Macro: Americas

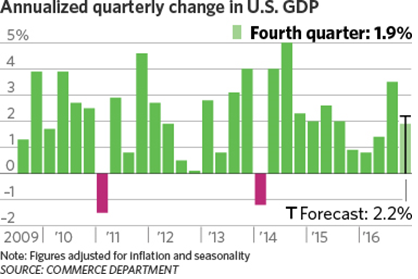

- The Federal Reserve kept rates steady at its end-of-January meeting and gave no indication that one was offing in March. Yellen will run out of time soon if she wants to make it three increases this year, though we still hold onto our forecast of two. Q4 GDP (first estimate) missed forecasts by coming in an annualized rate of 1.9% to bring 2016 to a 1.6% increase. Disappointing trade figures were the biggest contributor at -1.7% (though Q3 exports were goosed by one-time strong soybean exports). Consumer growth stayed solid at

+2.5% so we shall monitor the updates. 2017 looks due for a pick-up back over two percent per the Atlanta Fed’s forecast (+2.3%) and IMF’s latest numbers (+2.5% for all 2017). January’s unemployment is a low 4.8% and wages grew 2.5% annualized over the last three months, the poorest showing in the last twelve months. Other economic data is mixed with a move higher in retail sales, pending home sales and capital goods orders for December. However, actual factory production rose less than expected.

+2.5% so we shall monitor the updates. 2017 looks due for a pick-up back over two percent per the Atlanta Fed’s forecast (+2.3%) and IMF’s latest numbers (+2.5% for all 2017). January’s unemployment is a low 4.8% and wages grew 2.5% annualized over the last three months, the poorest showing in the last twelve months. Other economic data is mixed with a move higher in retail sales, pending home sales and capital goods orders for December. However, actual factory production rose less than expected. - Trump continued the combativeness of the campaign – past results may not predict future results, but past behavior often predicts future behavior! We still are wondering about actual policies that require legislation: the US debt limit, military buildup, tax breaks and healthcare insurance. TBD. Puerto Rico’s new governor is the same as the old one in terms of debt and interest payments – cannot pay it all, will not pay it all. On February 1, they missed payments on general obligation and most agency bonds though they did fully pay on bonds backed by sales taxes and certain agencies. The U.S. Congress’ financial oversight board has a May deadline for a rescue plan. Good luck.

- More traditional retailers put up concerning results with Neiman Marcus withdrawing its IPO, creating plans to cut 100 stores and eliminating 10,000 jobs. Teen retailer Wet Seal is being shut down by its private equity owner, which will cause 171 stores to close and over 3,000 employees laid off. American Apparel was sold to a Canadian firm and it began laying off 2,400 workers. Just wait until higher interest rates squeezes the survivors (and their landlords) further – this story is not yet over.

Macro: Europe

- Europe beat the US for 2016 GDP growth, up +1.8% after expanding by +0.5% in Q4 (not annualized). The U.K. beat those results with a +2.0% for the year after growing +0.6% in Q4

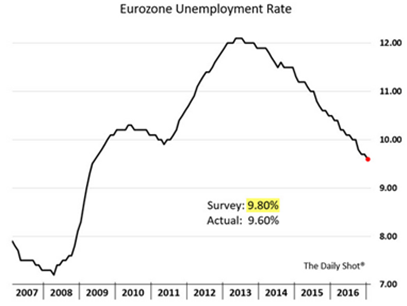

(unannualized), defying the Brexit doomsayers so far. Germany also led the results at +1.9% for 2017, possibly taking some pressure off of Merkel as she looks at autumn elections. Eurozone unemployment improved (see right) and industrial production showed an increase for November and October’s loss was revised positively. Italy however, showed an uptick in unemployment to just under 12%.

(unannualized), defying the Brexit doomsayers so far. Germany also led the results at +1.9% for 2017, possibly taking some pressure off of Merkel as she looks at autumn elections. Eurozone unemployment improved (see right) and industrial production showed an increase for November and October’s loss was revised positively. Italy however, showed an uptick in unemployment to just under 12%. - Italy’s banking crisis continues to unfold, though there were not many headlines in January. The country’s debt was downgraded by the last agency with an “A” rating on it, which will increase the haircut charged by the ECB on Italian bonds used for collateral – not much of a problem except for Italian banks that are stuffed with their

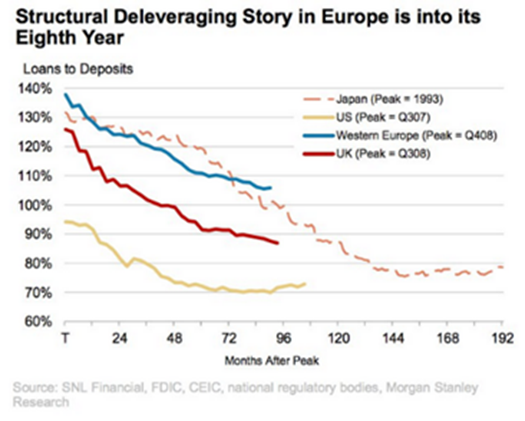

country’s debt and depend on that collateral for trading and business operations. And EU has warned Italy to not overstep their spending in an effort to stimulate the economy. As seen as on the graph to the left, Europe has not bottomed out in terms of cleaning out the bad debt from the mortgage and banking crisis of 2008. On the government side, all the EU members have increased their debt relative to GDP apart from a handful: Ireland, Germany, Malta and Latvia. The ECB may be buying the new issuance hand over fist but that just recycles the problem. Finally, the troika said that the new Greek financing is now dependent on the IMF participation, but an internal IMF memo calls Greek debt “highly unsustainable.” Will the IMF really let Greece completely wither away on the vine (let along implode)? There is no good answer.

country’s debt and depend on that collateral for trading and business operations. And EU has warned Italy to not overstep their spending in an effort to stimulate the economy. As seen as on the graph to the left, Europe has not bottomed out in terms of cleaning out the bad debt from the mortgage and banking crisis of 2008. On the government side, all the EU members have increased their debt relative to GDP apart from a handful: Ireland, Germany, Malta and Latvia. The ECB may be buying the new issuance hand over fist but that just recycles the problem. Finally, the troika said that the new Greek financing is now dependent on the IMF participation, but an internal IMF memo calls Greek debt “highly unsustainable.” Will the IMF really let Greece completely wither away on the vine (let along implode)? There is no good answer.

Macro: Asia

- China miraculously beat its 2016 Q4 GDP growth target, turning in +6.8% versus the +6.7% estimate. Retail sales increased +10.9% from a year earlier, the strongest reading in a year and more than the projected +10.7%.Industrial production rose +6% in December

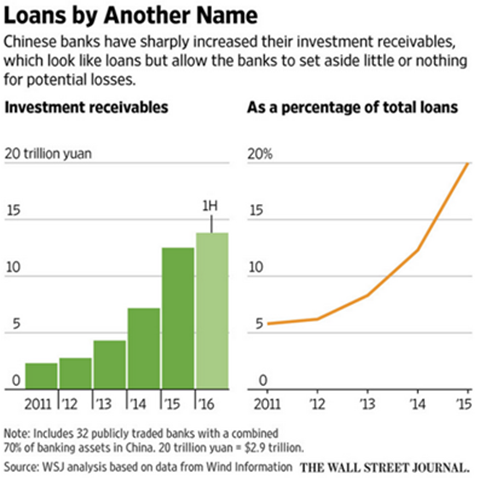

from a year earlier, compared with a +6.1% estimate. This rosy picture was undercut by +15.4% loan growth for 2016, demonstrating the dependence on ever-more debt to drive the same percentage increases of GDP. There is more evidence that the quality of this debt is worsening as seen in the graph to the right, which is a demonstration of the increased use of “shadow financing” or off-book financing. 2017 will see an increase of junk bonds that are coming due – CNY 211 billion ($31 billion) worth versus the CNY 155 billion that matured in 2016. These number can be absorbed by the government, if desired, as it still has $3 trillion of reserves, but it is one more demand on that declining resource. After all, what will the affect be on US Treasuries if the Chinese sped up sales? However, to reiterate from last month, this is not likely a 2017 concern but for 2018.

from a year earlier, compared with a +6.1% estimate. This rosy picture was undercut by +15.4% loan growth for 2016, demonstrating the dependence on ever-more debt to drive the same percentage increases of GDP. There is more evidence that the quality of this debt is worsening as seen in the graph to the right, which is a demonstration of the increased use of “shadow financing” or off-book financing. 2017 will see an increase of junk bonds that are coming due – CNY 211 billion ($31 billion) worth versus the CNY 155 billion that matured in 2016. These number can be absorbed by the government, if desired, as it still has $3 trillion of reserves, but it is one more demand on that declining resource. After all, what will the affect be on US Treasuries if the Chinese sped up sales? However, to reiterate from last month, this is not likely a 2017 concern but for 2018. - Chinese exports fell by a more-than-expected 6.1% y-o-y in December. Imports did rise in line with expectations at 3.1% over the same period. However, the upshot of the latest figures is that Chinese exports fell by 7.7% on the year in 2016 – the biggest

annual decline since the depths of the financial crisis in 2009. Global trade stalling out the last few years is stressing the export-led economic model that has served the country so well. The end of an era.

annual decline since the depths of the financial crisis in 2009. Global trade stalling out the last few years is stressing the export-led economic model that has served the country so well. The end of an era.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.