North America

- Q3 US Growth Again Revised Higher (+2.1% versus +1.9%) on higher inventories, with other changes insignificant and offsetting. Payrolls crushed glum predictions, growing at +266,000 for November with a positive revision for October. The ending of the GM strike (41,300 workers) which depressed last month’s number boosted this month’s. Unemployment dipped obligingly to 3.5% (again, rounding error) and hourly earnings ticked up to a solid +3.1% year-on-year. Under-employment also improved (7.0% to 6.9%) but the participation rate ticked away to 63.2% from 63.3%. Pending home sales missed, falling -1.7% for the month, missing a +0.8% rise, though year-on-year is still strong at +4.4%.

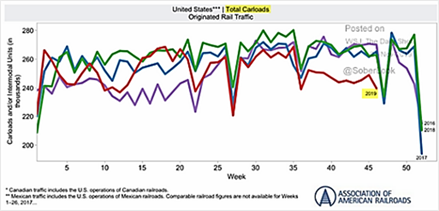

Durable goods improved (+0.6% versus -1.4% previous month) with core orders up +0.1% as the GM strike still hit autos and parts, but for less than in September. Rail traffic is still in decline between lower commodities shipments and Chinese imports (see right).

Durable goods improved (+0.6% versus -1.4% previous month) with core orders up +0.1% as the GM strike still hit autos and parts, but for less than in September. Rail traffic is still in decline between lower commodities shipments and Chinese imports (see right).

- The Federal Reserve’s next meeting should see Chair Powell holding rates steady until next year. Student loan debt delinquency rates ticked higher in Q3 2019, to 10.9% from 10.8% last quarter. The Fed also noted that these rates are almost certainly understated due to deferrals. The fact that these levels have stayed pretty consistent since 2013 is grim comfort. Credit card delinquencies were also stable last quarter at 8.3%, slightly better than the last cycle when they ran between 9% – 10%. Given better labor market conditions, they should be. Auto loan delinquencies are up slightly to 4.7% in Q3 from 4.6% in Q2. The Fed actively participated in the Treasury bond market via its “repo” operations, expanding its balance sheet to close to $300 billion, retracing over one-third the reduction from QE. As the US government issues more bonds and as the Fed replaces its mortgage bonds with Treasuries, these operations will expand.

Asia

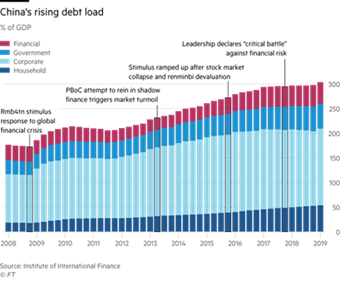

- China Reduced Borrowing Costs to 2.5% from 2.55% and added $26 billion in cash as well as $29 billion in medium term money. China’s central bank described 586 of the country’s

almost 4,400 lenders as “high risk,” slightly more than last year. It also highlighted the dangers associated with rising consumer leverage, saying household debt as a percentage of disposable income jumped to 99.9% in 2018 from 93.4% a year earlier. The PBOC and other regulators also warned about excessive corporate debt, which climbed to a record 165% of gross domestic product in 2018. With the US and China contributing over 60% of the total, global debt hit a new record of $250 trillion at the end of the first half of 2019, per the Institute of International Finance. Chinese industrial production missed the survey (+4.7% versus +5.4% year-on-year) as did retail sales growth (+7.2% versus +7.8%). Chinese vehicle sales continued to drop in October, but at a slower rate than seen earlier in the year, falling -4% year-on-year. In default news, a Peking University unit failed to repay $285 million local bond and Tunghsu Optoelectronic Technology failed to pay off a $241 million debt. Industrial firm Xiwang Group failed to pay a $140 million bond, missing a deadline on an already defaulted bond.

almost 4,400 lenders as “high risk,” slightly more than last year. It also highlighted the dangers associated with rising consumer leverage, saying household debt as a percentage of disposable income jumped to 99.9% in 2018 from 93.4% a year earlier. The PBOC and other regulators also warned about excessive corporate debt, which climbed to a record 165% of gross domestic product in 2018. With the US and China contributing over 60% of the total, global debt hit a new record of $250 trillion at the end of the first half of 2019, per the Institute of International Finance. Chinese industrial production missed the survey (+4.7% versus +5.4% year-on-year) as did retail sales growth (+7.2% versus +7.8%). Chinese vehicle sales continued to drop in October, but at a slower rate than seen earlier in the year, falling -4% year-on-year. In default news, a Peking University unit failed to repay $285 million local bond and Tunghsu Optoelectronic Technology failed to pay off a $241 million debt. Industrial firm Xiwang Group failed to pay a $140 million bond, missing a deadline on an already defaulted bond.

- “Peak China” was part of a Financial Times headline last month – the first I have read that prediction. The logic is straightforward – older population, high debt and US pushback. Coming up from behind with younger, cheaper, tech-aware and educated populations were cited India and Vietnam, plus the established competitors of Japan, Australia, South Korea and Taiwan.

Europe

- Brexit Battle on Hold until after the UK election on December 12th. If Johnson and the Conservatives win in the December elections (as expected), then perhaps there can finally be

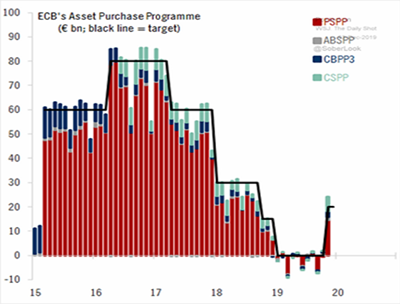

a resolution to the three-year mess. We shall see. It’s not like the EU is doing amazing. The ECB restarted QE (see graph right) and Lagarde had no monetary direction to start her presidency – she simply urged governments to expand their deficit spending as she undertakes a “comprehensive” review of ECB policy. Sounds like no change until Q1 2020 or later.

a resolution to the three-year mess. We shall see. It’s not like the EU is doing amazing. The ECB restarted QE (see graph right) and Lagarde had no monetary direction to start her presidency – she simply urged governments to expand their deficit spending as she undertakes a “comprehensive” review of ECB policy. Sounds like no change until Q1 2020 or later.

- EU Still Sputtering with German banks beginning to impose negative rates on savings for all accounts – the first one was Volksbank Fürstenfeldbruck charging 0.5% on accounts greater than one Euro. Italy’s largest bank, UniCredit, announced plans to cut as many as 8,000 jobs as it further shut branches. Meanwhile mass layoffs are in the works at Audi and Daimler, both cutting around 10,000 positions as part of the transition to more simple electric car production as well as addressing the decline in global sales from around 95 million to 90 million cars. German factory orders unexpectedly fell -0.4% in October, when a +0.4% increase had been forecast. Merkel’s coalition government looked shaky as partner SPD looked to renegotiate its role. Her CDU has been riven by internal struggles to replace her, compounding the problem. Retail sales for the euro area also disappointed, dropping by -0.6% in the month. Meanwhile, France braced for mass strikes and protests over pension reform. France’s high-speed trains stood still and teachers walked off the job as unions launched nationwide strikes and protests.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource