Americas

- In Case You Forgot, The Federal Reserve lowered interest rates at its July 30th-31st meeting, but only -0.25%, not the -0.50% the market hoped for. What got equities more

concerned was the messaging during the Q&A where Chair Powell said the rate cut was only a “mid-cycle adjustment” and thus not the start of steady reductions. Also, the cut had an element of “insurance,” which implied more of a “one-and-done” expectation. Bullish news that the reduction in the Fed’s balance sheet would stop falling two months early was ignored as inconsequential. Also passed over by the market was the update of its policy for reinvesting its maturing mortgages into a broad portfolio of Treasury securities (subject to a $20 billion/month limit). We all know what happened next – the US trade delegation returned from China empty-handed and Trump and Xi exchanged trade pain (see right). However, the US and Japan and the US and Europe separately inched forward on trade deals with US beef exports a winner.

concerned was the messaging during the Q&A where Chair Powell said the rate cut was only a “mid-cycle adjustment” and thus not the start of steady reductions. Also, the cut had an element of “insurance,” which implied more of a “one-and-done” expectation. Bullish news that the reduction in the Fed’s balance sheet would stop falling two months early was ignored as inconsequential. Also passed over by the market was the update of its policy for reinvesting its maturing mortgages into a broad portfolio of Treasury securities (subject to a $20 billion/month limit). We all know what happened next – the US trade delegation returned from China empty-handed and Trump and Xi exchanged trade pain (see right). However, the US and Japan and the US and Europe separately inched forward on trade deals with US beef exports a winner.

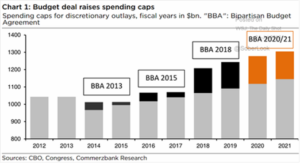

- Meanwhile, Trump And Congress Negotiated a Budget Deal which would raise discretionary spending to $1.37 trillion in fiscal year 2020, up from $1.32 trillion (see graph above).

The deal would increase US debt-to-GDP to 97% by 2029. MMT at work. Puerto Rico politics gave us a preview of the discord around government bankruptcy, as a sequence of governors resigned over political scandals and pressure. Illinois, are you watching?

The deal would increase US debt-to-GDP to 97% by 2029. MMT at work. Puerto Rico politics gave us a preview of the discord around government bankruptcy, as a sequence of governors resigned over political scandals and pressure. Illinois, are you watching?

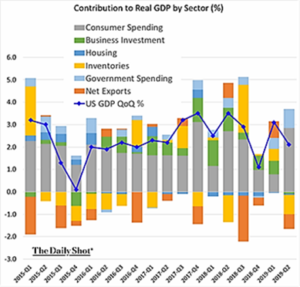

- US Economic Data showed slowing but better than expected Q2 GDP growth at +2.1% annualized. As the graph to the left shows, consumer spending (the grey bar) carried the day. Payrolls grew by +164,000 (basically at expectations) while unemployment held at 3.7% and the participation rate ticked up to 63.0%. Year-on-year wage growth picked up to +3.2% for the last twelve months, better than

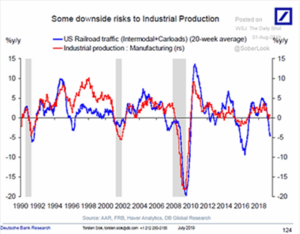

expected. US retail sales again moved higher in June by +0.4%, beating +0.2% forecasted. Industrial activity was slightly positive in June, with industrial production up +0.1%. US existing home sales tumbled down -2.2% year-on-year, despite low mortgage rates as median prices rose +4.3% from a year earlier. Looking ahead, US rail traffic is now down -3.3% for the year to date, implying tougher times for industrial production (see left). The Cass Freight Index posted similar moves (down over -6%, year-on-year). We are not sure that lower rates will do much to reverse this.

expected. US retail sales again moved higher in June by +0.4%, beating +0.2% forecasted. Industrial activity was slightly positive in June, with industrial production up +0.1%. US existing home sales tumbled down -2.2% year-on-year, despite low mortgage rates as median prices rose +4.3% from a year earlier. Looking ahead, US rail traffic is now down -3.3% for the year to date, implying tougher times for industrial production (see left). The Cass Freight Index posted similar moves (down over -6%, year-on-year). We are not sure that lower rates will do much to reverse this.

Asia

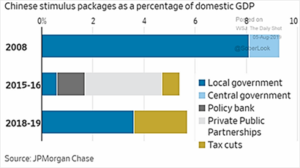

- China Continued to Stimulate the Economy as official Q2 GDP growth hit +6.2% – technically the slowest pace since 1992 but questionable as number. Exports were cited as a key weakness (falling -1.3% in June but imports were a big miss at -7.3%) and there was also slower housing activity (too many ghost cities?). So far, the central government has

spent/run up deficits to the same level as 2016 and the year is not over. With debt-to-GDP at 310%, China’s GDP growth has been borrowed, not built. Industrial production did pop up to “normal” levels to +6.3% year-on-year. Retail sales jumped +9.8% – the fastest clip since March 2018 – led by a +17.2% surge in car sales. However, for the first six months of 2019, auto sales were down -14% versus the same period in 2018. In response, Beijing pushed auto-finance companies, primarily arms of domestic carmakers, to start extending interest-free loans along with other perks to lure buyers. Early signs showed delinquencies already rising, albeit from very low levels. Meanwhile, the country’s second largest auditor Ruihua was accused of fabricating data, causing the regulator to suspend 46 IPOs and debt financings. The third Ruihua client came under investigation for missing cash – despite officially having CNY 1.8 billion on its balance sheet, Furen Group Pharmaceutical was unable to issue cash dividends of only CNY 60 million. Upon their audit, the Shanghai Stock Exchange discovered over CNY 1.7 billion missing! In addition, China Minsheng Investment Group Corp unit said that it won’t be able to repay the principal and interest on a $500 million bond due in August, affecting another $800 million in its debt. Is that high debt-to-GDP ratio causing unbearable strain?

spent/run up deficits to the same level as 2016 and the year is not over. With debt-to-GDP at 310%, China’s GDP growth has been borrowed, not built. Industrial production did pop up to “normal” levels to +6.3% year-on-year. Retail sales jumped +9.8% – the fastest clip since March 2018 – led by a +17.2% surge in car sales. However, for the first six months of 2019, auto sales were down -14% versus the same period in 2018. In response, Beijing pushed auto-finance companies, primarily arms of domestic carmakers, to start extending interest-free loans along with other perks to lure buyers. Early signs showed delinquencies already rising, albeit from very low levels. Meanwhile, the country’s second largest auditor Ruihua was accused of fabricating data, causing the regulator to suspend 46 IPOs and debt financings. The third Ruihua client came under investigation for missing cash – despite officially having CNY 1.8 billion on its balance sheet, Furen Group Pharmaceutical was unable to issue cash dividends of only CNY 60 million. Upon their audit, the Shanghai Stock Exchange discovered over CNY 1.7 billion missing! In addition, China Minsheng Investment Group Corp unit said that it won’t be able to repay the principal and interest on a $500 million bond due in August, affecting another $800 million in its debt. Is that high debt-to-GDP ratio causing unbearable strain?

- Trade Wars Are Intra-Asian Too as Japan and South Korea are also engaged in mutual punishment over an escalation in their WWII forced labor dispute. South Korean President Moon Jae-in threatened countermeasures after Japan’s cabinet approved the removal of South Korea’s from its list of favored export destinations, meaning some Japanese

exporters face more paperwork and on-site inspections before they can secure permits. “We won’t be defeated by Japan again,” Moon said as the country sought to collect damages against Japanese companies for WWII crimes. In particular, controls affect chemicals that are key in Korea’s vital semiconductor industry. Korea is also facing increased competition from China in its oil products exports. The graph to the left illustrates the squeeze by its largest neighbors, and its industrial production also fell -2.9% year-on-year, more than expected. The Korean people have started to ban Japanese products, hitting food and travel. Japan’s machine tools orders are at the lowest point since the GFC in 2008. Japanese exports fell for a seventh straight month in June, dropping 6.7% from a year earlier, with falling exports of semiconductor components and auto parts among the biggest drags. Electronic-related shipments to China dropped well over 20%, again highlighting weakness in the Chinese economy despite the official numbers. Finally, another China barometer, Singapore’s Q2 GDP shrank an annualized -3.4% on weak exports as its manufacturing production fell -3.8 year-on-year. Singapore exports plunge -17.3% in June for its biggest drop in six years. Electronic shipments plunged -31.9% with non-oil exports to China declining -15.8%. Exports out of India fell -9.7% month-on-month and Indonesian exports were down -9.0%. Historically, US growth has pulled Asia out of its slumps but so far that is not the case.

exporters face more paperwork and on-site inspections before they can secure permits. “We won’t be defeated by Japan again,” Moon said as the country sought to collect damages against Japanese companies for WWII crimes. In particular, controls affect chemicals that are key in Korea’s vital semiconductor industry. Korea is also facing increased competition from China in its oil products exports. The graph to the left illustrates the squeeze by its largest neighbors, and its industrial production also fell -2.9% year-on-year, more than expected. The Korean people have started to ban Japanese products, hitting food and travel. Japan’s machine tools orders are at the lowest point since the GFC in 2008. Japanese exports fell for a seventh straight month in June, dropping 6.7% from a year earlier, with falling exports of semiconductor components and auto parts among the biggest drags. Electronic-related shipments to China dropped well over 20%, again highlighting weakness in the Chinese economy despite the official numbers. Finally, another China barometer, Singapore’s Q2 GDP shrank an annualized -3.4% on weak exports as its manufacturing production fell -3.8 year-on-year. Singapore exports plunge -17.3% in June for its biggest drop in six years. Electronic shipments plunged -31.9% with non-oil exports to China declining -15.8%. Exports out of India fell -9.7% month-on-month and Indonesian exports were down -9.0%. Historically, US growth has pulled Asia out of its slumps but so far that is not the case.

Europe

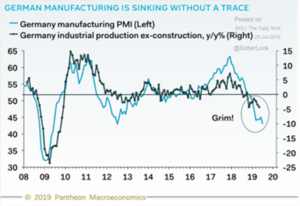

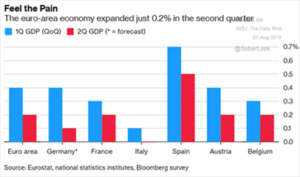

- GDP Growth was unimpressive, growing +0.2% for Q2 (+0.8% annualized), a slowdown versus Q1 as seen in the graph to the right. Industrial production was up +0.9% in May but drops

in June bode ill. German industrial production was down -5.2% year-on-year versus -3.1% expected in June with slippages across the board (automobiles, machinery, chemicals, etc.). Italy too had shrinking industrial production, registering at -4.2% year-on-year. On the other hand, Eurozone retail sales surprised on the upside at +2.6% year-on-year versus +1.3% expected. German factory orders for June were +2.5%, bouyed by foreign orders – though pan-Europe orders were down -0.6%. Recall that over 45% of European GDP is related to exports versus under 15% for the US. Viewing the trade conflicts (or lack thereof) from this starting point explains a lot of behavior.

in June bode ill. German industrial production was down -5.2% year-on-year versus -3.1% expected in June with slippages across the board (automobiles, machinery, chemicals, etc.). Italy too had shrinking industrial production, registering at -4.2% year-on-year. On the other hand, Eurozone retail sales surprised on the upside at +2.6% year-on-year versus +1.3% expected. German factory orders for June were +2.5%, bouyed by foreign orders – though pan-Europe orders were down -0.6%. Recall that over 45% of European GDP is related to exports versus under 15% for the US. Viewing the trade conflicts (or lack thereof) from this starting point explains a lot of behavior.

- ECB head Mario Draghi hinted at more stimulus in September, both with lowering (already-negative) rates and buying more bonds (quantitative easing). Assuming Lagarde’s ascension to the role later this year, we would expect more of the same. Amazingly, the entire Swiss yield curve (out to 50 years!) went negative as well as the entire German yield curve (out to 30 years). Negative yielding debt now totals a record $14 trillion – well over 25% of global debt. Danish bank Nordea offered a negative rate mortgage – yes, you will be paid to borrow money to buy a house in Denmark (ten year term at -0.5%), but only if you are a permanent resident!

- Finally, in the UK, Boris Johnson became the next Prime Minister so a “hard Brexit” is definitely on the table and perhaps that is the best thing at this stage. Sterling has already moved 20% versus the USD from 1.45 to 1.20 (pre-vote to current). Rip off the bandage and move on – certainly the EU has made the negotiations with Teresa May as difficult as they could be.

A final note on the trade war is the context that Xi is ordering a celebratory run-up to the 70th anniversary of the People’s Republic of China in October, an event that will have to showcase him as a strong leader of a powerful nation. With his government struggling to rejuvenate a sluggish economy and quell antigovernment protests in Hong Kong, Xi is not going to undercut his or the country’s image before then. Unless there is a large concession by Trump, then no deal in the next few months… monitor more closely as the US elections approach next year.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource