COVID-19

- June Economic Numbers were better amid the pandemic news, though an uptick in US cases, hospitalizations and deaths in late June/early July again dampened

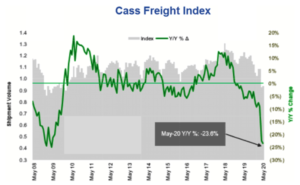

expectations. US freight shipments still were at the 2009 lows (see graph right – note there was a small pick-up at the end of the month) but as the below graph indicates, credit card spending year-on-year has been recouping losses (albeit thanks in part to more home deliveries). Underscoring the importance of transportation, the US Treasury announced it will lend $700 million in coronavirus stimulus funds to trucking firm YRC Worldwide Inc. and will receive a 30% equity stake in the firm. The Treasury noted

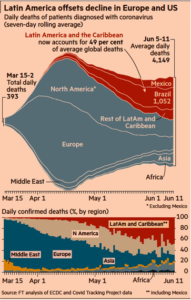

expectations. US freight shipments still were at the 2009 lows (see graph right – note there was a small pick-up at the end of the month) but as the below graph indicates, credit card spending year-on-year has been recouping losses (albeit thanks in part to more home deliveries). Underscoring the importance of transportation, the US Treasury announced it will lend $700 million in coronavirus stimulus funds to trucking firm YRC Worldwide Inc. and will receive a 30% equity stake in the firm. The Treasury noted  that YRC qualified for assistance under a $17 billion lending fund established in March for companies deemed essential to national security. Also of note was the shift of the COVID disease impact away from North American and Europe and towards South America. While a little out of date in this fast-moving situation, the graph to the right from the Financial Times was too interesting to ignore in the manner in which it presented the geographic change over time of the mortality impact of the disease. Finally, switching back to the financial impact, the European Central Bank announced last week it will upsize its Pandemic

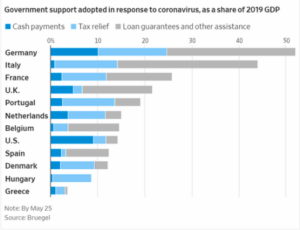

that YRC qualified for assistance under a $17 billion lending fund established in March for companies deemed essential to national security. Also of note was the shift of the COVID disease impact away from North American and Europe and towards South America. While a little out of date in this fast-moving situation, the graph to the right from the Financial Times was too interesting to ignore in the manner in which it presented the geographic change over time of the mortality impact of the disease. Finally, switching back to the financial impact, the European Central Bank announced last week it will upsize its Pandemic  Emergency Purchase Program by €600 billion ($680 billion) to a total sum of €1.35 trillion and extend the program until June 2021 from a prior conclusion at year-end. Furthermore, ECB officials estimated that more than half a trillion euros of Eurozone consumer debt (credit cards, car loans and mortgages) was considered unlikely to ever be fully repaid, with up to one trillion euros in losses. As a share of 2019 GDP, the left graph demonstrated the amount of assistance as of the end of May by the US and many European countries. Separately,

Emergency Purchase Program by €600 billion ($680 billion) to a total sum of €1.35 trillion and extend the program until June 2021 from a prior conclusion at year-end. Furthermore, ECB officials estimated that more than half a trillion euros of Eurozone consumer debt (credit cards, car loans and mortgages) was considered unlikely to ever be fully repaid, with up to one trillion euros in losses. As a share of 2019 GDP, the left graph demonstrated the amount of assistance as of the end of May by the US and many European countries. Separately,  Canada announced in early July that it expects a 16% budget deficit for 2020 (CAD 343 billion or $254 billion). Finally, the IMF projected that the world economy will contract by -4.9% in 2020, worse than previously estimated at -3.0%. US economic output was appraised at falling -8.0% and the Euro Area at -10.2%, with China the only major economy expected to grow, though only at +1.0%, lower than the +1.2% in the April forecast.

Canada announced in early July that it expects a 16% budget deficit for 2020 (CAD 343 billion or $254 billion). Finally, the IMF projected that the world economy will contract by -4.9% in 2020, worse than previously estimated at -3.0%. US economic output was appraised at falling -8.0% and the Euro Area at -10.2%, with China the only major economy expected to grow, though only at +1.0%, lower than the +1.2% in the April forecast.

- With Regards To A “Second Wave” of COVID-19 from the easing of restrictions, certain US states and some Asian countries (Japan, Hong Kong, Australia) have seen an upswing but other countries, in particular Brazil, Mexico and India, were still trying to reach the end of the “First Wave.” Regardless of country, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- Q2 GDP guesses are coming up and the esteemed Atlanta Fed revised its Q2 GDP annualized decline at -35% – much better than their estimate a month ago at -55% annualized, and now in line with private economist estimates. In short, bad but not as bad. This was largely due to the unemployment estimate coming in much better at 11.1% versus the previous month’s 13.3% as the participation rate improved from 60.8% to 61.5%. Underemployment also improved from 23% to 18% though these numbers are still a far cry from pre-pandemic levels. US factory orders also turned around, growing by +8.0% (though under expectations of +8.6%), as did durable goods orders (both headline and core numbers). Actual industrial output grew by +1.4% (net in line with expectations after revisions) and US retail sales posted a record gain of +17.7% in May, regaining more ground than anticipated as states reopened economies. The fall in April was revised from -16.4% to -14.7%, compounding the better numbers. A CIBC economist noted that “this is probably the easier part of the recovery in consumer spending, with pent-up demand as consumers sat at home supported by stimulus checks many households received in April.”

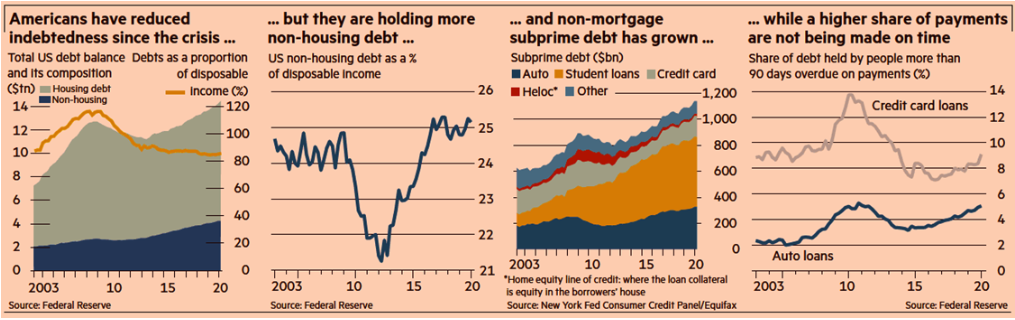

- The List of Bankruptcies grew to 3,427 as of June 24th, coming close to the 3,491 filings in the first half of 2008. Notable names included circus company Cirque du Soleil (3,500 employees), shale pioneer Chesapeake (2,300 employees) and high-end clothing retailer Brooks Brothers (4,000). United Airlines announced that it could furlough 36,000 from October 1st if flying demand does not pick up. Bloomberg estimated that as many as 25,000 stores may close in 2020, shattering the record of 9,800+ closed in 2019. The owner of Lane Bryant and Ann Taylor stores also announced bankruptcy and were looking to close 1,200 of their 2,800 locations by mid July. Delinquencies in commercial mortgage-backed securities jumped by 2.1% in June to 3.6% from 1.5% (highest in 16 years), primarily in the hotel and retail sectors. Fitch analysts projected that the impact from the coronavirus pandemic will drive the delinquency rate to between 8.25% and 8.75% by the end of Q3 2020. As the below graphic from Financial Times shows, consumers are under financial stress as subprime debt has increased and those borrowers are becoming behind on their payments.

Lower interest rates still could not offset consumer’s worries about the housing market as US sales of previously owned homes dropped in May by more than forecast to the lowest level since October 2010 as the coronavirus pandemic sent demand skidding along with the rest of the economy. Finally, in another illustrative point, according to a survey by Apartment List, an online rental platform, about 19% of Americans made no housing payment at all during the first week of July, and 13% paid only a portion of their rent or mortgage. At least inflation is missing from the misery so far with core (ex-food and energy) and overall inflation down -0.1% month-on-month in May.

- Federal Reserve Chair Powell spoke after the June 10th meeting stating that “We’re not even thinking about raising rates,” and almost all Fed officials forecasted keeping rates

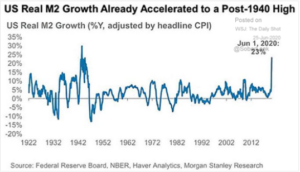

at zero through 2022. The New York Fed specified that the pace of bond buying would be maintained at about $80 billion a month for purchases of Treasuries and about $40 billion for mortgage-backed securities. In addition, June saw the Fed’s first direct purchases of corporate bonds totaling $428 million (including $15 million of junk bonds) and $5.3 billion of index bond funds. With bond prices at all- time highs, why the Fed moved forward with this program was surreal. One impact for certain was that money supply growth has spiked to levels not seen for eighty years (see graph right). It may not be showing much in consumer inflation but housing prices, the stock market and other financial measures showed it. If/How this money will filter into the “real” economy is still up for debate.

at zero through 2022. The New York Fed specified that the pace of bond buying would be maintained at about $80 billion a month for purchases of Treasuries and about $40 billion for mortgage-backed securities. In addition, June saw the Fed’s first direct purchases of corporate bonds totaling $428 million (including $15 million of junk bonds) and $5.3 billion of index bond funds. With bond prices at all- time highs, why the Fed moved forward with this program was surreal. One impact for certain was that money supply growth has spiked to levels not seen for eighty years (see graph right). It may not be showing much in consumer inflation but housing prices, the stock market and other financial measures showed it. If/How this money will filter into the “real” economy is still up for debate.

Macro: Asia

- China’s Trade Surplus Surged to a record in May as exports fell less than expected by -3.3% in US dollar terms, helped by an increase in medical-related sales, and imports slumped -16.7% along with energy and agricultural commodity prices. June sales of cars and commercial vehicles rose +11% year-on-year as government tax rebates and manufacturer discounts spurred consumers. On the other hand, there were a few high-profile defaults with the first property development company non-payment in five years on a $210 million loan, oil equipment firm Hilong Holding and, more sensationally, the collapse of Kingold Jewelry of Wuhan. Apparently the jewelry firm used 83 tons of fake gold bars to borrow $2.8 billion from fourteen financial institutions – equal to 22% of China’s annual gold production and 4.2% of the governments gold reserve! Apparently they gilded copper bars and were discovered when one creditor looked to sell the “gold” collateral to cover their losses. Where did the money go is the next question…

- Non-China Asia Continued to Struggle as demonstrated by Japan’s industrial output falling -8.4% in May (-25.9% year-on-year), particularly on lower automobile

manufacturing, much worse than the -5.9% economist survey. On the positive side, the report noted an expansion of output for June and July. Unemployment also moved higher from 2.6% to 2.9%. South Korea’s industrial production was also lower but better than expectations, with its, Malaysia’s and Thailand’s exports all down more than double-digits year-on-year. As the graph to the right shows, with world trade collapsed to 2008 levels, these export-oriented economies need a trade recovery soon!

manufacturing, much worse than the -5.9% economist survey. On the positive side, the report noted an expansion of output for June and July. Unemployment also moved higher from 2.6% to 2.9%. South Korea’s industrial production was also lower but better than expectations, with its, Malaysia’s and Thailand’s exports all down more than double-digits year-on-year. As the graph to the right shows, with world trade collapsed to 2008 levels, these export-oriented economies need a trade recovery soon!

Macro: Europe

- The ECB Gave Out €1.3 Trillion to member banks in three-year loans as deep as -1% interest rates, making this the largest bank

support program ever. In addition, its Asset Purchase and Pandemic Emergency Purchase Programs were in full gear as seen in the graph to the right. Essentially, the central bank will buy up most of the debt that will be issued by Eurozone governments this year to fund their crisis stimulus measures as well as almost every new corporate issue. Austria took advantage of the low rates by placing €2 billion in its second 100-year bond that will pay 0.88%! Eurozone retail sales in May did recover by +17.8% for the month, beating expectations but unemployment only edged up to 7.4% (by less than expected) as lockdowns gradually eased. However, while the all-important German industrial production had a nice May increase of +7.8%, badly missing the forecast of +11.1%. Year-on-year the export-oriented economy’s industrial production was down -19.3%, off the low of -25.0% in April. In short the European economy was still on ventilator support.

support program ever. In addition, its Asset Purchase and Pandemic Emergency Purchase Programs were in full gear as seen in the graph to the right. Essentially, the central bank will buy up most of the debt that will be issued by Eurozone governments this year to fund their crisis stimulus measures as well as almost every new corporate issue. Austria took advantage of the low rates by placing €2 billion in its second 100-year bond that will pay 0.88%! Eurozone retail sales in May did recover by +17.8% for the month, beating expectations but unemployment only edged up to 7.4% (by less than expected) as lockdowns gradually eased. However, while the all-important German industrial production had a nice May increase of +7.8%, badly missing the forecast of +11.1%. Year-on-year the export-oriented economy’s industrial production was down -19.3%, off the low of -25.0% in April. In short the European economy was still on ventilator support.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource