran began producing uranium enriched to 60% at its Fordo plant. An atomic bomb requires uranium enriched to 90%, so an incremental step towards weapons-grade enrichment.

adjust production based on the impact of sanctions against Russia. Regardless, apart from Saudi Arabia, the UAE and Kuwait, there is little ability to raise production beyond current levels. In fact, Saudi Arabia led the way lower in November per the graph on the right. Iran remained rocked by riots over the death of a woman at the hands of the country’s “morality police” and an oil deal looked dead due to their misogynistic policies and weapons support for Russia against Ukraine. Also hindering prospective negotiations, Iran began producing uranium enriched to 60% at its Fordo plant. An atomic bomb requires uranium enriched to 90%, so an incremental step towards weapons-grade enrichment.

US Oil Production ticked higher to 12.1 mbpd as companies increased operating rigs from 610 as of October 28th to 627 as of November 25th. Oil output in the Permian Basin was to hit another record of 5.5 mbpd in December, with overall output in shale regions due to rise 91,000 bpd to 9.2 mbpd. Per AAA, US average regular gasoline prices declined about 10%, reaching $3.47 per gallon on November 30th, 29¢ lower from last month. Californian average regular gasoline prices declined from $5.31 to $4.81 – very high still but a similar percentage decline. US crude oil exports fell slightly from the record of 5.1 mbpd for the last week of November. Oil reached the level in early December where Biden announced he would authorize some repurchases ($67-72 per barrel) but the optics are poor for Democrats to be seen as supporting oil production and there are Congressionally-mandated sales over the next few years that would make such an effort misleading. These mandated SPR sales were set at 147 million barrels from 2024 thru 2027, which is half the end-of-month reserves of 389 million barrels.

China’s Crude Oil Imports in November rose +12% from a year earlier to their highest in 10 months, as companies replenished stocks with cheaper oil and as new plants started up. The world’s largest crude importer brought in 11.4 mbpd, notably higher than October’s 10.16 mbpd. Note that this additional feedstock is expected to be exported directly or in the form of refined product, not necessarily for domestic consumption or strategic reserve. Agriculture imports underscored the slowdown in the Chinese economy as China imported 7.35 million tonnes of soybeans in November, down 14% from a year earlier. The small number came after arrivals in the world’s top buyer of soybeans plunged to just 4.1 million tonnes in October, their lowest level since 2014.

Brazil Soybean Crop Seen 22% Higher in 2022-23 as planted area looked to increase almost +4% along with corn output 5.5% higher as better weather unfolded. Soy planting was basically completed at the end of November. Argentina’s 2022-23 wheat harvest forecast was cut to 11.8 million tonnes, down from the previous forecast of 13.7 million tonnes, the Rosario grains exchange said. It further warned that it could fall further amid a protracted drought that is hammering farmers. Australia, on the other hand, one of the world’s largest wheat exporters, was poised to harvest another record crop this season even as heavy rains hurt yields in the eastern states. Farmers were set to gather 36.6 million tons in 2022-23, an increase of 1% from the previous all-time high last season, a jump of almost +14% from the September forecast. Canola production was estimated at 7.3 million tons, the highest ever and +4% more than last season.

Last items:

- In case you have time to hoist a few in London: https://www.standard.co.uk/business/redesigned-london-underground-map-cheapest-pints-beer-tube-stations-b1040634.html

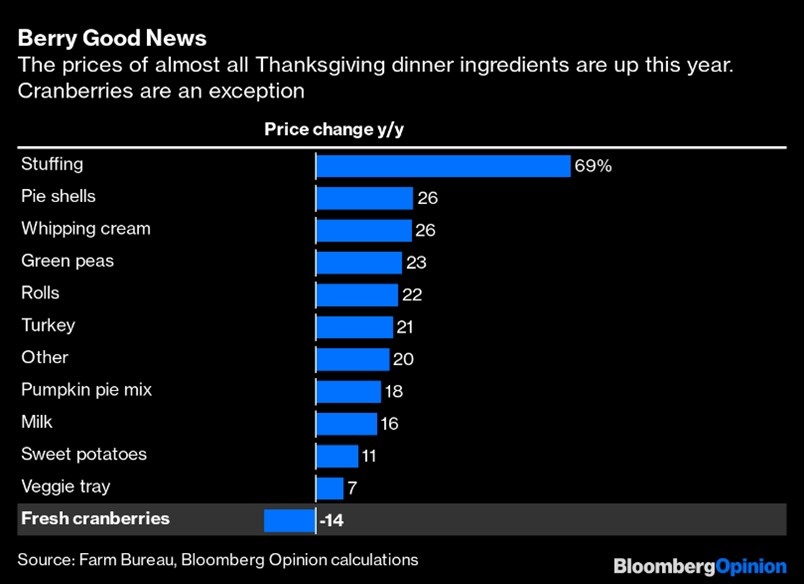

- Thanksgiving WAS more expensive this year (and lucky me, I do love cranberries!):

- And finally, remember that you can’t spell “cryptomania” without “pyromania”… with some minor re-arranging.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource